Shares of Nuvoco Vistas Corp. fell nearly 7% on Wednesday to hit two-month-low, after the company slipped into loss in the third quarter of this financial year. The building materials company reported a loss of Rs 61.4 crore.

The Ahmedabad-based firm in the same quarter of the previous fiscal reported a profit of Rs 31 crore, according to its stock exchange notification.

Revenue decreased by 0.5% year-on-year for the three months ended December, reaching Rs 2,409 crore. Operating income, or earnings before interest, taxes, depreciation, and amortisation, fell 37.1% year-on-year to Rs 258 crore. The Ebitda margin contracted by 620 basis points to 0.7% from 16.9% in the same period the previous year.

The company's consolidated cement sales volume registered a strong growth of 16% year-on-year to 4.7 MMT in third quarter of financial year 2025.

"Price increases in the recent period continue to reflect a positive trend, while sustained improvements in demand should support prices as well. Strategic priorities for the company remain centered on driving premiumisation, optimising geomix, enhancing fuel mix efficiency, strengthening brand presence, and maintaining cost excellence," said Jayakumar Krishnaswamy, managing director, Nuvoco Vistas Corp.

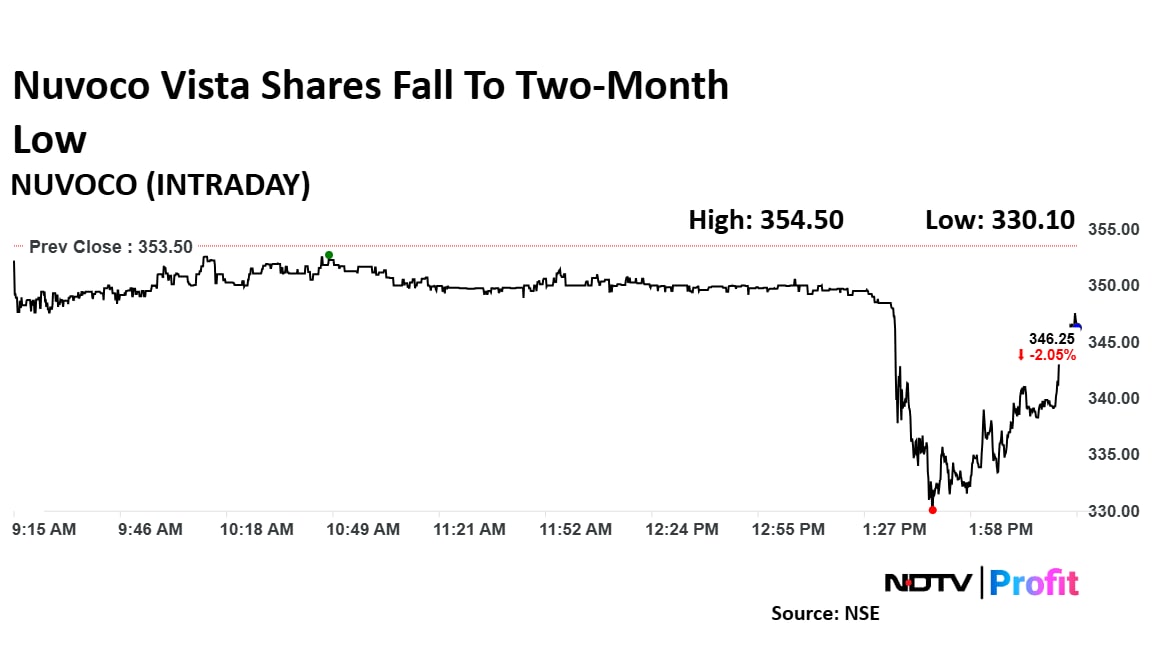

Nuvoco Vista Share Price Today

Shares of Nuvoco Corp. fell as much as 6.62% to Rs 330.10 apiece, the lowest level since Nov. 21. It pared losses to trade 4% lower at Rs 339.35 apiece, as of 2:27 p.m. This compares to a 0.40% advance in the NSE Nifty 50.

The stock has risen 2.29% in the last 12 months. Total traded volume so far in the day stood at 2.6 times its 30-day average. The relative strength index was at 37.

Out of 19 analysts tracking the company, nine maintain a 'buy' rating, five recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 12%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.