- Ukraine agreed to a revised peace deal with Russia, minor details remain unresolved

- Brent oil futures dropped as much as 2.4% on the peace deal news in London trading

- US and Ukrainian officials continue peace talks; Russia's stance on the plan is unclear

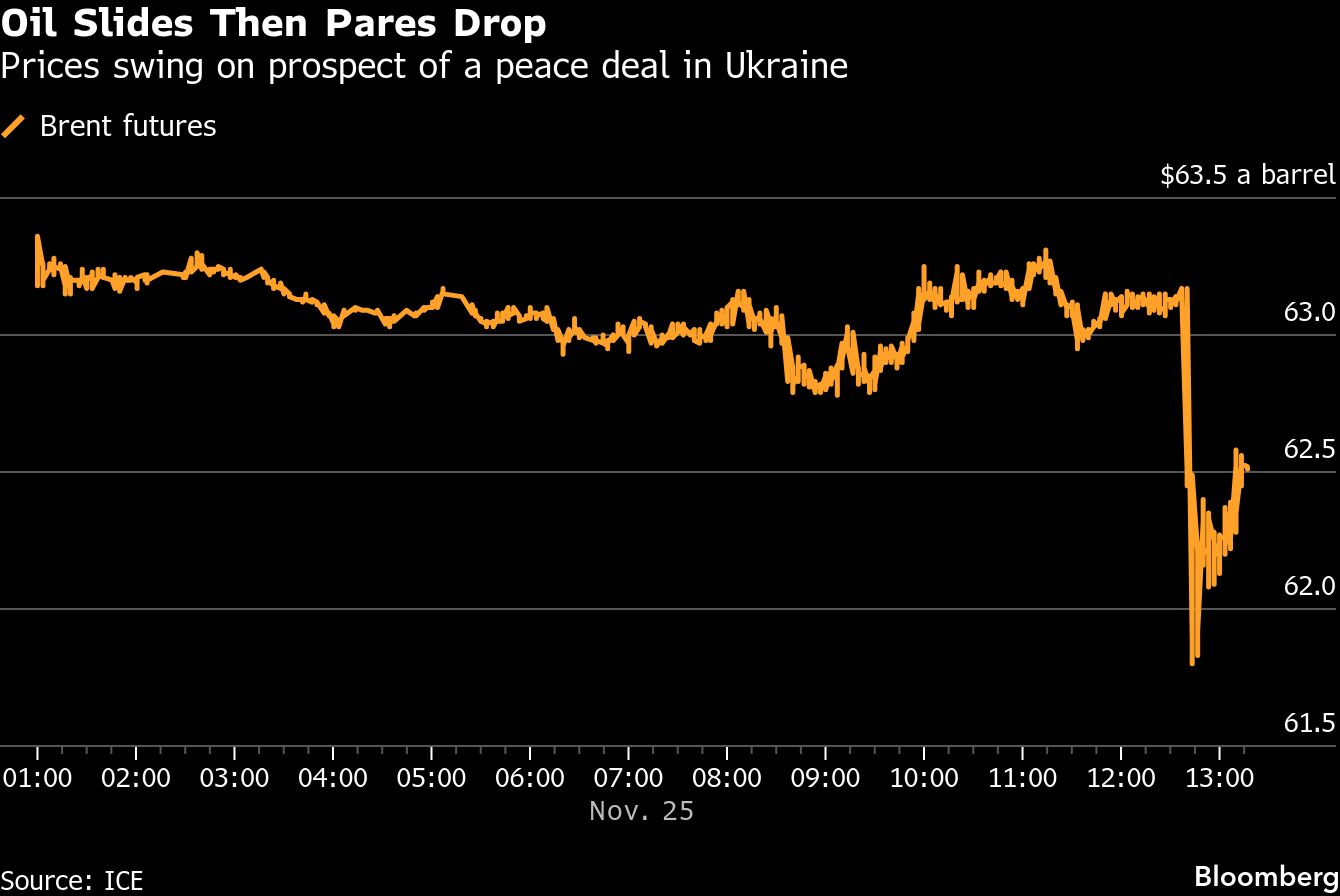

Oil fell sharply after ABC News reported that Ukraine agreed to the terms of a revised peace deal geared toward ending Russia's war in the country, though some minor details were still outstanding.

Brent futures extended earlier losses to fall as much as 2.4% in London, before paring some of that decline. The ABC report didn't elaborate on what minor details still needed to be solved. Ukraine's President Volodymyr Zelenskiy said talks on a peace plan are continuing with the US. Russia's position on the plan was unclear.

The comments follow a frenzy of diplomacy over recent days in a bid to strike a deal. US and Ukrainian officials have been negotiating in Geneva after an initial draft of a peace plan surfaced late last week. Meanwhile, US and Russian delegations are in Abu Dhabi for meetings as President Donald Trump cited progress on his proposal and Moscow and Ukraine carried out airstrikes overnight.

An end to the war would have significant ramifications for the oil market. Russia is one of the world's top producers and its flows are heavily sanctioned by the US, European Union and UK. It's still far from certain, though, that Russia will accept a revised plan that cut several points from the initial proposal following input from European officials.

A barrage of Ukrainian drone attacks on Russian refineries have also hampered flows of refined fuels, sending prices surging in recent weeks. Moscow and Kyiv exchanged strikes overnight, with Ukraine targeting a key oil refinery and a major export port.

Any uptick in Russian oil volumes would only add to the oversupply in a market that the International Energy Agency says is heading for a record annual surplus next year. Producers both inside and outside the Organization of the Petroleum Exporting Countries and its allies have been ramping up output in recent months, boosting supplies at a faster pace than demand is growing. Oil prices are down this year and on course for a fourth monthly decline.

“Trading volumes are expected to drop over the next few days as the US prepares for the long Thanksgiving weekend,” said Keshav Lohiya, founder of consultant HiLo Analytics. “The big bearish headline in the run-up to Thanksgiving is the rush to hammer out a Ukraine–Russian peace deal.”

Prices:

Brent for January settlement fell 1.2% to $62.62 a barrel at 8:23 a.m. in New York.

WTI for January delivery slipped 1.2% to $58.11a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.