Share price of Prestige Estates Projects Ltd. fell over 5% on Wednesday, after Morgan Stanley downgraded the stock to 'underweight' from its previous 'overweight' rating, citing weaker pre-sales momentum and a reduced outlook for the company. The brokerage firm also lowered its price target for Prestige Estates to Rs 1,510 from Rs 1,770 per share, implying an 11.4% downside.

Morgan Stanley has revised its pre-sales growth estimate for financial year 2025 to just 9% year-on-year, down significantly from its earlier estimate of 28%. The downgrade is attributed to weaker-than-expected pre-sales, with the company achieving only 29% of its financial year 2025 target in the first half of the year. In contrast, other developers in the market are benefiting from a strong equity market, pent-up demand, and limited supply of quality properties.

Despite delivering a solid 63% pre-sales growth in fiscal 2024, Prestige's pre-sales in the first half of fiscal 2025 showed a sharp 36% year-on-year decline, which is well below the revised estimates for the financial year. This slowdown in pre-sales momentum, combined with high capital expenditures in the company's investment properties business, has prompted the downgrade, Morgan Stanley said.

On the positive side, the brokerage highlighted that if approvals are granted on time and if residential Ebitda margins improve beyond the current 27%, the stock could outperform. However, the firm cautioned that the stock is not as cheap as its peers in terms of implied P/E ratio, based on pre-sales and net margins.

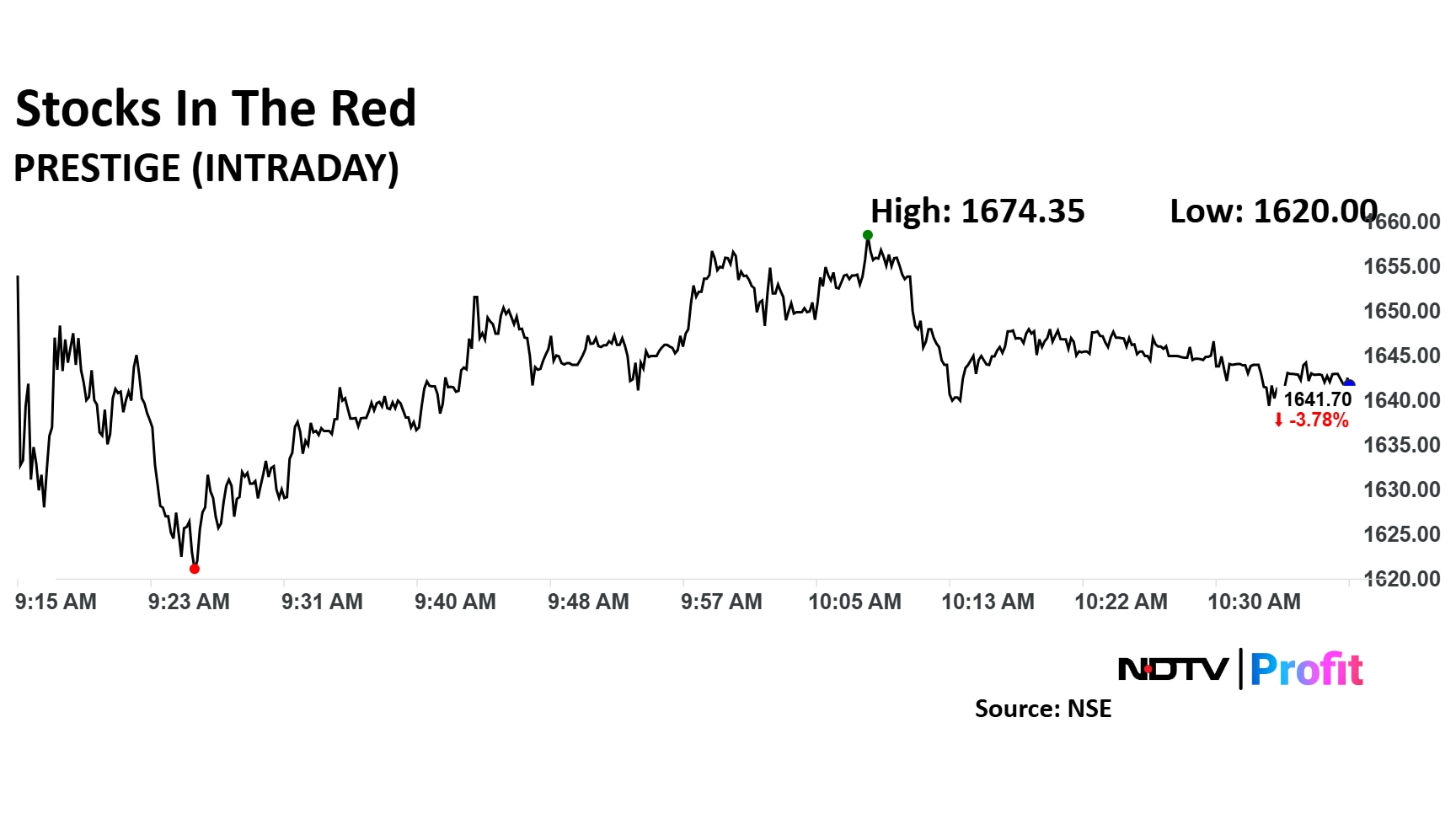

Prestige Estates Share Price

Share price of Prestige Estate fell as much as 5.05%, before paring loss to trade 3.75% lower at Rs 1,642.25 apiece, as of 10:44 a.m. This compares to a flat NSE Nifty 50.

The stock has risen 71.66% in the last 12 months. Total traded volume so far in the day stood at 3.4 times its 30-day average. The relative strength index was at 48.17.

Out of 19 analysts tracking the company, 15 maintain a 'buy' rating and four suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 15.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.