The shares of Polycab India Ltd. rose nearly 6% on Monday after Jefferies hikes target price to Rs 7,150 from Rs 7,050 per share.

Additionally, the stock will trade ex-dividend on tomorrow. Given India's T+1 settlement cycle, shares purchased on the record date (June 24 in this case) will not be eligible for the dividend payment. Therefore, investors who own shares by June 23 will be the beneficiaries.

Jefferies has reaffirmed its ‘Buy' rating on Polycab citing strong growth in its Cables & Wires business, a profitable turnaround in FMEG, and a robust order book.

Polycab remains the leader in the organised C&W segment, increasing its market share to 26–27% in the previous fiscal, up from 18% in financial year 2020. A 26% sales CAGR over four years was supported by timely capex of Rs 28,000 crore, capacity utilisation of 70%, and a pan-India distribution network of 200,000 retailers. The company's sales are well-diversified, with the top 10 customers contributing just 22%, said the brokerage.

The company has also secured large infrastructure orders, including two BharatNet projects worth Rs 30,000 crore in Bihar and Rs 6,500 crore in Karnataka, Goa, Puducherry, in addition to a Rs 4,000 crore RDSS order. These will be executed over a 3-year construction period followed by 10 years of maintenance.

Meanwhile, the FMEG segment turned profitable in the last quarter after 10 quarters of strategic investment. Polycab aims for 8–10% operating margins by fiscal 30, driven by better scale, product mix, and efficiency.

Despite a 25% stock rally since March, Polycab trades at 34x FY26E, only 4% above its five-year average. Jefferies sees further upside, but cautions on risks like private capex slowdown, copper price volatility, and FMEG traction. Still, the outlook remains strong.

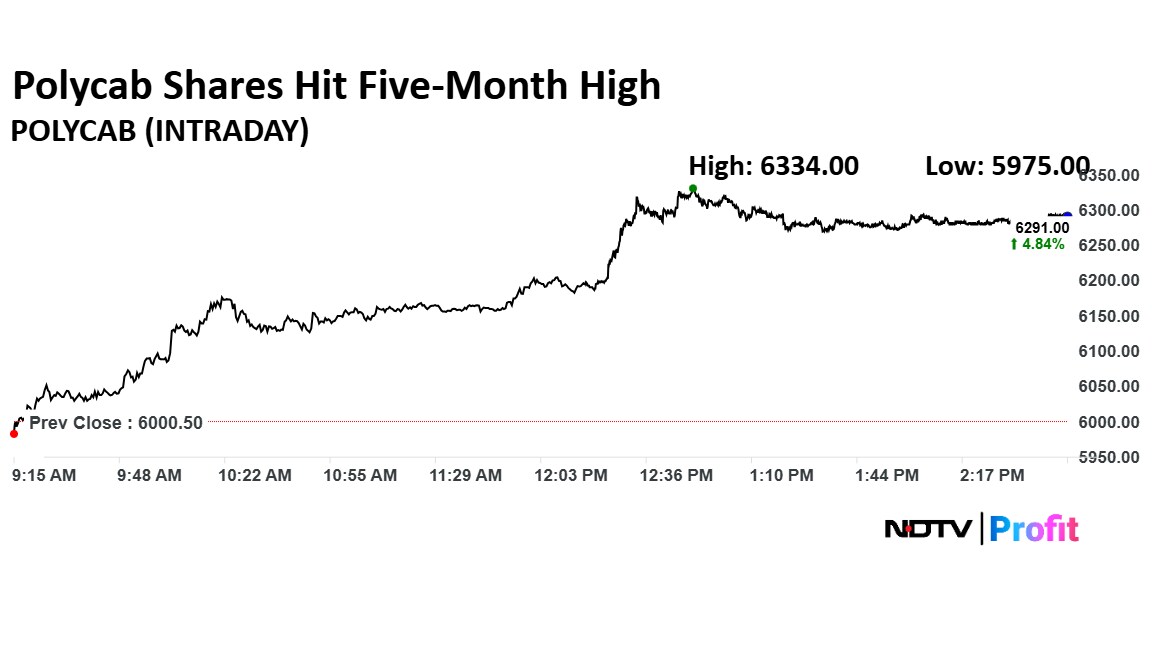

Polycab Share Price

The shares of Polycab rose as much as 5.56% to Rs 6,334 apiece, the highest level since Jan 24. It pared gains to trade 4.84% higher at Rs 6,291 apiece, as of 2:21 p.m. This compares to a 0.44% decline in the NSE Nifty 50 Index.

It has fallen 11.44% in the last 12 months and 13.65% year-to-date. Total traded volume so far in the day stood at 4.3 times its 30-day average. The relative strength index was at 53.56.

Out of 36 analysts tracking the company, 26 maintain a 'buy' rating, five recommend a 'hold,' and five suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.