Shares of Paytm parent One 97 Communications Ltd., Zensar Technologies Ltd., Dixon Technologies Ltd., Dalmia Bharat Ltd. and United Breweries Ltd. on Wednesday reacted after the companies announced their first-quarter results a day ago.

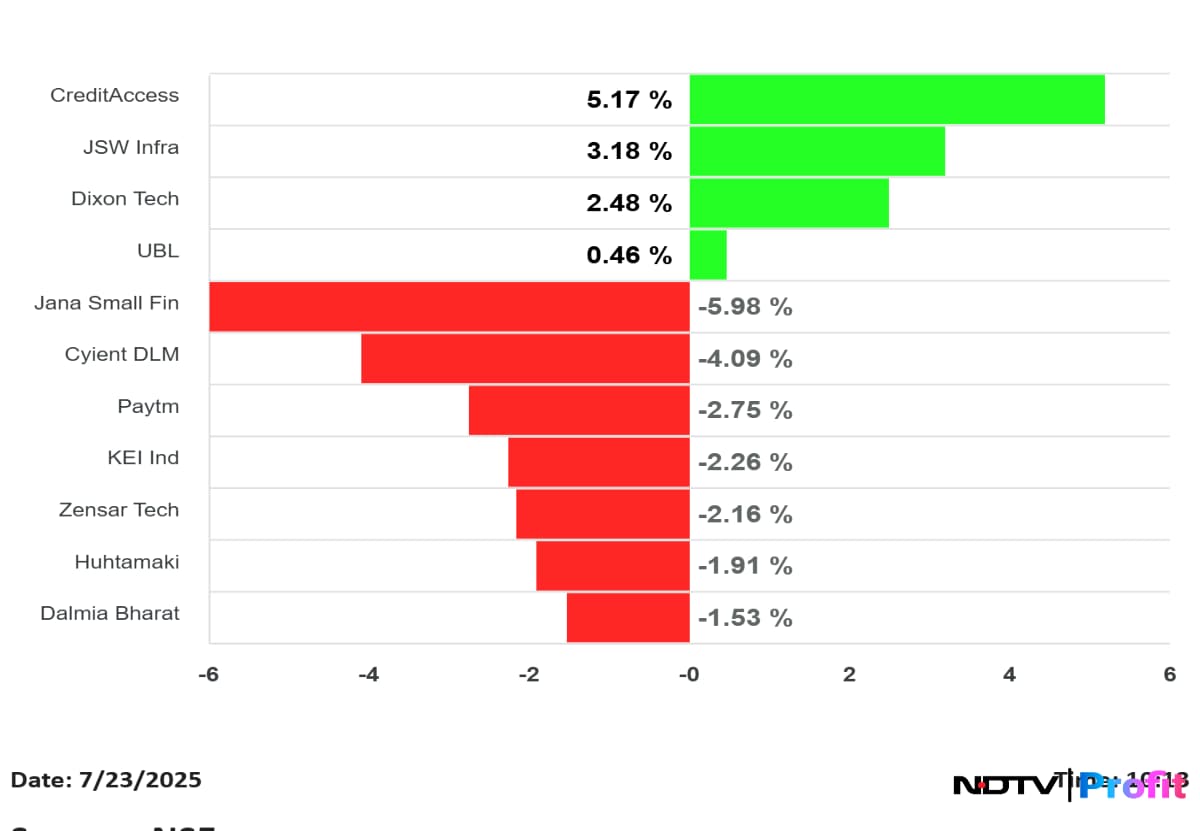

CreditAccess Grameen Ltd., JSW Infrastructure Ltd. and Dixon Tech shares traded higher early in the session. On the other hand, Jana Small Finance Bank Ltd., Cyient DLM Ltd., Paytm and KEI Industries Ltd. fell.

Stock movement after Q1 results.

Q1 Results Post Tuesday Markets Hours

One 97 Communications Q1 FY26 Highlights (Cons, QoQ)

Revenue up 0.31% at Rs 1917 crore versus Rs 1911 crore.

Ebitda at Rs 71 crore versus loss of Rs 89.5 crore.

Ebitda margin 3.7%

Net profit Rs 122.5 crore versus loss of Rs 544.6 crore.

EBbitda and profit turned profitable due to AI-led operational leverage, better cost structure and higher other income.

Revenue from distribution of financial services up 100% to Rs 561 crore.

Distribution of financial services was driven by an increase in merchant loans, trail revenue from DLG portfolio and better collections.

