Shares of Eicher Motors Ltd., Brigade Enterprises Ltd. and Lupin Ltd. were in focus on Thursday, after the companies announced their fourth quarter results.

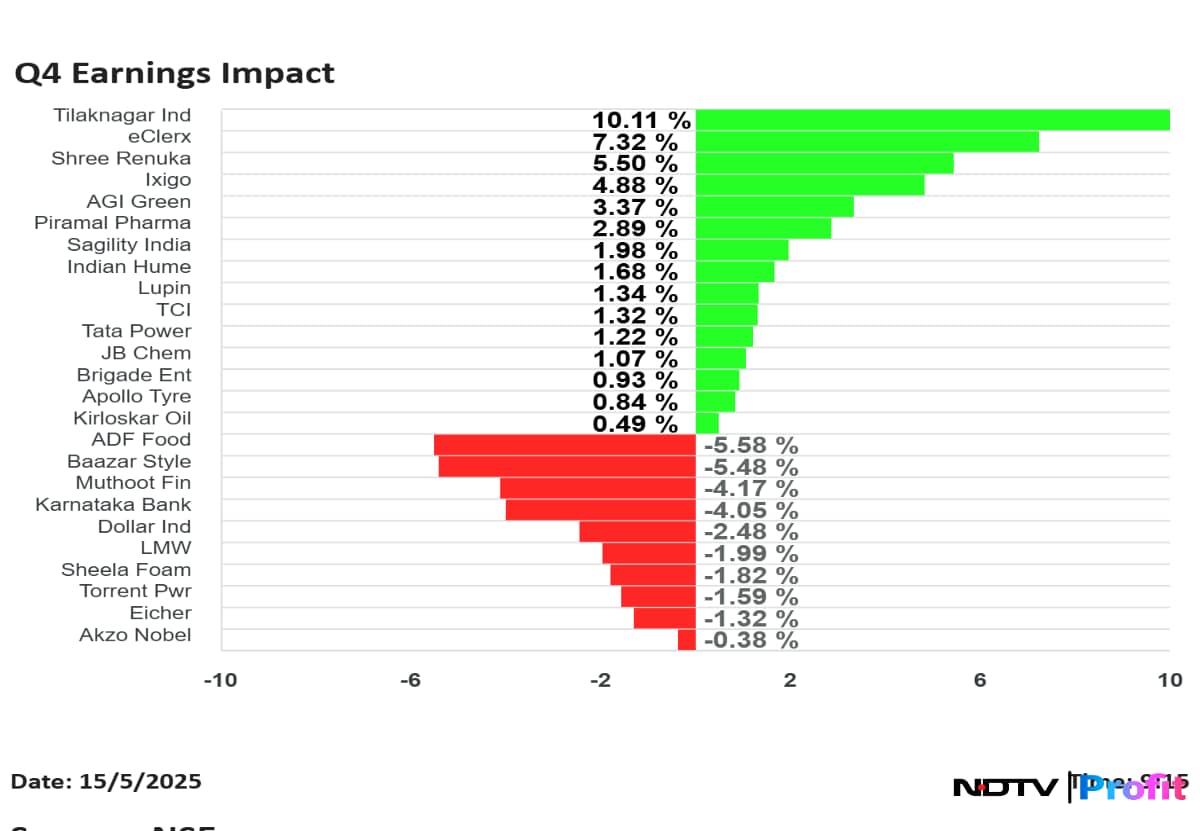

Tilaknagar Industries Ltd. shares rose the most, while Baazar Style Ltd. fell the most, among the companies that announced their results for quarter ended March.

Eicher Motors Q4 FY25 Highlight (Consolidated, YoY)

Share price fell 1.59% at Rs 5,360.

Revenue up 23.1% to Rs 5,241 crore versus Rs 4,256 crore (Bloomberg estimate: Rs 5,160 crore).

Ebitda up 11.4% to Rs1,257.7 crore versus Rs 1,128.64 crore (Bloomberg estimate: Rs 1,303 crore).

Margin at 24% versus 26.5% (Bloomberg estimate: 25.3%).

