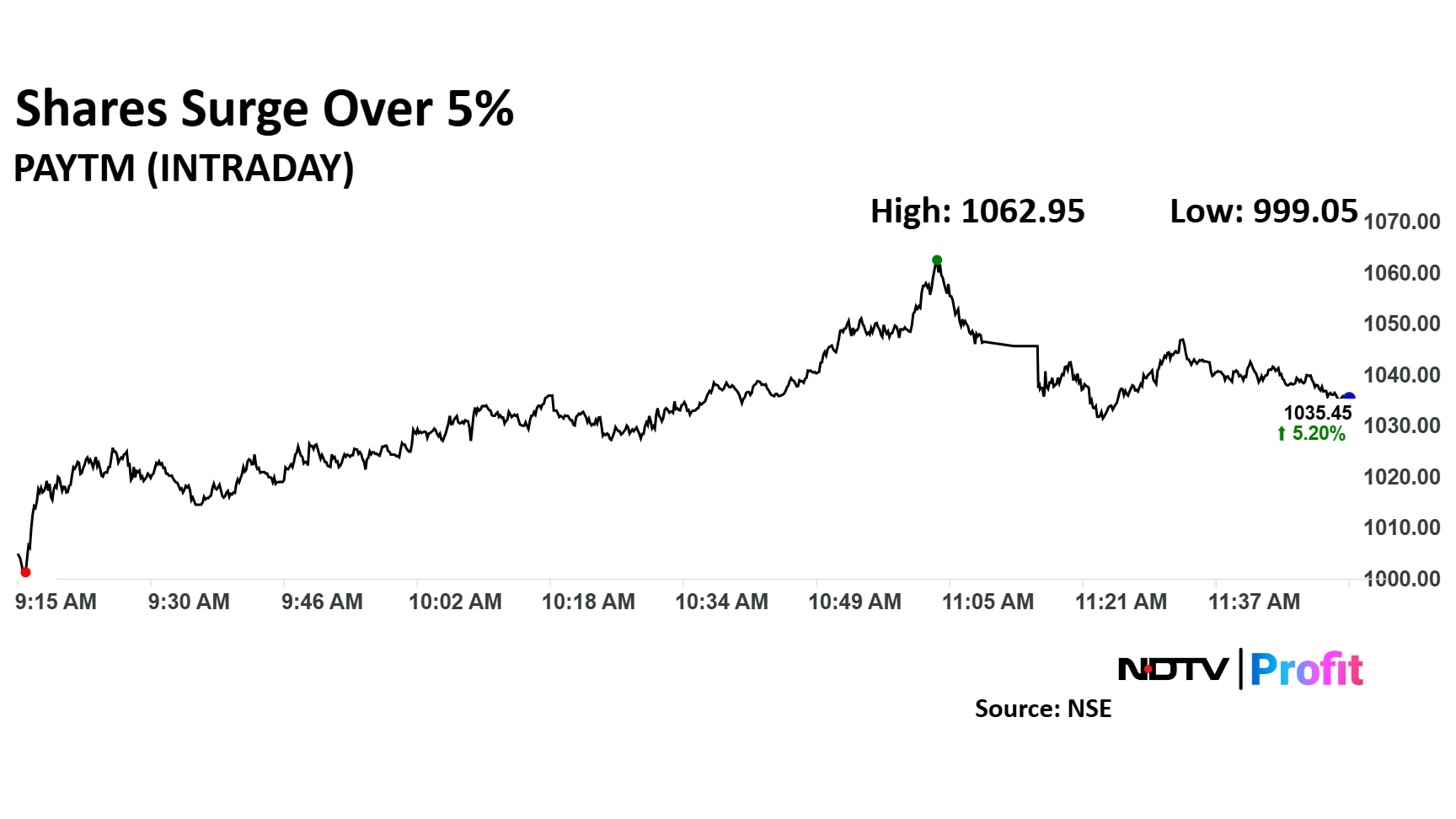

Share price of One97 Communications Ltd. jumped over 5% on Tuesday, marking the third consecutive session of strong gains for the digital payments giant. The rally follows the company's announcement of the successful sale of its 5.4% stake in PayPay Corp., Japan's prominent digital payments company last week.

On Friday, the Paytm operator's shares rose by 3.53% after the company disclosed the sale of the stake, valued at over Rs 2,300 crore, to Japan's SoftBank. The stock continued its upward momentum into Monday, climbing nearly 3% as investors digested the news.

This rally marks a significant recovery for Paytm, which has surged more than 68.69% over the past year. The stock's recovery comes after the company has been struggling to gain ground following regulatory actions last year by the Reserve Bank of India on Paytm Payments Bank.

The stake sale was completed through Paytm's subsidiary, One97 Communications Singapore Pvt.

As per the announcement, the company had offloaded its 5.4% stake in PayPay Corp. to SoftBank for a sum of $280 million (approximately Rs 2,364 crore).

This divestment is part of Paytm's broader strategy to streamline its operations by offloading non-core assets, thereby allowing the company to focus on its core payments solutions business.

The sale of the PayPay stake is one of several strategic moves made by Paytm in recent months. Earlier this year, the company divested its entertainment, sports, and events ticketing business, Insider and TicketNew, to Zomato for Rs 2,048 crore.

Paytm Share Price Today

The scrip rose as much as 5.55% to Rs 1,062.95 apiece. It pared gains to trade 3.08% higher at Rs 1,038 apiece, as of 11:51 a.m. This compares to a 1.13 decline in the NSE Nifty 50.

It has risen 68.58% in the last 12 months. Total traded volume so far in the day stood at 2.3 times its 30-day average. The relative strength index was at 76.

Out of 18 analysts tracking the company, seven maintain a 'buy' rating, six recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 28.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.