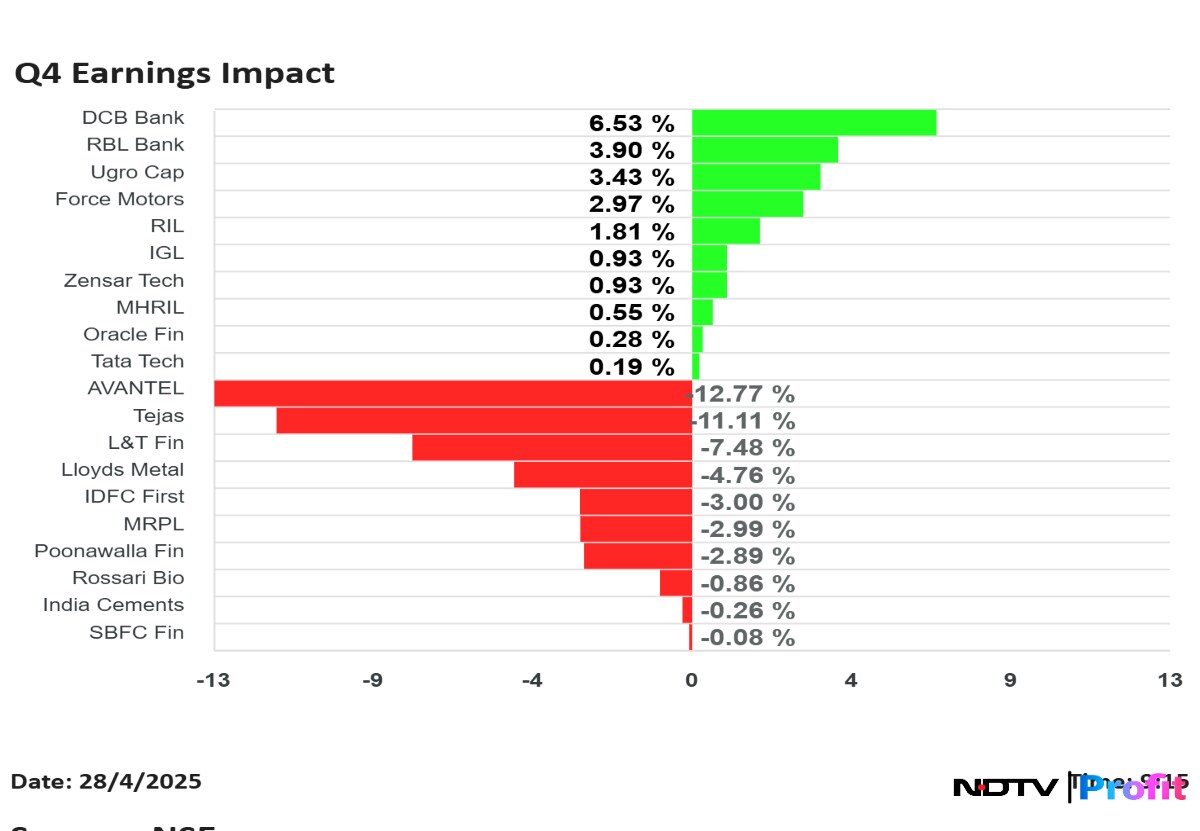

Shares of Reliance Industries Ltd., Tata Technologies Ltd., RBL Bank Ltd., were in focus on Monday, after the companies announced their fourth quarter results.

DCB Bank Ltd. shares rose the most, while Tejas Networks Ltd. fell the most, among the companies that announced their results for quarter ended March.

Reliance Industries Q4FY25 (Consolidated, QoQ)

Share price rises 3.35% at Rs 1,344.

Revenue up 9% to Rs 2,61,388 crore versus Rs 2,39,986 crore.

Ebitda flat at Rs 43,832 crore versus Rs 43,789 crore.

Ebitda margin at 16.8% versus 18.2%, down 148 bps; biggest contraction in last 10 quarters.

Net profit up 5% to Rs 19,407 crore vs Rs 18,540 crore.

Reliance Jio Q4FY25 (QoQ)

Revenue up 2% to Rs 30,018 crore versus Rs 29,307 crore.

Ebitda up 2% to Rs 15,852 crore versus Rs 15,478 crore.

Ebitda margin at 52.8% versus 52.8%.

Net profit up 3% to Rs 6,642 crore versus Rs 6,477 crore.

ARPU up 1.4% to Rs 206 versus Rs 203.

Subscriber at 48.8 crore versus 48.2 crore.

Tata Technologies Q4FY25 (Consolidated, QoQ)

Share price rises 0.80% at Rs 698.75.