Net profit up 27.3% to Rs 1,362.15 crore versus Rs 1,070.45 crore (Bloomberg estimate: Rs 1,252 crore).

Recommended final dividend of Rs 70 per equity share for FY25.

Tata Power Q4 FY25 Highlight (Consolidated, YoY)

Share price rose 1.78% at Rs 404.

Revenue up 7.9% to Rs 17,096 crore versus Rs 15,846.6 crore (Bloomberg estimate: Rs 17,094 crore).

Ebitda up 39.2% to Rs 3,245.6 crore versus Rs 2,332 crore (Bloomberg estimate: Rs 3,094 crore).

Margin at 19% versus 14.7% (Bloomberg estimate: 18.1%).

Net profit up 16.5% to Rs 1,043 crore versus Rs 895 crore (Bloomberg estimate: Rs 1,026 crore).

Kirloskar Oil Engines Q4 FY25 Results Highlights (Consolidated, YoY)

Share price up 0.99% at Rs 742.45.

Revenue rose 5.6% at Rs 1,753 crore versus Rs 1,660 crore.

Ebitda up 3.4% at Rs 313 crore versus Rs 303 crore.

Margin at 17.9% versus 18.3%.

Net profit down 11.8% at Rs 131 crore versus Rs 149 crore.

Eclerx Services Q4 FY25 Results Highlights (Consolidated, QoQ)

Share price rises 11.80% at Rs 3,073.

Revenue up 5.2% at Rs 898 crore versus Rs 854 crore.

EBIT up 3.4% at Rs 178 crore versus Rs 172 crore.

Margin at 19.8% versus 20.1%.

Net profit up 11% at Rs 152 crore versus Rs 137 crore.

Brigade Enterprises Q4 FY25 Highlights (Consolidated, YoY)

Share price falls 2.02% at Rs 1,070.

Revenue down 14% to Rs 1,460 crore versus Rs 1,702 crore.

Ebitda down 3.8% to Rs 416 crore versus Rs 433 crore.

Margin expands to 28.5% versus 25.4%.

Net profit up 19.8% to Rs 247 crore versus Rs 206 crore.

Baazar Style Q4 FY25 Results Highlights (Consolidated, YoY)

Share price down 8.08% at Rs 294.50.

Revenue up 54.5% at Rs 345 crore versus Rs 223 crore.

Ebitda up 69.3% at Rs 40 crore versus Rs 23.6 crore.

Margin at 11.6% versus 10.5%.

Net loss Rs 6.4 crore.

Le Travenues Q4 FY25 Results Highlights (Consolidated, QoQ)

Share price rose 6.63% at Rs 178.75.

Revenue up 17.6% at Rs 284 crore versus Rs 242 crore.

Ebitda up 16.1% at Rs 24.73 crore versus Rs 21.3 crore.

Margin at 8.7% versus 8.8%.

Net profit up 7.7% at Rs 16.7 crore versus Rs 15.5 crore.

Torrent Power Q4 FY25 Highlight (Consolidated, YoY)

Share price declined 2.40% at Rs 1,415.10.

Revenue down 1.1% to Rs 6,456.3 crore versus Rs 6,528.6 crore (Bloomberg estimate: Rs 6,540 crore).

Ebitda up 2% to Rs 1,130.79 crore versus Rs 1,109.09 crore (Bloomberg estimate: Rs 1,169 crore).

Margin at 17.5% versus 17% (Bloomberg estimate: 18%).

Net profit up 146.5% to Rs 1,060 crore versus Rs 430 crore (Bloomberg estimate: Rs 474 crore).

Muthoot Finance Q4 FY25 Earnings Highlights (Standalone, YoY)

Share price fell 5.22% at Rs 2,142.

Net profit up 42.7% at Rs 1,508 crore versus Rs 1,056 crore.

NII up 36.01% at Rs 2,904 crore versus Rs 2,135 crore.

GNPA at 3.41% versus 4.22% (QoQ).

Total income up 43% at Rs 4,889 crore versus Rs 3,418 crore.

Hitachi Energy Q4 FY25 Results Highlights (YoY)

Share price down 2.95% at Rs 16,242.

Revenue up 11% at Rs 1,884 crore versus Rs 1,695 crore.

