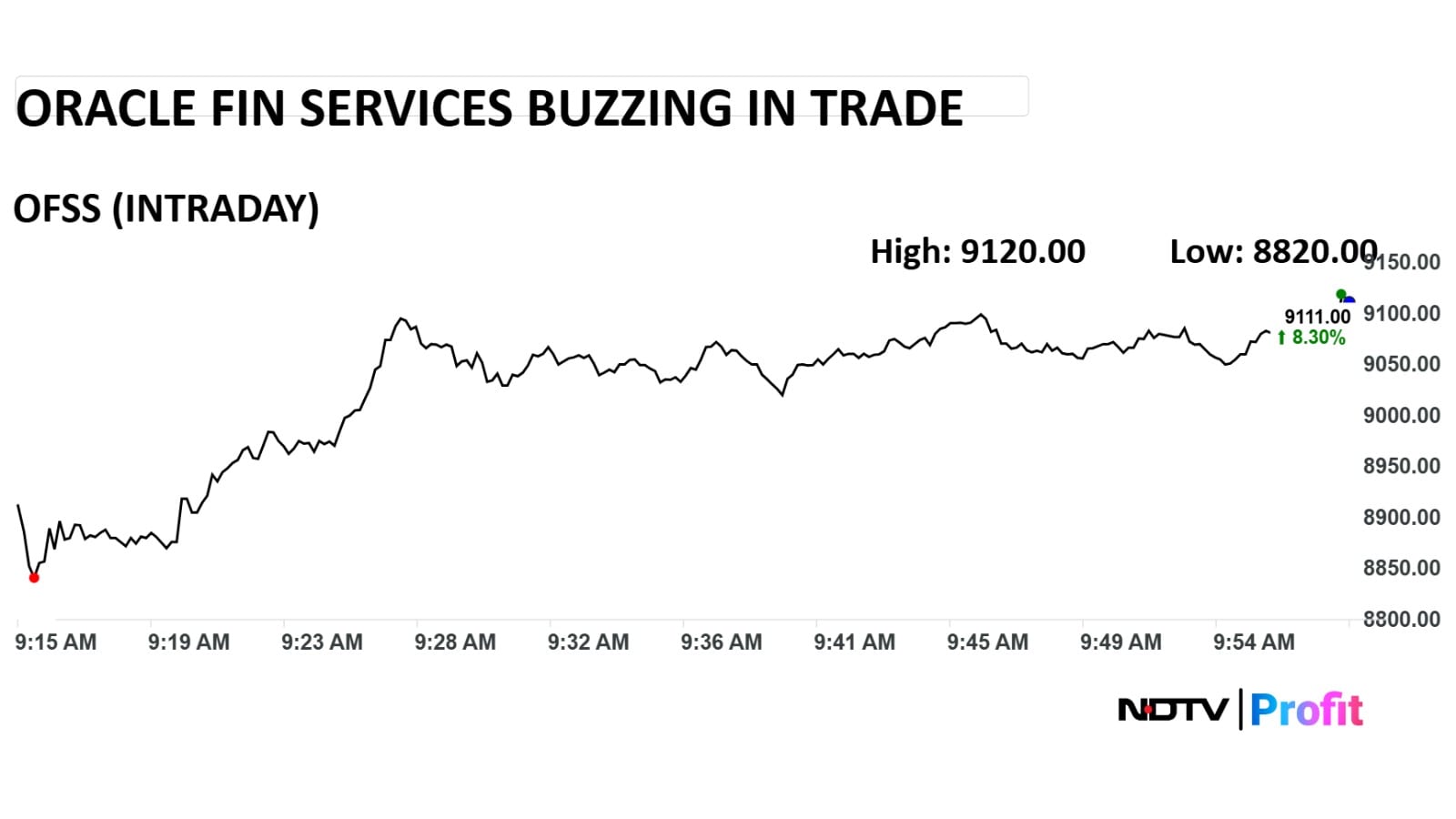

Shares of Oracle Financial Services Ltd. rose over 8% during early trade on Wednesday, the sharpest jump in four months. The stock reached an intraday high of Rs 9,137.

The surge comes after Oracle Corp., the Indian company's US-based parent, delivered upbeat commentary and robust growth in its global cloud infrastructure business.

Oracle's recent quarterly update highlighted a significant jump in bookings, driven by deals with four multi-billion dollar contracts, which includes flagship deals with Nvidia, OpenAI and TikTok.

The parent company further said that its new cloud bookings soared to $455 billion, with the expectation that the cloud business will grow at a rate of 77% this year and increase eightfold over the next five years.

What Does This Mean For OFSS?

The positive developments at Oracle Corp directly benefit Oracle Financial Services — a company specialising in cloud-native banking and financial services.

Being a subsidiary, OFSS directly gains access and benefits from Oracle's cutting-edge technology and cloud infrastructure as well as sales channels.

The company, therefore, can leverage Oracle's synergies to develop and deliver cloud-based products to its own clients.

The surge in Oracle Financial Services share price comes at a time when the stock has faced intense pressure. On a year-to-date basis, OFSS shares have fallen almost 30%. Meanwhile, over a one-year period, the stock has corrected by almost 20%.

High volumes have aided movement, with the stock trading almost five times more than its average 30-day volumes. The stock also trades with a Relative Strength Index of 50, which suggests neutral market sentiment.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.