Praj Industries Ltd. saw its share price drop over 6%, following the release of its third-quarter financial results for fiscal 2025, which fell short of analysts' expectations. The company's consolidated net profit declined by 42% year-over-year to Rs 41.10 crore, missing the Bloomberg consensus estimate of Rs 78 crore.

Revenue for the quarter increased by 2.9% to Rs 853.03 crore, compared to Rs 828.62 crore in the same period last year. However, this was below the estimated Rs 951 crore. The company's Ebitda fell by 25% to Rs 72.71 crore, against an estimate of Rs 115 crore. Ebitda margins contracted to 8.5% from 11.8%, missing the expected 12.1%.

The weak earnings report reflects ongoing challenges for Praj Industries, including higher operational costs and market volatility. Despite a modest increase in revenue, the significant drop in profitability and margins seems to have raised concerns among investors.

Praj Industries, founded in 1983 by Dr. Pramod Chaudhari, is an engineering and biotechnology company specialising in bio-based technologies. The company is headquartered in Pune, India.

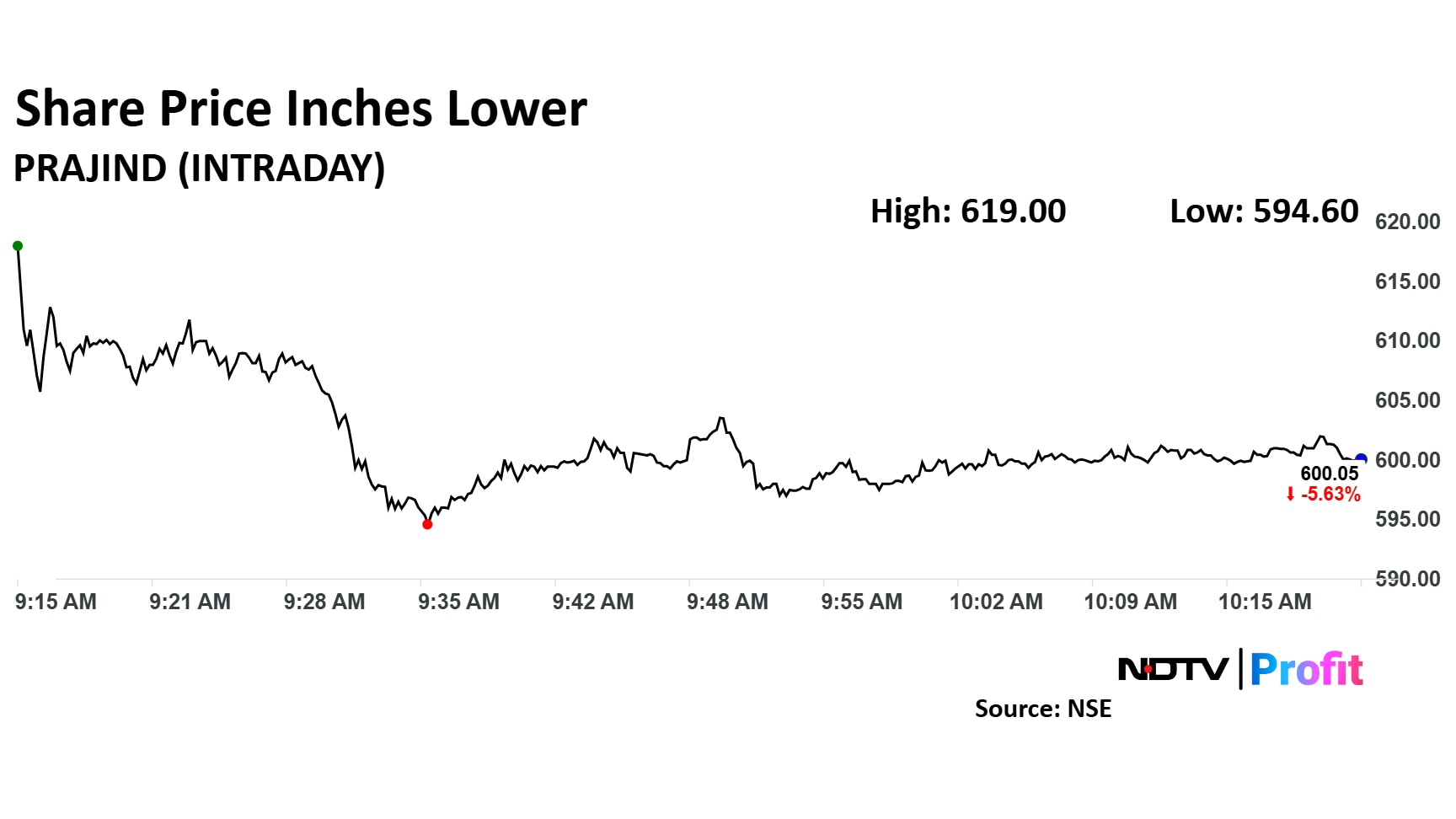

Praj Industries Share Price Today

Shares of Praj Industries fell as much as 6.5% to Rs 594.60 apiece, before paring gains to trade 5.56% lower at Rs 635.85 apiece, as of 10:15 a.m. This compares to a 0.41% advance in the NSE Nifty 50.

The stock has risen 20.46% in the last 12 months. Total traded volume so far in the day stood at 3.8 times its 30-day average. The relative strength index was at 25.

All eight analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 42.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.