Revenue down 2.4% to Rs 1,285.65 crore versus Rs 1,317.38 crore (Bloomberg estimate: Rs 1,331.7 crore).

Net profit up 12% to Rs 188.87 crore versus Rs 168.64 crore (Bloomberg estimate: Rs 177.75 crore).

EBIT down 1% to Rs 202.26 crore versus Rs 203.58 crore (Bloomberg estimate: Rs 251.45 crore).

Margin at 15.7% versus 15.5% (Bloomberg estimate: 18.7%).

The board recommended a final dividend of Rs 8.35 and one-time special dividend of Rs 3.35 per share.

RBL Bank Q4FY25 (Standalone, YoY)

Share price rises 4.73% at Rs 196.99.

Net profit down 80.5% to Rs 68.7 crore versus Rs 352 crore (Bloomberg estimate: Rs 47.5 crore).

Net interest income down 2% at Rs 1,563 crore versus Rs 1,600 crore.

NIM at 4.89%, down 1 bps (QoQ).

Gross NPA at 2.6% versus 2.92% (QoQ).

Net NPA at 0.29% versus 0.53% (QoQ).

Rise in provisions and slight fall in net interest income weighed on RBL Bank's net profit for the quarter ended March.

The board recommended the dividend of Rs 1 per equity share.

IDFC FIRST Bank Q4FY25 (Standalone, YoY)

Share price falls 4.49% at Rs 63.11.

Net profit down 58% at Rs 304 crore versus Rs 724 crore (Bloomberg estimate: Rs 421.5 crore).

Net interest income up 10% at Rs 4,907 crore versus Rs 4,469 crore (Bloomberg estimate: Rs 5,073.5 crore).

Net Interest Margin at 5.95% (Bloomberg estimate: 6.14%).

Core Operating income up 8.7% at Rs 6,609 crore versus Rs 6,079 crore.

Net NPA at 0.53% versus 0.52% (QoQ).

Gross NPA at 1.87% versus 1.94% (QoQ).

DCB Bank Q4FY25 (Standalone, YoY)

Share price rises 7.38% at Rs 136.40.

Net profit up 14% to Rs 177.07 crore versus Rs 155.68 crore.

Net interest income up 10% at Rs 557.96 crore versus Rs 507.48 crore.

Gross NPAs at 2.99% versus 3.11% (QoQ).

Net NPAs at 1.12% versus 1.18% (QoQ).

The board of DCB Bank has recommended a dividend of Rs 1.35 per share.

Poonawala Fincorp Q4FY25 (Consolidated, YoY)

Share price falls 4.44% at Rs 363.50.

NII up 8.54% at Rs 610 crore versus Rs 562 crore.

Net profit down 81.2% at Rs 62.3 crore versus Rs 332 crore (Bloomberg estimate: Rs 168 crore).

Gross NPA at 1.84% versus 1.85% (QoQ).

Net NPA at 0.85% versus 0.81% (QoQ).

Assets under management up 43% at Rs Rs 35,631 crore.

PAT impacted during the year due to onetime Opex and accelerated provisioning in Q2FY25.

Rossari Biotech Q4FY25 (Consolidated, YoY)

Share price falls 2.60% at Rs 681.15.

Revenue up 22.6% at Rs 580 crore versus Rs 473 crore.

Ebitda up 9.4% at Rs 69.5 crore versus Rs 63.5 crore.

Margin at 12% versus 13.4%.

Net profit up 1% at Rs 34.4 crore versus Rs 34 crore.

Oracle Financial Services Q4FY25 (Consolidated, QoQ)

Share price rises 1.93% at Rs 8,770.

Revenue up 0.05% at Rs 1,716 crore versus Rs 1715 crore.

Ebitda up 7.16% at Rs 747.7 crore versus Rs 698 crore.

Ebitda margin up 289 bps at 43.57% versus 40.68%.

Net profit up 19.03% at Rs 644 crore versus Rs 541 crore.

Force Motors Q4FY25 (Consolidated, YoY)

Share price rises 3.47% at Rs 9,479.

Revenue up 17.15% at Rs 2,356 crore versus Rs 2011 crore.

Ebitda up 18.15% at Rs 330.06 crore versus Rs 279.34 crore.

Ebitda margin up 11 bps at 14% versus 13.89%.

Net profit up 210.71% at Rs 435 crore versus Rs 140 crore.

Exceptional Gain of Rs 394 crore from Madhya Pradesh government regarding Industrial Investment Promotion Assistance Scheme, 2010.

Recommends final dividend of Rs 40 per share.

Mahindra Holidays & Resorts India Q4FY25 (Consolidated, YoY)

Share price rises 1.22% at Rs 304.

Revenue up 5.2% to Rs 361 crore versus Rs 343 crore.

