Shares of Oil and Natural Gas Corp. surged over 3% on Friday after Jefferies cut its target price with a potential upside of 58%, citing that "recent correction is overdone".

The stock of the state-owned oil and gas explorer has corrected over 30% in the last three months, tracking a 10% decline in crude price, analysts at Jefferies said in a note. "This presents a buying opportunity in stock."

Jefferies reiterated 'buy' on the company and cut the target to Rs 375 per share from Rs 410 apiece earlier.

Special additional excise duty capped crude realisation from legacy fields that account for 95% of standalone production at $75 per barrel earlier. "Consequently, earnings impact is limited to 2% at current crude prices."

Management remains confident of ramping up production from current levels, achieving 5-6% CAGR over fiscal 2025-27, led by KG basin, Jefferies said. The brokerage expects KG production to contribute 10% to fiscal 2026 consolidated Ebitda, with better realisations more than offsetting higher operational expenditure.

HSBC slashed its target price last month amid concerns about the company's weak oil revenue and declining production rates. The brokerage cut the target price to Rs 215 from Rs 230. It maintained its 'reduce' rating on ONGC, citing the limited impact of the government's recent gas price reform.

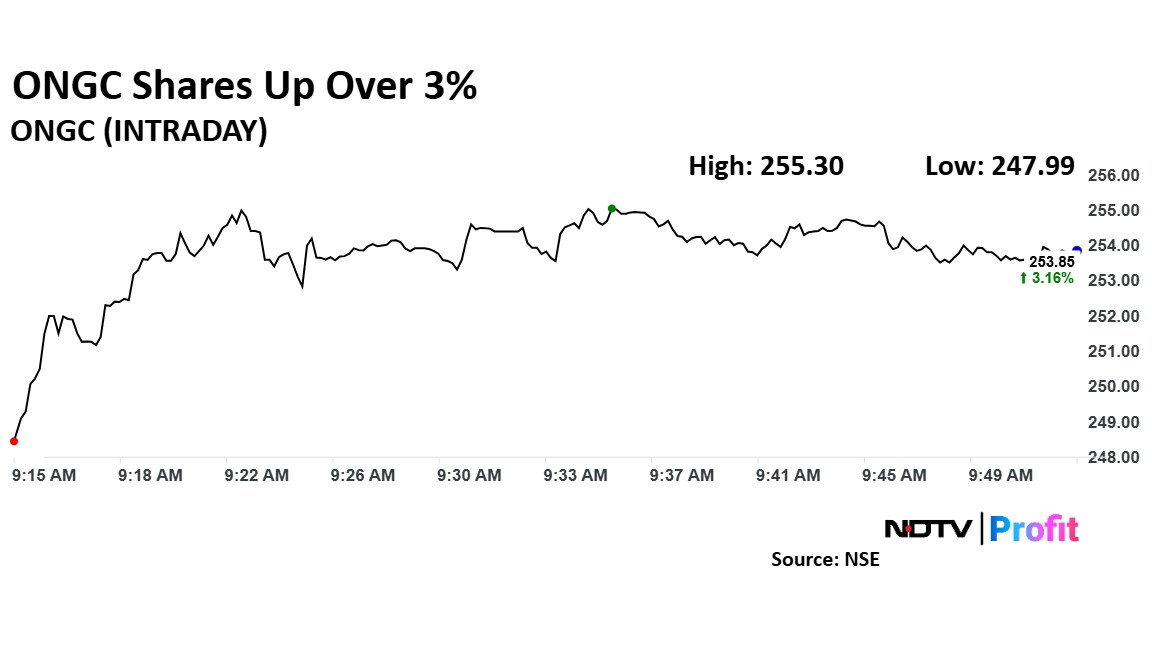

ONGC's stock rose as much as 3.7% during the day to Rs 255.3 apiece on the NSE. It was trading 3.06% higher at Rs 253.6 apiece, compared to a 0.43% advance in the benchmark Nifty 50 as of 09:51 a.m.

It has risen 21% during the last 12 months. The total traded volume so far in the day stood at 5.6 times its 30-day average. The relative strength index was at 55.

Twenty out of the 30 analysts tracking the company have a 'buy' rating on the stock, five suggest a 'hold' and five have a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 23%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.