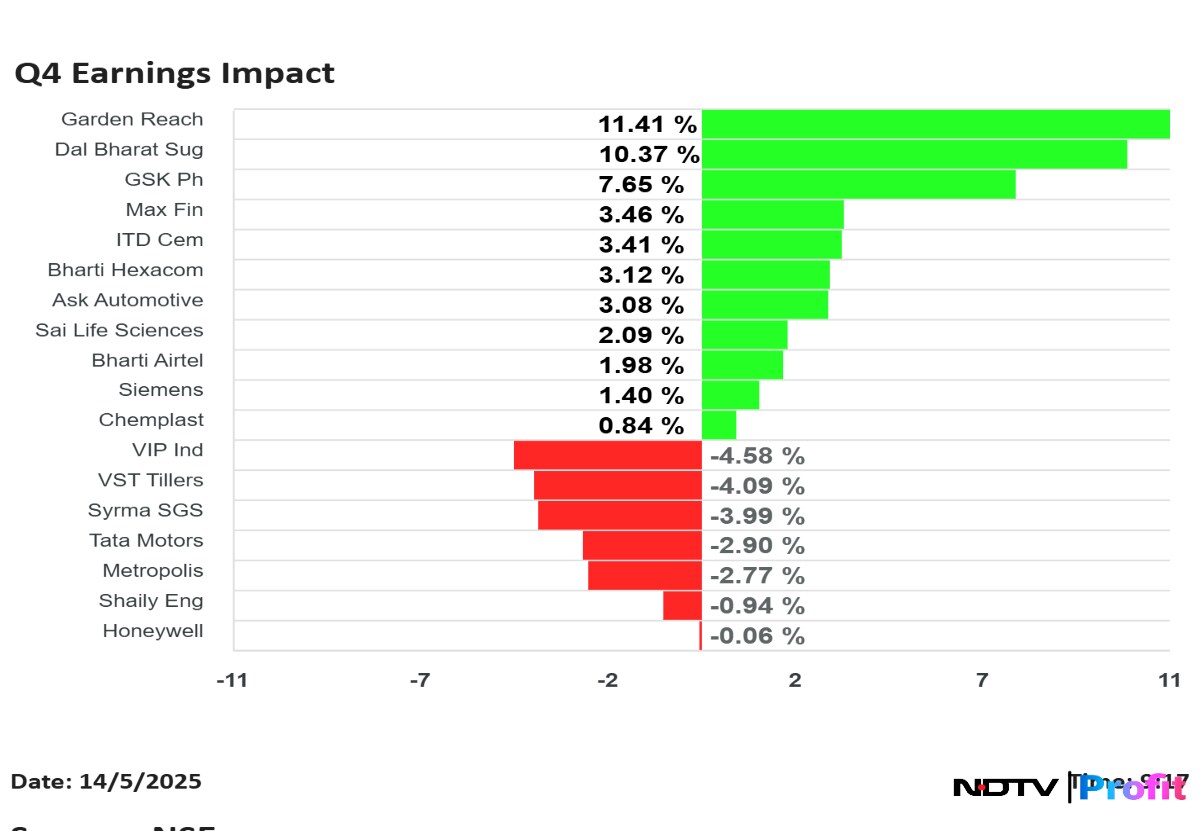

Shares of Bharti Airtel Ltd., Siemens Ltd. and Tata Motors Ltd. were in focus on Wednesday, after the companies announced their fourth quarter results.

Garden Reach Ltd. shares rose the most, while Syrma SGS Ltd. fell the most, among the companies that announced their results for quarter ended March.

Siemens Q2 Earnings Highlights (Standalone, YoY)

Share price rose 2.17% at Rs 2,980.

Revenue up 2.5% at Rs 3,809 crore versus Rs 3,716 crore.

Ebitda declines 29.4% to Rs 386 crore versus Rs 547 crore.

Margin contracts to 10.1% versus 14.7%.

Net profit down 24.8% to Rs 674 crore versus Rs 896 crore.