Ebitda up 55% to Rs 94.75 crore versus Rs 61.3 crore.

Margin at 26.2% versus 17.9%.

Net profit up 73% to Rs 57.5 crore versus Rs 33.3 crore.

L&T Finance Q4FY25 (Standalone, YoY)

Share price falls 5.58% at Rs 165.55.

Revenue up 8.2% at Rs 2,150 crore versus Rs 1,987 crore.

Net profit up 15.7% at Rs 631 crore versus Rs 545 crore.

Recommends final dividend of Rs 2.75 per share.

Tejas Networks Q4FY25 (Consolidated, YoY)

Share price falls 14.37% at Rs 735.50.

Revenue up 43.7% to Rs 1,907 crore versus Rs 1,327 crore.

Ebitda down 60.8% to Rs 121 crore versus Rs 309 crore.

Margin at 6.3% versus 23.3%.

Net loss of Rs 71.8 crore versus profit of Rs 147 crore.

Zensar Tech Q4FY25 (Consolidated, QoQ)

Share price rises 2.29% at Rs 718.10.

Revenue up 2.5% to Rs 1,359 crore versus Rs 1,326 crore.

EBIT up 2.9% to Rs 189 crore versus Rs 183 crore.

Margin at 13.9% versus 13.8%.

Net profit up 10% to Rs 176 crore versus Rs 160 crore.

Lloyds Metals and Energy Q4FY25 (Consolidated, YoY)

Share price falls 6.21% at Rs 1,201.10.

Revenue down 23.5% to Rs 1,183 crore versus Rs 1,546 crore.

Ebitda down 44% to Rs 250 crore versus Rs 450 crore.

Margin at 21.2% versus 29.1%.

Net profit down 27% to Rs 202 crore versus Rs 277 crore.

The board has approved raising up to Rs 5,000 crore via bonds, securities, and other means.

Bhansali Engineering Q4FY25 (Consolidated, YoY)

Share price falls 2.96% at Rs 107.40.

Revenue up 7.4% to Rs 345 crore versus Rs 321 crore.

Ebitda down 5.7% to Rs 48 crore versus Rs 51 crore.

Ebitda margin to 13.96% versus 15.89%.

Net profit down 2.3% to Rs 39 crore versus Rs 40 crore.

Final dividend of Rs 1 per share.

Mangalore Refinery and Petrochemicals Q4FY25 (Standalone, QoQ)

Share price falls 4.67% at Rs 130.71.

Revenue up 7.8% to Rs 24,596 crore versus Rs 21,871 crore.

Ebitda up 9.6% to Rs 1,130 crore versus Rs 1,031 crore.

Margin to 4.6% versus 4.7%.

Net profit up 19.4% to Rs 363 crore versus Rs 304 crore.

Avantel Q4FY25 (Consolidated, YoY)

Share price falls 13.72% at Rs 112.01.

Revenue up 17.95% to Rs 49.26 crore versus Rs 41.76 crore.

Ebitda down 36.14% to Rs 11.59 crore versus Rs 18.15 crore.

Margin down 19.93% to 23.52% versus 43.46%.

Net profit down 49.95% to Rs 6.08 crore versus Rs 12.15 crore.

India Cements Q4 Highlights (Consolidated, YoY)

Share price falls 3.30% at Rs 278.30.

Revenue down 3.1% to Rs 1,197 crore versus Rs 1,236 crore.

Ebitda loss to Rs 3 crore versus profit of Rs 37 crore.

Net profit of Rs 19.14 crore versus loss of Rs 50.06 crore.

Exceptional items during the quarter include: Profit on sale of investment in subsidiaries, Coromandel Electric and Coromandel Travels, amounting to Rs 92.81 crore, including reversal of provision for diminution in value of investment and provision for diminution in value of vessel held for sale and others of Rs 2.68 crore.

SBFC Finance Q4FY25 (Standalone, YoY)

Share price falls 2.78% at Rs 103.20.

Total income up 29.2% to Rs 361.1 crore versus Rs 279.4 crore

Net profit up 29% to Rs 94.4 crore versus Rs 73.4 crore.

Net interest income up 25% at Rs 211 crore versus Rs 169 crore.

Board approves raising up to Rs 3,000 crore via NCDs.

IGL Q4FY25 (Cons, QoQ)

Share price rises 1.93% at Rs 181.64.

Net Revenue up 5.1% at Rs 3,950.6 crore vs Rs 3,759.1 crore.

Ebitda up 36.7% at Rs 497.2 crore vs Rs 363.6 crore.

Ebitda margin up 290 bps at 12.6% vs 9.7%.

Net Profit up 22.2% at Rs 349.2 crore vs Rs 285.8 crore.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.