- FSN E-Commerce's net profit rose 142% to Rs 23.32 crore in Q1 FY26

- Revenue increased 23.42% to Rs 2,154.94 crore in the same period

- EBITDA grew 46.52% to Rs 140.68 crore with a margin of 6.52%

Nykaa's parent FSN E-Commerce Ventures Ltd's share price rose in Wednesday's session as the company reported its net profit more than doubled in the first quarter of the financial year 2026. Its consolidated net profit advanced 142% on the year to Rs 23.32 crore versus Rs 9.64 crore.

Nykaa's profit margin jumped 102 basis points to 6.52% in April–June from the corresponding period of the previous financial year. Its revenue and Ebitda both advanced in the first quarter.

FSN E-Commerce management expressed confidence to break even in the current financial year. Citi Research and Jefferies raised their target prices following the good set of numbers for the first quarter.

Nykaa is able to keep the momentum in its beauty and personal care segment while it saw revenue growth in the fashion segment which convinced analysts to retain their views on the stock.

Nykaa Q1 Highlights (Consolidated, YoY)

Revenue up 23.42% to Rs 2,154.94 crore versus Rs 1,746.00 crore.

Net profit up 142% to Rs 23.32 crore versus Rs 9.64 crore.

Ebitda up 46.52% to Rs 140.68 crore versus Rs 96.01 crore.

Margin up 102 bps at 6.52% versus 5.49%.

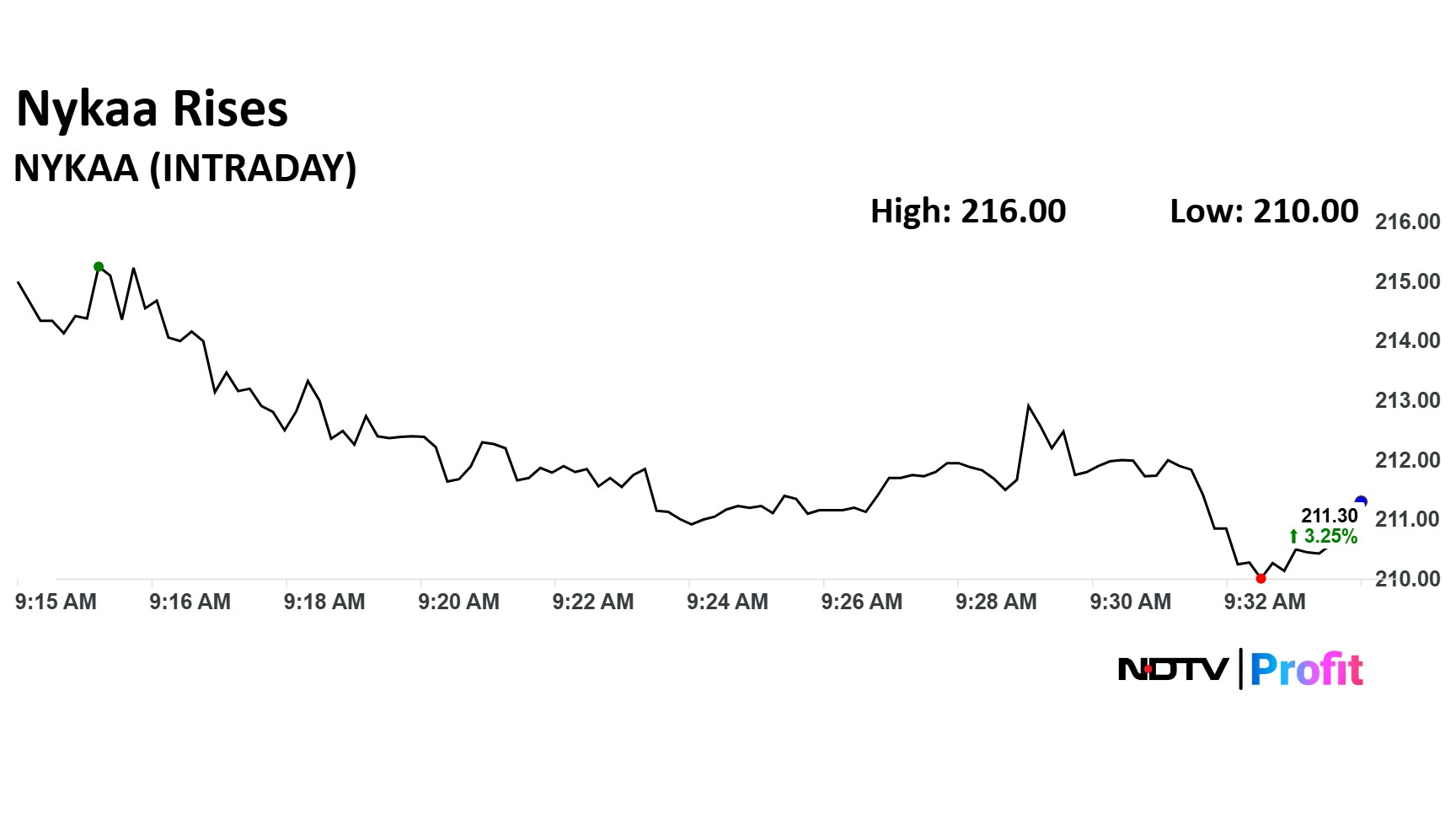

FSN E-Commerce share price advanced 5.55% to Rs 216 apiece, the highest level since July 24. It was trading 2.96% higher at Rs 210.79 apiece as of 9:35 a.m., as compared to 0.29% advance in the NSE Nifty 50 index.

The stock advanced 12.67% in 12 months, and 29% on a year-to-date basis. Total traded volume so far in the day stood at 1.8 times its 30-day average. The relative strength index was at 52.42.

Out of 26 analysts tracking the company, 13 maintain a 'buy' rating, four recommend a 'hold' and nine suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 0.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.