Tata Motors Q4 FY25 Highlights Highlights (Consolidated, YoY)

Share price down 3.07% at Rs 686.

Revenue up 0.4% to Rs 1,19,503 crore versus Rs 1,19,033 crore (Bloomberg estimate: Rs 1,22,618 crore).

Ebitda up 0.6% at Rs 16,644 crore versus Rs 16,545 crore (Bloomberg estimate: Rs 16,308 crore).

Margin at 14% versus 13.9% (Bloomberg estimate: 13.1%).

Net profit down 51.3% to Rs 8,470 crore versus Rs 17,407 crore (Bloomberg estimate: 7,662 crore).

GlaxoSmithKline Pharmaceuticals Q4 FY25 Highlights (Consolidated, YoY)

Share price 8.11% higher at Rs 3,015.

Revenue up 4.8% at Rs 974.4 crore versus Rs 929.8 crore.

Ebitda up 29.5% at Rs 333.2 crore versus Rs 257.3 crore.

Margin at 34.2% versus 27.7%.

Net profit up 35% at Rs 262.9 crore versus Rs 194.5 crore.

Bharti Hexacom Q4 FY25 Earnings Highlights (QoQ)

Share price rose 5.08% at Rs 1,789.90.

Revenue up 1.7% at Rs 2,289 crore versus Rs 2,251 crore.

Ebitda up 1.4% at Rs 1,168 crore versus Rs 1,152 crore.

Margin at 51% versus 51.2%.

Net profit up 79.4% to Rs 468 crore versus Rs 261 crore.

Bharti Airtel Q4 FY25 Result Highlights (Consolidated, QoQ)

Share price rose 2.66% at Rs 1,869.

Revenue up 6% to Rs 47,876 crore versus Rs 45,129 crore.

Ebitda up 10% at Rs 27,009 crore versus Rs 24,597 crore.

Margin at 56.4% versus 54.5% — highest in at least the last five years.

Net profit down 25% to Rs 11,022 crore versus Rs 14,781 crore.

Average revenue per user at Rs 245 versus Rs 245.

Dalmia Bharat Sugar and Industries Q4 FY25 Highlights (Consolidated, YoY)

Share price up 12.29% at Rs 452.

Revenue up 35.6% at Rs 1,017 crore versus Rs 750 crore.

Ebitda up 63.02% at Rs 194 crore versus Rs 119 crore.

Ebitda margin up 320 bps at 19.07% versus 15.86%.

Net profit up 126.37% at Rs 206 crore versus Rs 91 crore.

Syrma SGS Technology Q4 FY25 Results Highlights (Consolidated, YoY)

Share price fell 6.09% at Rs 530.

Revenue down 18.5% at Rs 924.4 crore versus Rs 1,134.2 crore (Bloomberg estimate: Rs 1,340 crore).

Ebitda up 43.8% at Rs 107.5 crore versus Rs 74.7 crore (Bloomberg estimate: Rs 106 crore).

Margin at 11.6% versus 6.6% (Bloomberg estimate: 7.9%).

Net profit up 87.3% at Rs 65.4 crore versus Rs 34.9 crore (Bloomberg estimate: Rs 56 crore).

Garden Reach Shipbuilders Q4 FY25 Results Highlights (YoY)

Share price up 14.89% at Rs 2,200.

Revenue up 61.7% to Rs 1,642 crore versus Rs 1,015.7 crore.

Ebitda up 144.5% to Rs 220.95 crore versus Rs 90.35 crore.

Margin at 13.5% versus 8.9%.

Net profit up 118.6% to Rs 244 crore versus Rs 111.6 crore.

Honeywell Automation Q4 FY25 Results Highlights (YoY)

Share price down 2.14% at Rs 35,050.

Revenue up 17.2% at Rs 1,114.5 crore versus Rs 950.7 crore.

Ebitda down 6.2% at Rs 159 crore versus Rs 170 crore.

Margin at 14.3% versus 17.9%.

Net profit down 5.6% at Rs 140 crore versus Rs 148 crore.

