Oil rose for a second day as supply disruptions from Canada's wildfires countered OPEC's latest bumper supply increase.

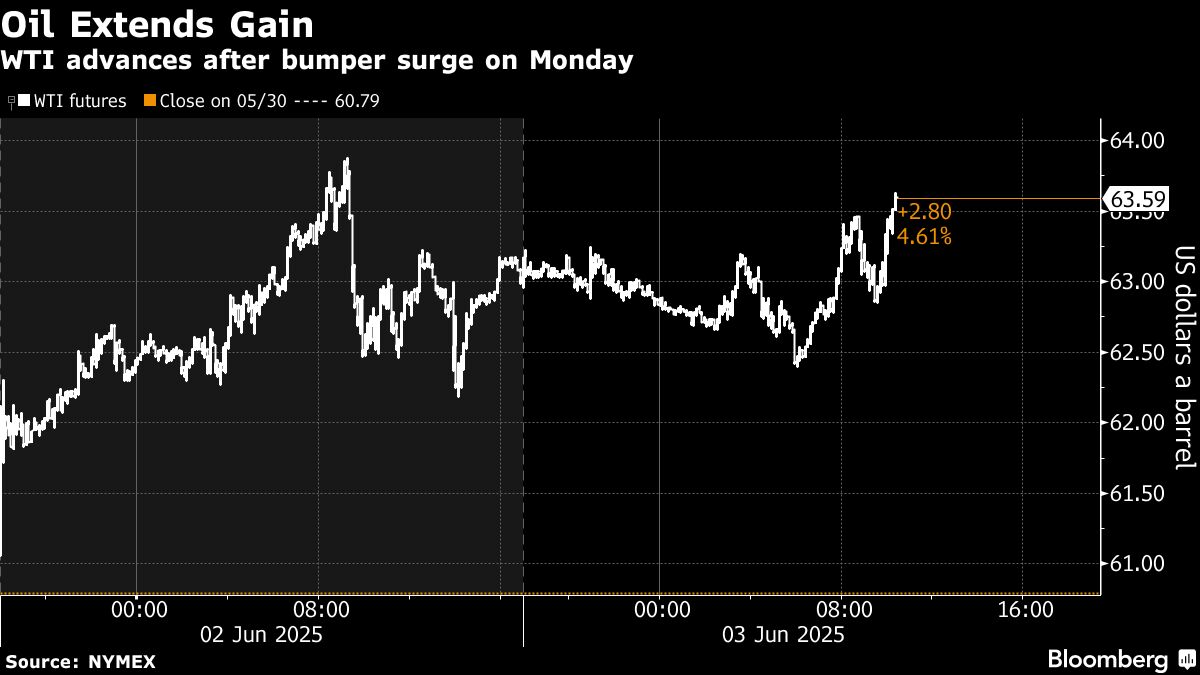

West Texas Intermediate advanced more than 1% to top $63 a barrel, building on a 2.8% jump on Monday. The blazes in Canada's energy heartland of Alberta have shut down almost 350,000 barrels a day of heavy crude production, more than three quarters the amount of oil OPEC and its allies agreed over the weekend to add back to the market. Strong US hiring data also supported prices.

Meanwhile, President Donald Trump said the US won't allow any uranium enrichment as part of a potential nuclear deal with Iran, countering an earlier report that some enrichment could be allowed. Geopolitics have returned into focus over recent days as traders also weigh the repercussions of Ukraine's brazen drone attack on Russian military infrastructure.

US crude rose as much as 5.1% on Monday after OPEC+ boosted supply in line with expectations, easing concerns of a bigger increase and leading to an unwinding of bearish bets made in advance of the weekend decision. Oil is still down about 12% this year after the producer group abandoned its former strategy of defending higher prices by curbing output and on concerns trade wars will hamper demand.

“Beyond the near-term, we continue to expect that crude markets will struggle to absorb OPEC barrels over the coming months as Gulf exports are more likely set to rise following peak seasonal demand for the region,” said Daniel Ghali, a commodity strategist at TD Securities.

Crude has also found support in recent days from a softer dollar. A gauge of the greenback closed at its lowest since July 2023 on Monday before rebounding slightly, with Wall Street banks reinforcing their calls that it will decline further.

Prices

WTI for July delivery rose 1.7% to $63.59 a barrel at 10:31 a.m. in New York.

Brent for August settlement climbed 1.5% to $65.61 a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.