PVR Inox Ltd.'s share price rose to the highest level in nearly six months after its net loss shrank because of good operating profit. It has reported Ebitda in line with estimates because of its good cost control initiatives, the brokerage said.

PVR Inox's occupancy rate and screen rose during the April–June period. The company has opened 20 new screens, with 14 screens under the FOCO and asset-light models. FOCO stands for franchise-owned and company-operated screens, BofA said in a note.

Now, PVR Inox has 55 new screens signed under FOCO and 72 under the asset-light model, which displays the company's intent on capital allocation expansion over the next 18–24 months, BofA said.

PVR Inox's management said that the Ebitda will be similar, while the return on capital employed will likely be much healthier, BofA said.

BofA maintained an underperform rating with Rs 945 apiece, which implied an 8.7% downside from the current market price. The brokerage said that a consistent good content pipeline will ensure a case for re-rating.

PVR Inox Q1 Earnings Key Highlights (Consolidated, YoY)

Net loss Rs 54 crore versus loss of Rs 179 crore

Revenue rose 23.4% to Rs 1,469 crore versus Rs 1,191 crore

Ebitda rose 58% to Rs 397 crore versus Rs 252 crore

Margin at 27% versus 21.1%

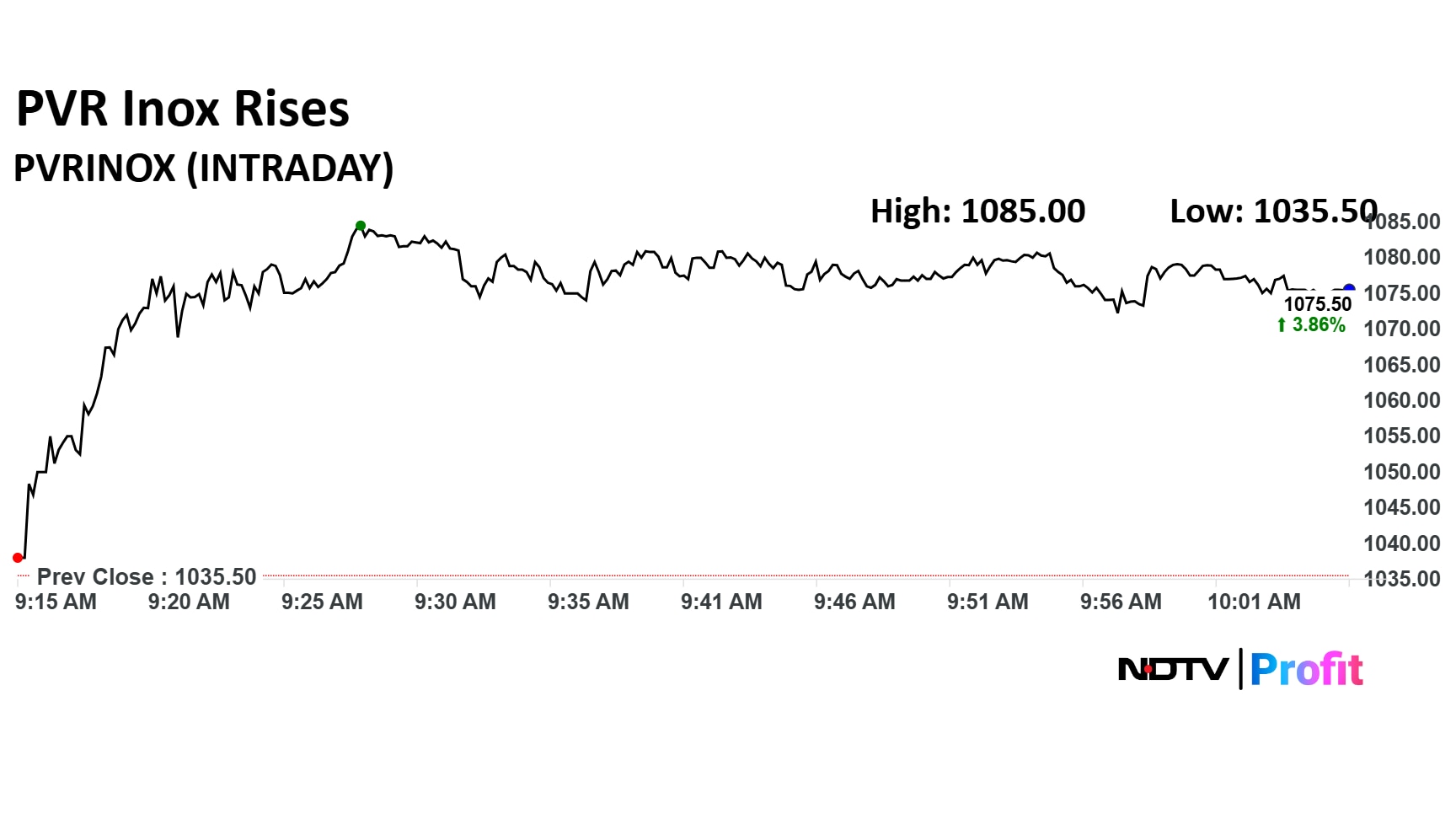

PVR Inox share price advanced 4.78% to Rs 1,085 apiece, the highest level since Feb 10. It was trading 3.98% higher at Rs 1,076.70 apiece as of 10:04 a.m., which implied a 0.39% decline in the NSE Nifty 50 index.

The stock declined 26.49% in 12 months and 17.58% on a year-to-date basis. Total traded volume so far in the day stood at 13 times its 30-day average. The relative strength index was at 70.43.

Out of 21 analysts tracking the company, 15 maintain a 'buy' rating, four recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 17.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.