Shaily Engineering Q4 FY25 Results Highlights (Consolidated, YoY)

Share price down 5.05% at Rs 1,675.60.

Revenue up 27.7% at Rs 217.8 crore versus Rs 170.6 crore.

Ebitda up 57.1% at Rs 54.5 crore versus Rs 34.7 crore.

Margin at 25% versus 20.3%.

Net profit up 47.9% at Rs 28.6 crore versus Rs 19.3 crore.

VIP Industries Q4 FY25 Results Highlights (Consolidated, YoY)

Share price falls 5.31% at Rs 328.70.

Revenue down 4.3% at Rs 494.2 crore versus Rs 516.3 crore (Bloomberg estimate: Rs 503 crore).

Ebitda down 17% at Rs 6.5 crore versus Rs 7.8 crore (Bloomberg estimate: Rs 35 crore).

Margin at 1.3% versus 1.5% (Bloomberg estimate: 7%).

Net loss of Rs 27.4 crore versus loss of Rs 23.9 crore (Bloomberg estimate: Loss of Rs 9 crore).

ITD Cementation Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rose 5.32% at Rs 595.

Revenue up 9.8% at Rs 2,480 crore versus Rs 2,258 crore.

Ebitda up 17.6% at Rs 259 crore versus Rs 220 crore.

Margin at 10.5% versus 9.8%.

Net profit up 27% at Rs 113 crore versus Rs 89.5 crore.

Max Financial Q4 Earnings (Consolidated, YoY)

Share price rises 4.72% at Rs 1,351.

Total income down 16.8% at Rs 12,396 crore versus Rs 14,897 crore.

Net profit at Rs 31.31 crore versus Loss of Rs 44.05 crore.

ASK Automotive Q4 FY25 Results Highlights (Consolidated, YoY)

Share price 4.64% higher at Rs 458.

Revenue up 8.6% at Rs 850 crore versus Rs 782 crore.

Ebitda up 26% at Rs 104 crore versus Rs 82.3 crore.

Margin at 12.2% versus 10.5%.

Net profit up 20.6% at Rs 57.6 crore versus Rs 47.8 crore.

Metropolis Healthcare Q4 FY25 Results Highlights (Consolidated, YoY)

Share price fell 3.03% at Rs 1,650.10.

Revenue up 4.3% at Rs 345.3 crore versus Rs 331 crore (Bloomberg estimate: Rs 353 crore).

Ebitda down 22% at Rs 62.3 crore versus Rs 80 crore (Bloomberg estimate: Rs 83.4 crore).

Margin at 18% versus 24.2% (Bloomberg estimate: 23.6%).

Net profit down 20% at Rs 29.1 crore versus Rs 36.4 crore (Bloomberg estimate: Rs 39 crore).

Aurionpro Solutions Q4 FY25 Results Highlights (Consolidated, YoY)

Share price up 2.72% at Rs 1,429.80.

Revenue up 32% at Rs 327 crore versus Rs 247 crore.

Ebitda up 25.4% at Rs 66 crore versus Rs 52.6 crore.

Margin at 20.2% versus 21.3%.

Net profit up 31% at Rs 50.3 crore versus Rs 38.5 crore.

VST Tillers Q4 FY25 Results Highlights (Consolidated, YoY)

Share price falls 5.45% at Rs 3,535.

Revenue up 10.2% at Rs 301 crore versus Rs 273 crore.

Ebitda up 1.4% at Rs 40.4 crore versus Rs 40 crore.

Margin at 13.4% versus 14.6%.

Net profit down 29.7% at Rs 24.4 crore versus Rs 34.8 crore.

Chemplast Sanmar Q4 FY25 Results Highlights (Consolidated, YoY)

Share price 2.94% higher at Rs 412.

Revenue up 9.5% at Rs 1,150.8 crore versus Rs 1,050.7 crore.

Ebitda up 75% at Rs 36.7 crore versus Rs 21 crore.

Margin at 3.2% versus 2%.

Net loss of Rs 54.17 crore versus loss of Rs 31.13 crore.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.