Dabur India Ltd., Coal India Ltd. and Tata Chemicals Ltd. were in focus on Thursday after they announced their fourth quarter results.

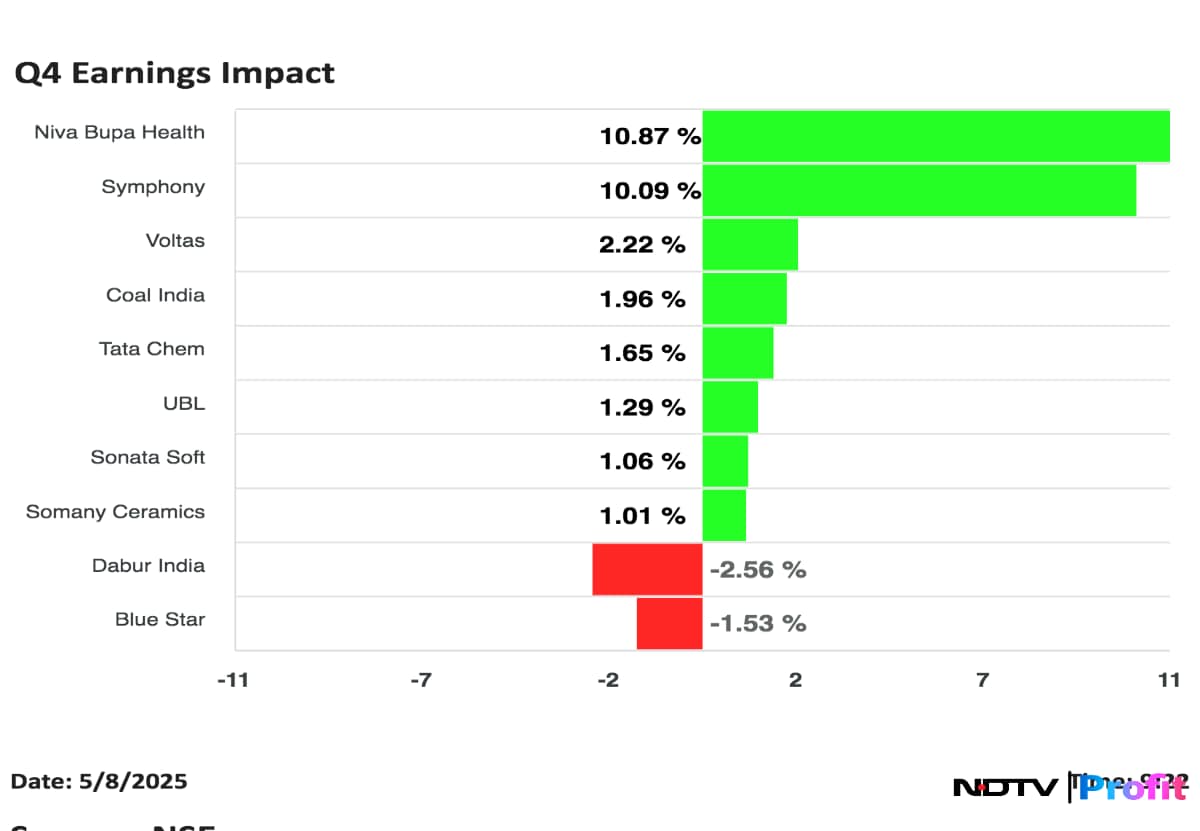

While Niva Bupa Health Insurance Co. rose the most, Blue Star Ltd. fell the most among companies that announced their results for quarter ended March.

Dabur India Q4 FY25 Highlights (Consolidated, YoY)

Shares fell as much as 4.36% to Rs 461.10.

Revenue up 0.6% to Rs 2,830 crore versus Rs 2,815 crore (Estimate: Rs 2,845.8 crore).

Ebitda down 8.6% to Rs 427 crore versus Rs 467 crore (Estimate: Rs 438.1 crore).

Margin at 15% versus 16.6% (Estimate: 15.4%).

Net profit down 8.4% to Rs 320 crore versus Rs 349 crore (Estimate: Rs 324.1 crore).

Consumer care revenue up 1.8% at Rs 2,254 crore versus Rs 2,214 crore.

Food business revenue down 5.31% at Rs 500 crore versus Rs 528 crore.

Retail business revenue down 20.78% at Rs 24.56 crore versus Rs 31 crore.

In Q4, International Business achieved 19 % constant currency growth and 17% growth during the full year.

Expects consumer demand in India to recover in the coming quarters, both in urban and rural markets.

Coal India Q4 Highlights (Consolidated, YoY)

Shares rose as much as 2.99% to Rs 394.75.

Revenue down 1% to Rs 37,824.54 crore versus Rs 38,213.48 crore (Bloomberg estimate: Rs 36,638.2 crore).

Ebitda up 4% to Rs 11,790.15 crore versus Rs 11,387.59 crore (Estimate Rs 11,332 crore).

Margin at 31.2% versus 29.8% (Estimate 30.9%).

Net profit up 12% to Rs 9,604.02 crore versus Rs 8,572.14 crore (Bloomberg Estimate: Rs 8,413.5 crore).

Other income grew by 75% to Rs 3,937 crore versus Rs 2,244 crore.

Tata Chemicals Q4 FY25 Highlights (Consolidated, YoY)

Shares rose as much as 2.23% to Rs 844.65.

