Patel Engineering Ltd. saw its share price rise by 6.1% on Thursday following the announcement of its third-quarter earnings. The company reported a consolidated net profit of Rs 80.24 crore, marking a 14.49% increase from Rs 70.24 crore in the same period last year. This robust performance has been well-received by investors, driving the stock price upwards.

The company's revenue for the October-December quarter surged to Rs 1,206 crore, up from Rs 1,061 crore in the year-ago period. This growth reflects Patel Engineering's strong operational capabilities and strategic execution. The company's expenses for the quarter stood at Rs 1,125 crore, compared to Rs 1,030.94 crore in the corresponding period of the previous fiscal year.

Founded in 1949, Patel Engineering has a diverse portfolio including projects in dams, tunnels, hydroelectric projects, irrigation, highways, roads, bridges, railways, and real estate.

The company's expertise extends to various sectors, including EPC (Engineering, Procurement, and Construction) and real estate. Patel Engineering has been involved in the construction of structures such as hotels, theatres, sports stadiums, and office buildings.

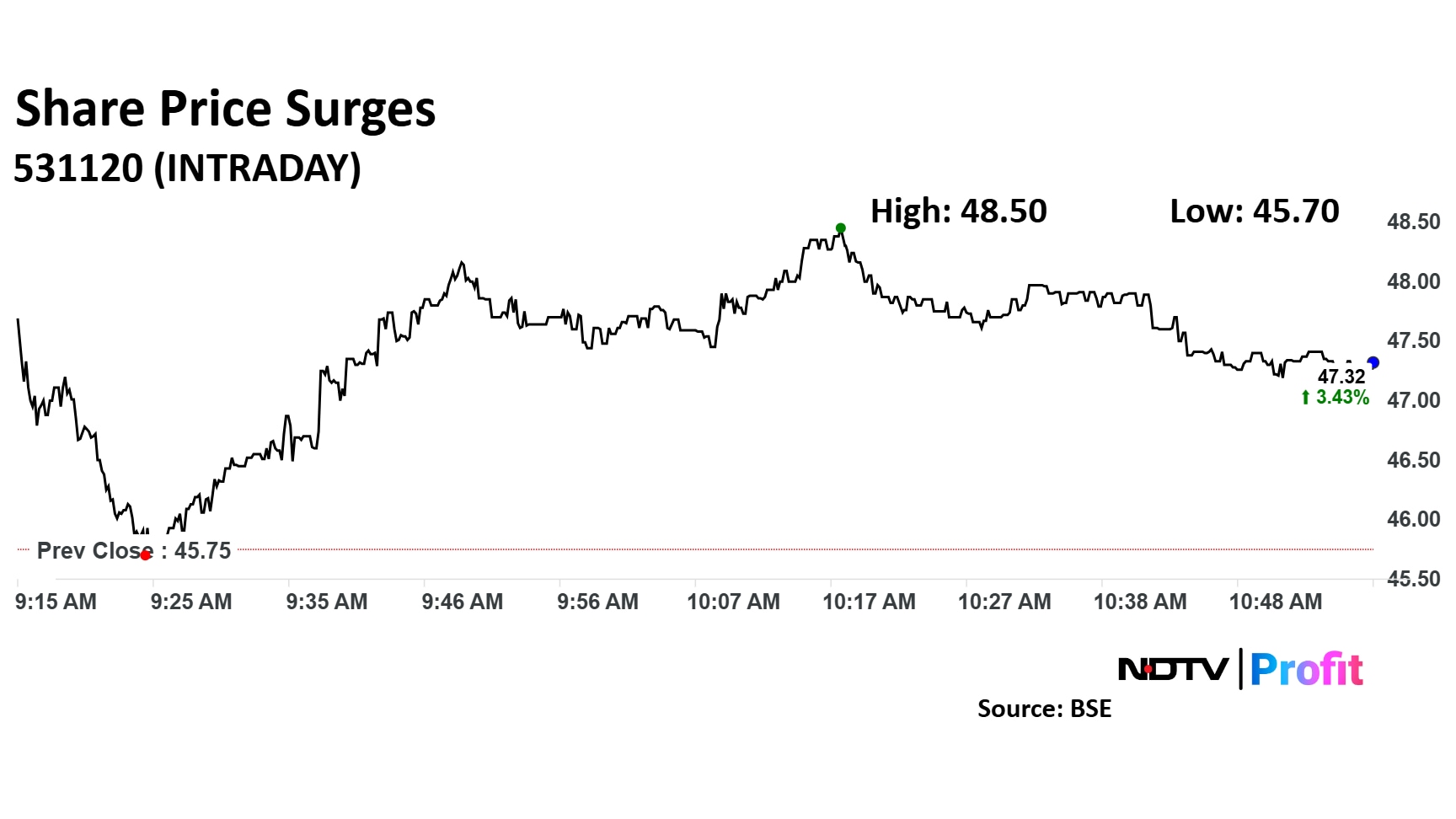

The scrip rose as much as 6.10% to Rs 48.51 apiece. It pared gains to trade 3.67% higher at Rs 47.40 apiece, as of 10:56 a.m. This compares to a 0.56% advance in the NSE Nifty 50 Index.

It has fallen 30.40% in the last 12 months. Total traded volume so far in the day stood at 3.5 times its 30-day average. The relative strength index was at 45.

Out of two analysts tracking the company, both maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 52.7%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.