The appointments committee of the union cabinet has cleared the appointment of managing directors and chief executive officers for two public sector banks. The shares of both the Indian Bank and Punjab National Bank have seen over 2% rise in price.

Ashok Chandra has been appointed MD and CEO of Punjab National Bank, according to people in the know, who spoke to NDTV Profit on the condition of anonymity. He is currently the executive director at Canara Bank.

Further, Binod Kumar has been appointed as MD and CEO of Indian Bank. Kumar is currently executive director at Punjab National Bank.

According to people in the know, both these appointments have been made for three-year terms.

Indian Bank Share Price

Indian Bank stock rose as much as 5.17% during the day to Rs 528.85 apiece on the NSE. It was trading 4.78% higher at Rs 526.85 apiece, compared to a 0.32% advance in the benchmark Nifty 50 as of 11:29 a.m.

It has risen 19.75% in the last 12 months. Total traded volume so far in the day stood at 1.3 times its 30-day average. The relative strength index was at 49.94.

Nine of the 11 analysts tracking the bank have a 'buy' rating on the stock and two recommend a 'hold', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 655.11, implying an upside of 24.2%

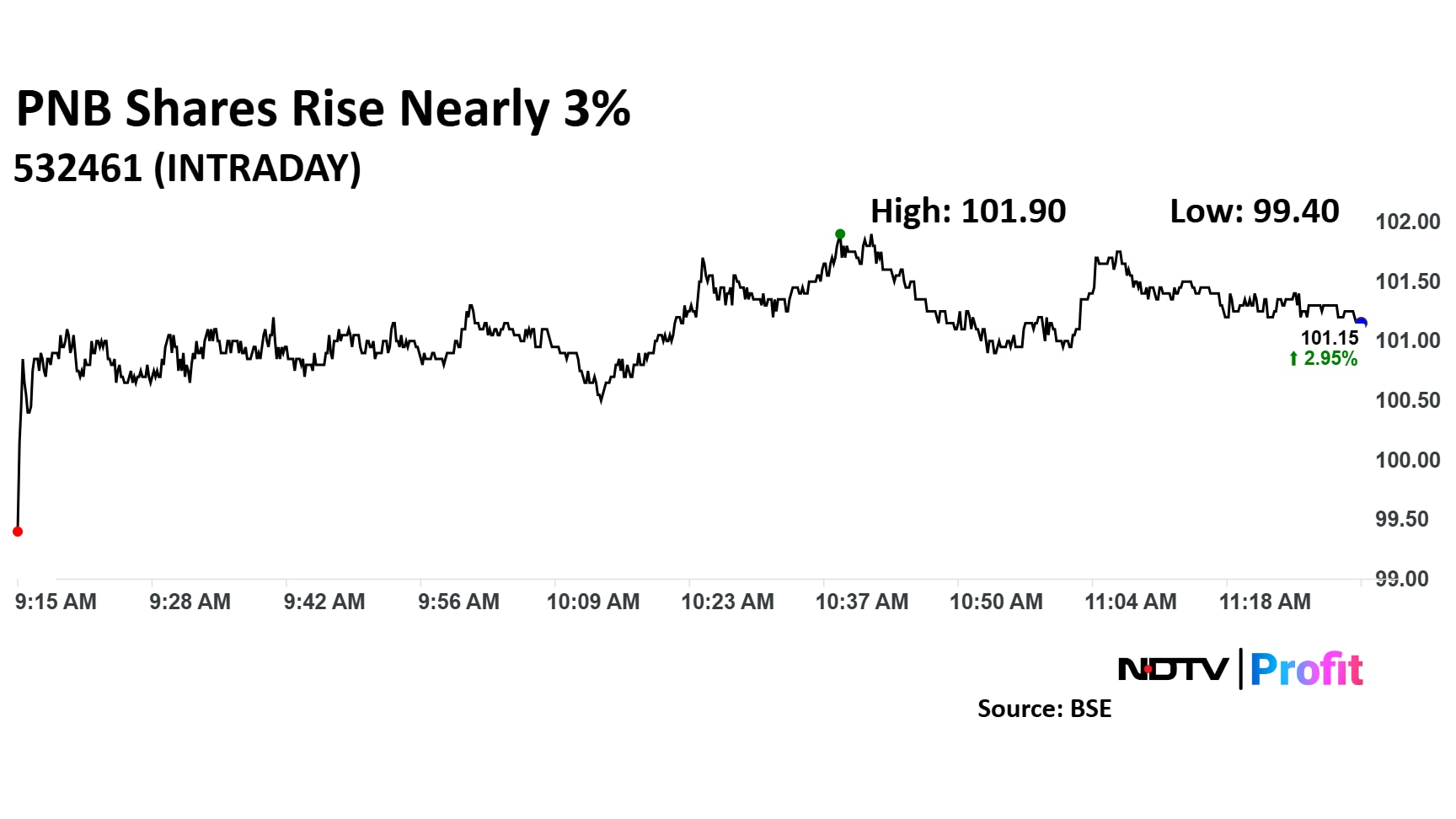

Punjab National Bank Share Price

Punjab National Bank stock rose as much as 3.72% during the day to Rs 101.9 apiece on the NSE. It was trading 3.10% higher at Rs 101.30 apiece, compared to a 0.32% advance in the benchmark Nifty 50 as of 11:29 a.m.

It has risen 3.09% in the last 12 months. Total traded volume so far in the day stood at 1.2 times its 30-day average. The relative strength index was at 48.25.

Eight of the 18 analysts tracking the bank have a 'buy' rating on the stock, five recommend a 'hold' and five suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 107.25, implying a upside of 5.7%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.