Britannia Industries Ltd.'s quarterly profit surpassed estimates on the back of lower tax expenses and higher other income.

Net profit rose 33.4 percent year-on-year to Rs 404.20 crore in the quarter ended September, according to the biscuit maker's exchange filing. That's higher than the Rs 365 crore estimated by analysts tracked by Bloomberg.

Revenue rose 6.2 percent to Rs 3,048.80 crore, meeting the Rs 3041-crore estimate. Tax expense reduced by a third to Rs 95.50 crore over the previous year. The Wadia Group company had opted for a lower corporate tax rate proposed by Finance Minister Nirmala Sitharaman in September. Also, other income jumped 55 percent to Rs 68.2 crore during the three-month period.

The better-than-estimated profit came despite consumption slowing, with demand for consumer goods dropping to a seven-year low in rural India in the three months through September. Volumes of larger rival Hindustan Unilever Ltd., too, failed to pick up.

“We continued to grow faster than the market with a sequential revenue growth of 13 percent,” the company's Managing Director Varun Berry said in a statement accompanying the earnings. “In the base business, we continued our premiumisation & innovation journey with the launch of limited edition ‘Treat Cream biscuits' & ‘Little Hearts Strawberry'. We have also seen sequential growth in some of the new category launches and our plan is to scale up ‘salted snacks' in West & ‘croissant' in East & South,” Berry said. “We continued to invest in enhancing our brand equity through focused product campaigns.”

Earnings before interest, tax and depreciation rose 8.3 percent to Rs 492.20 crore over previous year while operating margin expanded to 16.1 percent from 15.8 percent.

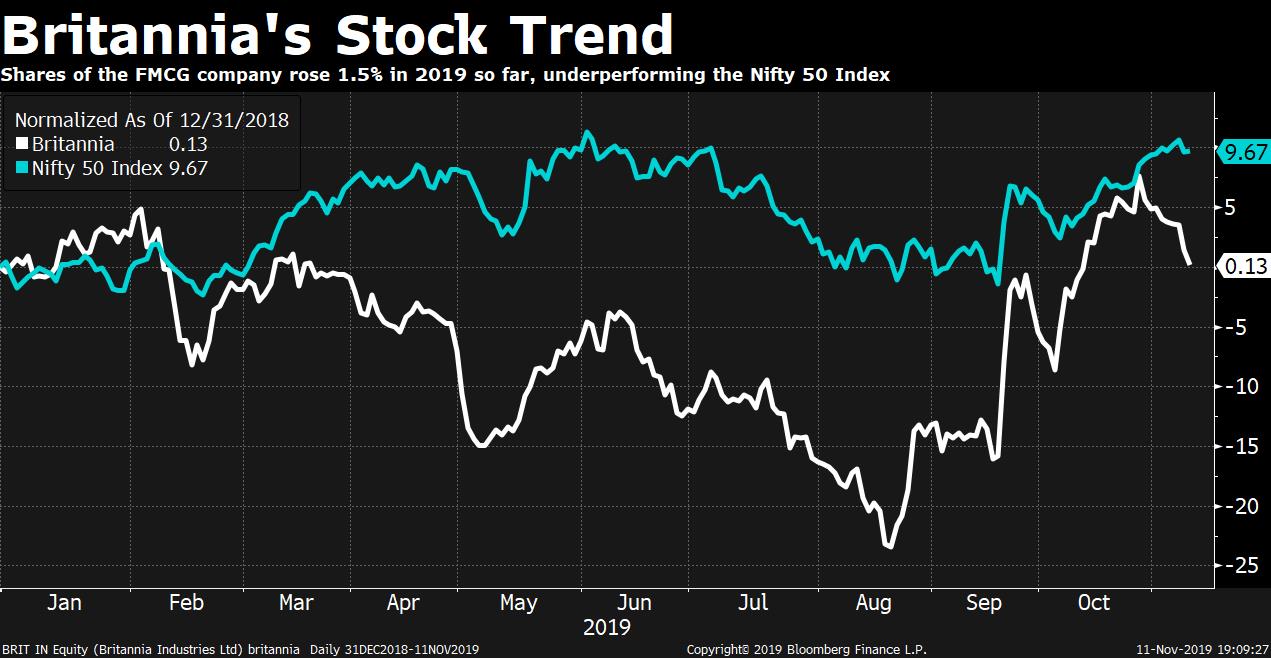

Shares of Britannia have gained nearly 1.5 percent so far this year, compared with a 9.22 percent rise in the benchmark NSE Nifty 50 Index.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.