Ebitda up 30.8% at Rs 238 crore versus Rs 182 crore.

Margin at 12.6% versus 10.7%.

Net profit up 61.8% at Rs 184 crore versus Rs 114 crore.

Hitachi Energy order book rose 55.7% to Rs 2,190.8 crore in Q4.

Shree Renuka Sugar Q4 FY25 Results Highlights (Consolidated, YoY)

Share price 7.29% higher at Rs 32.80.

Revenue down 21.66% at Rs 2,713 crore versus Rs 3,463 crore.

Ebitda down 8.87% at Rs 314.3 crore versus Rs 344.9 crore.

Ebitda margin up 162 bps at 11.58% versus 9.95%.

Net profit at Rs 91.6 crore versus loss of Rs 112 crore.

Other income aided PAT, other Income at 61.3 crore vs 10 crore.

Deferred tax credit of 15.8 crore vs tax expense of 67 crore.

Tilaknagar Industries Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 13.91% at Rs 344.80.

Revenue up 14.3% at Rs 881 crore versus Rs 770 crore.

Ebitda up 63% at Rs 78.4 crore versus Rs 48.2 crore.

Margin at 8.9% versus 6.2%.

Net profit up at Rs 77.3 crore versus Rs 31.4 crore.

Sheela Foam Q4 FY25 Results Highlights (Consolidated, YoY)

Share price falls 2.71% at Rs 645.60.

Revenue up 0.5% at Rs 850 crore versus Rs 845 crore.

Ebitda down 59% at Rs 33 crore versus Rs 80.5 crore.

Margin at 3.9% versus 9.5%.

Net profit down 66.7% at Rs 21.5 crore versus Rs 64.6 crore.

ADF Foods Q4 FY25 Results Highlights (Consolidated, YoY)

Share price falls 6.08% at Rs 219.11.

Revenue up 3.5% at Rs 159 crore versus Rs 153.6 crore.

Ebitda down 28% at Rs 25 crore versus Rs 34 crore.

Margin at 15.5% versus 22.3%.

Net profit down 36% at Rs 16.4 Cr versus Rs 26 crore.

Karnataka Bank Q4 FY25 Results Highlights (YoY)

Share price fell 5.14% at Rs 197.

Net profit down 8% at Rs 252 crore versus Rs 274 crore.

Net NPA at 1.31% versus 1.39% (QoQ).

Gross NPA at 3.08% versus 3.11% (QoQ).

Net interest income down 6% at Rs 781 crore versus Rs 834 crore.

Operating profit down 25% at Rs 375 crore versus Rs 500 crore.

Provisions down 83% at Rs 31 crore versus Rs 185 crore.

Provisions down 63% at Rs 31 crore versus Rs 84 crore (QoQ).

Indian Hume Pipes Q4 FY25 Results Highlights (YoY)

Share price 2.69% higher at Rs 418.

Revenue down 3% at Rs 395 crore versus Rs 407 crore.

Ebitda down 23% at Rs 59 crore versus Rs 77 crore.

Margin at 15% versus 18.9%.

Net profit at Rs 499 crore versus Rs 44 crore.

LMW Q4 FY25 Results Highlights (Consolidated, YoY)

Share price falls 2.69% at Rs 17,513.

Revenue down 17.2% at Rs 804 crore versus Rs 971 crore.

Ebitda down 21% at Rs 58 crore versus Rs 73.5 crore.

Margin at 7.2% versus 7.6%.

Net profit down 27.6% at Rs 47.8 crore versus Rs 66 crore.

Transport Corp India FY25 Results Highlights (Consolidated, YoY)

Share price rises 2.04% at Rs 1,171.40.

Revenue up 9.3% at Rs 1,179 crore versus Rs 1,079 crore.

Ebitda up 11.2% at Rs 122 crore versus Rs 109 crore.

Margin at 10.3% versus 10.1%.

Net profit up 11.9% at Rs 114 crore versus Rs 102 crore.

Akzo Nobel India Q4 FY25 Results Highlights (Consolidated, YoY)

Share price down 1.51% at Rs 3,460.60.

