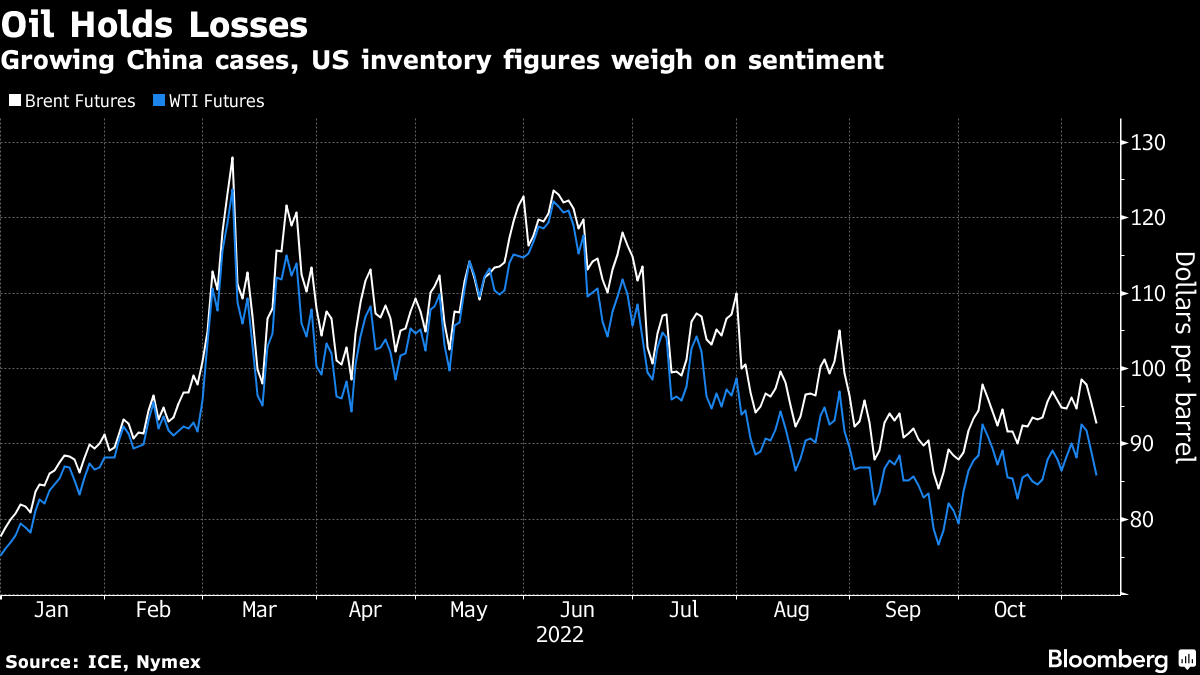

(Bloomberg) -- Oil declined as US crude inventories rose while China struggles to contain rising Covid cases.

West Texas Intermediate lost 3.5% to settle near $86 a barrel. US crude stockpiles rose 3.93 million barrels, climbing to the highest since July 2021, according to government data. Meanwhile, swelling virus outbreaks in China show the strain its Covid Zero strategy is facing, with cases in Beijing hitting the highest in more than five months.

“The macro data from China is much more negative” than the weekly crude inventories report and is “the real driver of trading direction,” said Rebecca Babin, a senior energy trader at CIBC Private Wealth Management. “However, if you were hoping to see crude draws add to an overwhelmingly negative macro backdrop, this report did not deliver.”

Crude has rebounded of late, with Brent futures rallying toward $100 earlier this week, after the Organization of Petroleum Exporting Countries and its allies agreed to cut supplies. The International Energy Agency said on Wednesday that the group may need to rethink its plans as they are damaging emerging economies. The world's main physical oil benchmark, Dated Brent, rallied back above $100 this week.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.