18_04_2024..jpg?downsize=773:435)

Share price of Paytm-parent One97 Communications Ltd. hit a 52-week high on Thursday, as UBS significantly hiked its target price from Rs 490 to Rs 1,000 per share. This marks a 9% potential upside from the stock's closing level on Wednesday. The brokerage maintained a 'neutral' rating on the scrip.

The revision comes on the back of easing regulatory challenges and signs of recovery in the company's key metrics, UBS said.

With the Reserve Bank of India lifting restrictions on onboarding new customers, Paytm is set for a turnaround in its monthly transactional users and digital payments market share, it said.

After a sharp decline in digital payments market share—from 24% pre-RBI action to 18.5%—the worst is behind Paytm. The company is also benefitting from higher UPI spending, UBS said.

The brokerage forecasts a 35% increase in payments revenue by next year, driven by higher MTUs and improved net payment margins. They highlighted that Paytm's stock has already surged 70% in the past three months.

The brokerage expects Paytm to achieve adjusted Ebitda breakeven by the fourth quarter of this fiscal. The brokerage anticipates an Ebitda margin of 10% by next year, supported by stable costs and growing revenue, with overall expenses (excluding payment processing charges) remaining flat compared to last year.

While UBS acknowledged Paytm's marked financial improvement, it believes the current valuation already prices in the recovery. The brokerage's 12-month price target of Rs 1,000 implies that company is valued at 5.5 times its expected revenue in fiscal 2026.

Paytm Share Price

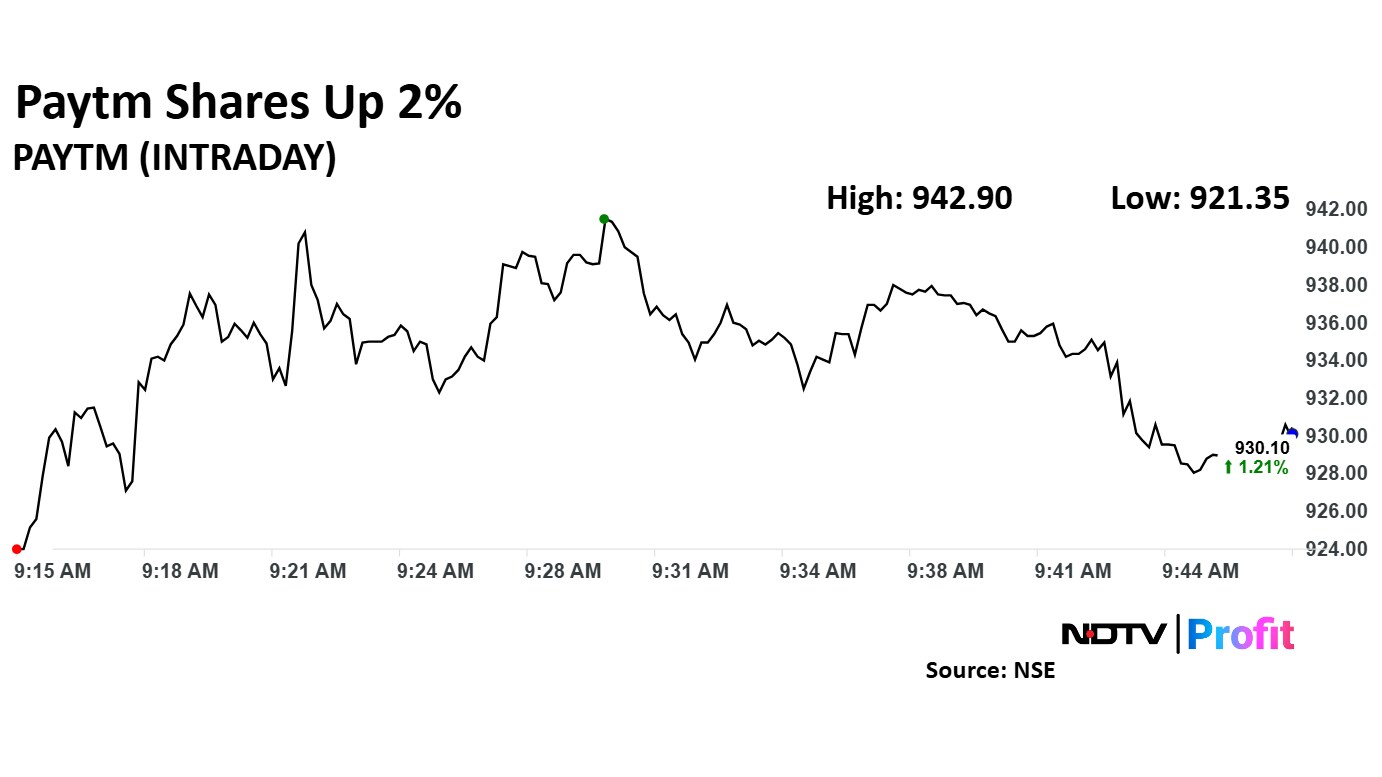

Shares of One97 Communications rose as much as 2.61%, before paring gains to trade 1.21% higher at Rs 930.10 apiece, as of 09:49 a.m. This compares to a 0.02% advance in the NSE Nifty 50.

The stock has risen 42.84% on a year-to-date basis. The relative strength index was at 70.89.

Out of 18 analysts tracking the company, seven maintain a 'buy' rating, six recommend a 'hold', and five suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 19.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.