Revenue up 9.1% to Rs 1,022.00 crore versus Rs 937.00 crore.

Ebitda up 32.5% to Rs 139.70 crore versus Rs 105.40 crore.

Margin at 13.7% versus 11.2%.

Net profit down 0.3% to Rs 108.40 crore versus Rs 108.70 crore.

AGI Greenpac Q4 FY25 Results Highlights (YoY)

Share price falls 2.28% at Rs 818.40.

Revenue up 13.3% at Rs 704.8 crore versus Rs 622.3 crore.

Ebitda up 5.8% at Rs 154.2 crore versus Rs 145.7 crore.

Margin at 21.9% versus 23.4%.

Net profit up 40% at Rs 96.6 crore versus Rs 64.6 crore.

Apollo Tyres Q4 Earnings (Consolidated, YoY)

Share price up 3.26% at Rs 490.85.

Revenue up 2.6% at Rs 6,424 crore versus Rs 6,258 crore.

Ebitda down 18.5% at Rs 837 crore versus Rs 1,028 crore

Margin at 13% versus 16.4%.

Net profit down 47.9% at Rs 185 crore versus Rs 354 crore.

One-time loss of Rs 119 crore in Q4.

Piramal Pharma Q4 Earnings (Consolidated, YoY)

Share price rises 3.18% at Rs 226.

Revenue up 7.9% at Rs 2,754 crore versus Rs 2,552 crore.

Ebitda up 5.9% at Rs 561 crore versus Rs 530 crore.

Margin at 20.4% versus 20.8%.

Net profit up 51.6% at Rs 153 crore versus Rs 101 crore.

Dollar Industries Q4 Earnings (Consolidated, YoY)

Share price falls 4.68% at Rs 388.

Revenue up 9.8% at Rs 549 crore versus Rs 500 crore.

Ebitda down 1% at Rs 56.5 crore versus Rs 57.2 crore.

Margin at 10.3% vs 11.4%.

Net profit down 11.6% at Rs 29.2 crore versus Rs 33.1 crore.

To pay final dividend of Rs 3 per share.

JB Chemicals And Pharma Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 1.20% at Rs 1,632.10.

Revenue up 10% at Rs 949 crore versus Rs 862 crore (Bloomberg estimate: Rs 939 crore).

Ebitda up 14% at Rs 226 crore versus Rs 198 crore (Bloomberg estimate: Rs 227 crore).

Margin at 23.8% versus 23% (Bloomberg estimate: 24.2%).

Net profit up 15.5% at Rs 146 crore versus Rs 126 crore (Bloomberg estimate: Rs 142 crore).

Jubilant FoodWorks Q4 FY25 Results Highlight (Consolidated, YoY)

Share price rises 2.03% at Rs 707.85.

Revenue up 33.6% to Rs 2,103 crore versus Rs 1,574 crore (Bloomberg estimate: Rs 1,933 crore).

Ebitda up 24.7% to Rs 389 crore versus Rs 312 crore (Bloomberg estimate: Rs 339 crore).

Margin at 18.5% versus 19.8% (Bloomberg estimate: 17.5%).

Net profit down 76.9% to Rs 48 crore versus Rs 207.5 crore (Bloomberg estimate: Rs 38.5 crore).

The company had an exceptions gain of Rs 170 crore in Q4 FY24.

Sagility India Q4 FY25 Results Highlights (Consolidated, YoY)

Share price falls 3% at Rs 45.64.

Revenue up 22% to Rs 1,568 crore versus Rs 1,283 crore.

Ebitda up 21.5% to Rs 373 crore versus Rs 307 crore.

Margin at 23.8% versus 23.9%.

Net profit up 127.7% to Rs 182.6 crore versus Rs 80.2 crore.

Lupin Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 2.29% at Rs 2,118.90.

Revenue up 14.2% to Rs 5,667 crore versus Rs 4,961 crore. (Bloomberg estimate: Rs 5,564 crore).

Ebitda up 32.5% to Rs 1,321 crore versus Rs 997 crore.

Margin at 23.3% versus 20%.

Net profit up 114.9% to Rs 772 crore versus Rs 359 crore (Bloomberg estimate: Rs 735 crore).

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.