Revenue up 1% at Rs 3,509 crore versus Rs 3,475 crore (Bloomberg estimate: Rs 3,642.4 crore).

Ebitda down 26% at Rs 327 crore versus Rs 443 crore (Bloomberg estimate: Rs 452.4 crore).

Margin at 9.3% versus 12.7% (Bloomberg estimate:12.4%).

Net loss narrows to Rs 56 crore versus Rs 850 crore (Bloomberg estimate: Rs 74-crore profit).

Revenue growth was constrained by pricing pressure observed across all geographical regions.

Ebitda decline was primarily driven by lower pricing.

UK Soda Ash unit ceased its operations in early February 2025, resulting in an additional exceptional charge of Rs 55 crore.

Demand is robust in Asia (excluding China and India) and Americas (excluding USA), while slight decline is observed in demand of Africa.

Market conditions remain challenging as India continues to grow, while China, US and Western Europe are witnessing slight declines due to reduced demand for flat and container glass.

Niva Bupa Health Q4 (YoY)

Shares rose as much as 12.16% to Rs 90.88.

Premium Earned (Net) grew 11% by 1,527 crore versus Rs 1,381 crore.

Gross written premium grew 36% year-on-year at 2,395 crore.

PAT up 31% at Rs 206 crore versus Rs 157 crore.

Claims Settlement Ratio at 93.2% versus 91.8% (QoQ).

Q4 Combined Ratio without 1/n at 86.1% versus 96.3% (QoQ).

FY25 Combined Ratio without 1/n at 96.1% versus 100.9% (QoQ).

Combined Ratio is a combination of Loss Ratio and Expense Ratio.

Combine Ratio lower the better.

Retail health segment market share increased to 9.4% from 9.1% in FY24.

Continues to be one of the fastest growing companies in health insurance.

Blue Star Q4 Highlights (Consolidated, YoY)

Shares fell as much as 2.31% to Rs 1,639.

Revenue up 20.8% to Rs 4,019 crore versus Rs 3,328 crore (Bloomberg estimate: Rs 3,986 crore).

Ebitda up 15.3% to Rs 279 crore versus Rs 242 crore.

Margin at 7% versus 7.3%.

Net profit up 21.3% to Rs 194 crore versus Rs 160 crore (Bloomberg estimate: Rs 208 crore).

Segment Revenue

Electro-mechanical projects and commercial AC system representing 49% revenue grew 30% year-on-year.

Unitary products representing 48% revenue grew 15% year-on-year.

The room AC business performed well, driven by demand and dealer stocking.

Soft April growth, demand is expected to rise in May-June 2025.

Voltas Q4 Highlights (Consolidated, YoY)

Shares rose as much as 3.54% to Rs 1,288.

Revenue up 13% to Rs 4,767 crore versus Rs 4,203 crore (Bloomberg estimate: Rs 4873.1 crore).

Ebitda up 75.3% to Rs 333 crore versus Rs 190 crore.

Margin at 7% versus 4.5%.

Net profit up 107.8% to Rs 241 crore versus Rs 116 crore. (Bloomberg estimate: Rs 264.1 crore)

Segment Revenue

Unitary Cooling Products representing 73% of revenue grew by 17%

Electro - Mechanical Projects and Services representing 24% of revenue grew by 3.6%.

Engineering Products and Services degrew by 15%.

Symphony Q4 Highlights (Consolidated, YoY)

Shares rose as much as 12.07% to Rs 1,344.70.

Revenue up 46.98% at Rs 488 crore versus Rs 332 crore.

Ebitda up 87.71% at Rs 107 crore versus Rs 57 crore.

Ebitda margin up 475 bps at 21.92% versus 17.16%.

Net profit up 89.65% at Rs 79 crore versus Rs 48 crore.

United Breweries Q4 Highlights (Consolidated, YoY)

Shares rose as much as 2.90% to Rs 2,245.

Revenue down 8.9% at Rs 2,323 crore versus Rs 2,133 crore (Bloomberg estimate: Rs 2,331.95 crore).

Ebitda up 30.97% at Rs 186.65 crore versus Rs 142.51 crore.

Ebitda margin up 135 bps at 8.03% versus 6.68%.

Net profit up 19.75% at Rs 97 crore versus Rs 81 crore (Bloomberg estimate: Rs 90.12 crore).

Beer revenue falls by 7.5% year-on-year.

Sonata Software Q4 Highlights (Consolidated, QoQ)

Shares rose as much as 4.48% to Rs 415.

Revenue down 8% to Rs 2,617 crore versus Rs 2,843 crore (Bloomberg estimate: Rs 2,441.5 crore).

EBIT up 14% to Rs 150 crore versus Rs 131 crore.

EBIT margin at 5.7% versus 4.6%.

Net profit up 1.9% to Rs 107 crore versus Rs 105 crore (Bloomberg estimate: Rs 92.5 crore).

Somany Ceramics Q4 Highlights (Consolidated, YoY)

Shares rose as much as 2.78% to Rs 432.65.

Revenue up 4.5% to Rs 773 crore versus Rs 739 crore (Bloomberg estimate: Rs 741.5 crore).

Ebitda down 18% to Rs 66 crore versus Rs 81 crore.

Margin at 8.5% versus 11%.

Net profit down 32.3% to Rs 21 crore versus Rs 31 crore (Bloomberg estimate: Rs 24.9 crore).

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.