18_04_2024..jpg?downsize=773:435)

Shares of One97 Communications Ltd., the parent company of Paytm, saw a significant uptick of over 3%, hitting nearly three-year high, following the announcement of its plan to sell 5.4% stake in Japan's digital payments giant PayPay Corp. The sale, valued at approximately $280 million (or Rs 2,364 crore), is to be executed in partnership with investor SoftBank.

At a meeting held on Friday, Dec. 6, the board of directors of One97 Communications Singapore Pvt. approved the sale of stock acquisition rights in PayPay. The Vijay Shekhar Sharma-led company disclosed the development in an exchange filing. The deal is expected to close by December 2024, subject to the successful completion of all necessary corporate approvals and closing conditions.

This move is part of Paytm's broader strategy to offload non-core assets and streamline its focus on core businesses, especially after facing challenges from regulatory restrictions imposed on its payments bank operations by the Reserve Bank of India.

In line with this strategy, Paytm had previously sold its entertainment, sports, and events ticketing businesses—Insider and TicketNew—to Zomato for Rs 2,048 crore.

The announcement sent Paytm shares soaring on Friday, with a surge of up to 3.6%, reaching Rs 990.9 apiece on the Bombay Stock Exchange. The stock closed 2.02% higher at Rs 975.8 per share, outpacing the benchmark Sensex, which registered a modest 0.07% decline.

Investors will closely monitor how this strategic divestment shapes Paytm's future operations and its impact on the company's financial performance moving forward.

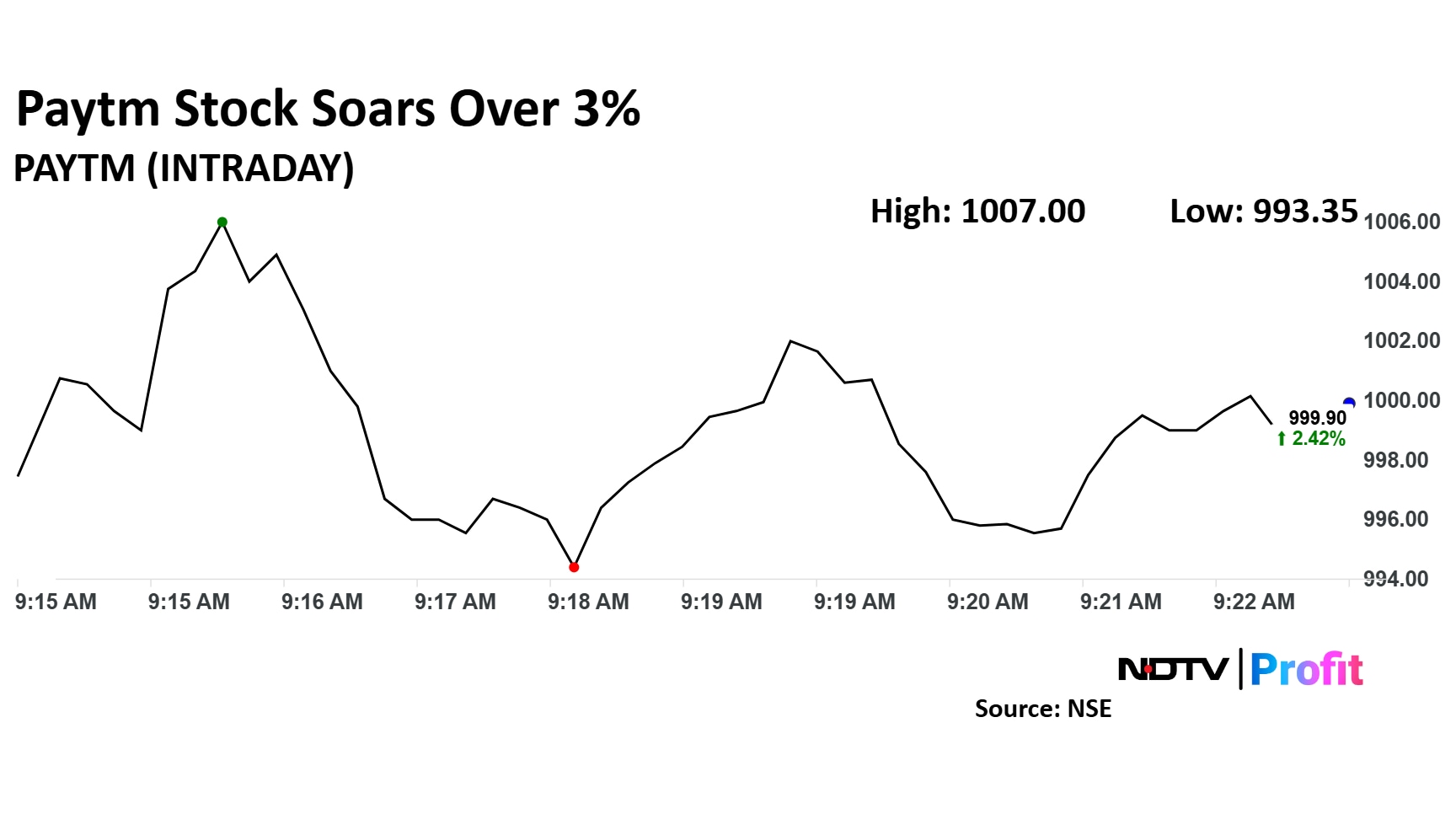

Paytm Share Price Today

Paytm share price rose as much as 3.15% to Rs 1,007 apiece. The stock pared gains to trade 2.70% higher at Rs Rs 1,002.60 apiece, as of 09:30 a.m. This compares to a flat NSE Nifty 50 index.

The stock has risen 52.68% in the last 12 months. Total traded volume so far in the day stood at 5 times its 30-day average. The relative strength index was at 74.

Out of 18 analysts tracking the company, seven maintain a 'buy' rating, six recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 26.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.