Marketing expenses down 65% YoY, ESOP cost down 88% is aiding Profitability.

Zensar Tech Q1FY26 (Cons QoQ)

Revenue is up 1.9% at Rs 1,385 crore versus Rs 1,359 crore (estimate Rs 1375 crore)

EBIT down 0.6% at Rs 188 crore versus Rs 189 crore

EBIT margin at 13.5% versus 13.9%.

Net Profit is up 3.2% at Rs 182 crore versus Rs 176 crore (estimate Rs 172 crore)

Co reports 1.9% in constant currency growth

US region saw a sequential QoQ growth of 4.3%

Europe region saw a sequential QoQ decline of 5.8%

Highest growth was seen in Media and Technology of 5.5% QoQ

Deal wins for Q1 stands at $172 M vs $213.5M in Q4

Attrition for Q1 at 9.8% vs 9.9% in Q4

Dixon Technologies Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 95.1% to Rs 12,835.66 crore versus Rs 6,579.80 crore.

Ebitda up 95% to Rs 482.37 crore versus Rs 247.90 crore.

Margin at 3.8% versus 3.8%.

Net Profit up 68% to Rs 224.97 crore versus Rs 133.68 crore.

Dalmia Bharat Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 0.4% to Rs 3,636 crore versus Rs 3,621 crore.

Ebitda up 32% to Rs 883 crore versus Rs 669 crore.

Margin at 24.3% versus 18.5%.

Net Profit up 179% to Rs 393 crore versus Rs 141 crore.

Exceptional loss of 113 crore in Q1 FY25.

United Breweries Q1 Earnings Key Highlights (Standalone, YoY)

Revenue rises 15.7% to Rs 2,862 crore versus Rs 2,472 crore.

Ebitda up 9% to Rs 310.52 crore versus Rs 284.74 crore.

Margin at 10.8% versus 11.5%.

Net Profit up 6% to Rs 183.71 crore versus Rs 173.28 crore.

Jana Small Finance Bank Q1 Earnings Highlights

NII down 2.4% at Rs 595 crore vs Rs 609 crore.

Gross NPA at 2.91% Vs 2.71% (QoQ).

Net NPA Flat at 0.94% (QoQ).

Net Profit down 40.2% at Rs 101.9 crore vs Rs 170.5 crore.

Huhtamaki Q1 Earnings Key Highlights (YoY)

Revenue drops 4.3% to Rs 612 crore versus Rs 639 crore.

Ebitda rises 33.3% to Rs 42.6 crore versus Rs 32 crore.

Margin at 7% versus 5%.

Net profit falls 35.3% to Rs 24.9 crore versus Rs 38.5 crore.

CreditAccess Grameen Q1 Earnings Key Highlights (YoY)

Total Income falls 3.2% at Rs 1,464 crore versus Rs 1,513 crore.

Net Profit falls 84.9% to 60.2 crore versus Rs 398 crore.

NII down 2.27% at Rs 906 crore versus Rs 927 crore.

Impairment at Rs 571 cr vs 174 cr.

GNPA at 4.7% vs 4.76% (QoQ)

NNPA at 1.78% vs 1.73% (QoQ)

Welspun Specialty Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue rises 24.2% at Rs 201 crore versus Rs 162 crore.

Ebitda falls 60.4% to Rs 4.3 crore versus Rs 10.9 crore.

Margin contracts to 2.1% versus 6.7%.

Net loss at Rs 8 lakh versus profit of Rs 2 crore.

KEI Industries Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 25.4% to Rs 2,590.32 crore versus Rs 2,065.02 crore.

Net Profit up 30% to Rs 195.75 crore versus Rs 150.25 crore.

Ebitda up 18% to Rs 258.01 crore versus Rs 219.08 crore.

Margin at 10% versus 10.6%.

JSW Infrastructure Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 21.2% to Rs 1,223.85 crore versus Rs 1,009.77 crore.

Net Profit up 32% to Rs 384.68 crore versus Rs 292.44 crore.

Ebitda up 32% to Rs 581.16 crore versus Rs 440.12 crore.

Margin at 47.5% versus 43.6%.

Cyient DLM Q1 Earnings Key Highlights (Consolidated, YoY)

Revenue up 8.0% to Rs 278.43 crore versus Rs 257.89 crore.

Net Profit down 30% to Rs 7.46 crore versus Rs 10.60 crore.

Ebitda up 25% to Rs 25.07 crore versus Rs 19.99 crore.

Margin at 9% versus 7.8%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.