NTPC Ltd.'s share price declined nearly 3% during early trading on Monday after the company reported a fall in the consolidated net profit for the third quarter of the financial year 2025 due to higher current and deferred taxes. The results were announced on Saturday.

The power generation and distribution company reported a 1.8% decrease in its net profit to Rs 5,063 crore in the October-December 2024 quarter, compared to Rs 5,155 crore a year ago. Bloomberg analysts' consensus estimate was at Rs 5,104 crore.

Revenue rose 5.2% to Rs 45,053 crore, missing the consensus estimate of Rs 46,577 crore.

On the operating side, Ebitda increased 20.3% to Rs 13,667 crore, above the estimate of Rs 10,973.4 crore. Margin improved to 30.3% from 26.5% from the year ago period. The projection was 23.6%.

As of December, NTPC's installed capacity stood at 76,598 MW.

Over the next 12 to 18 months, key factors influencing NTPC's outlook include an increase in peak power deficits, which is expected to drive up plant load factors, according to Nuvama. Additionally, the timely commissioning of planned capacity is anticipated to boost profitability, while subsidiaries and joint ventures are projected to contribute a growing share to overall performance, the brokerage said.

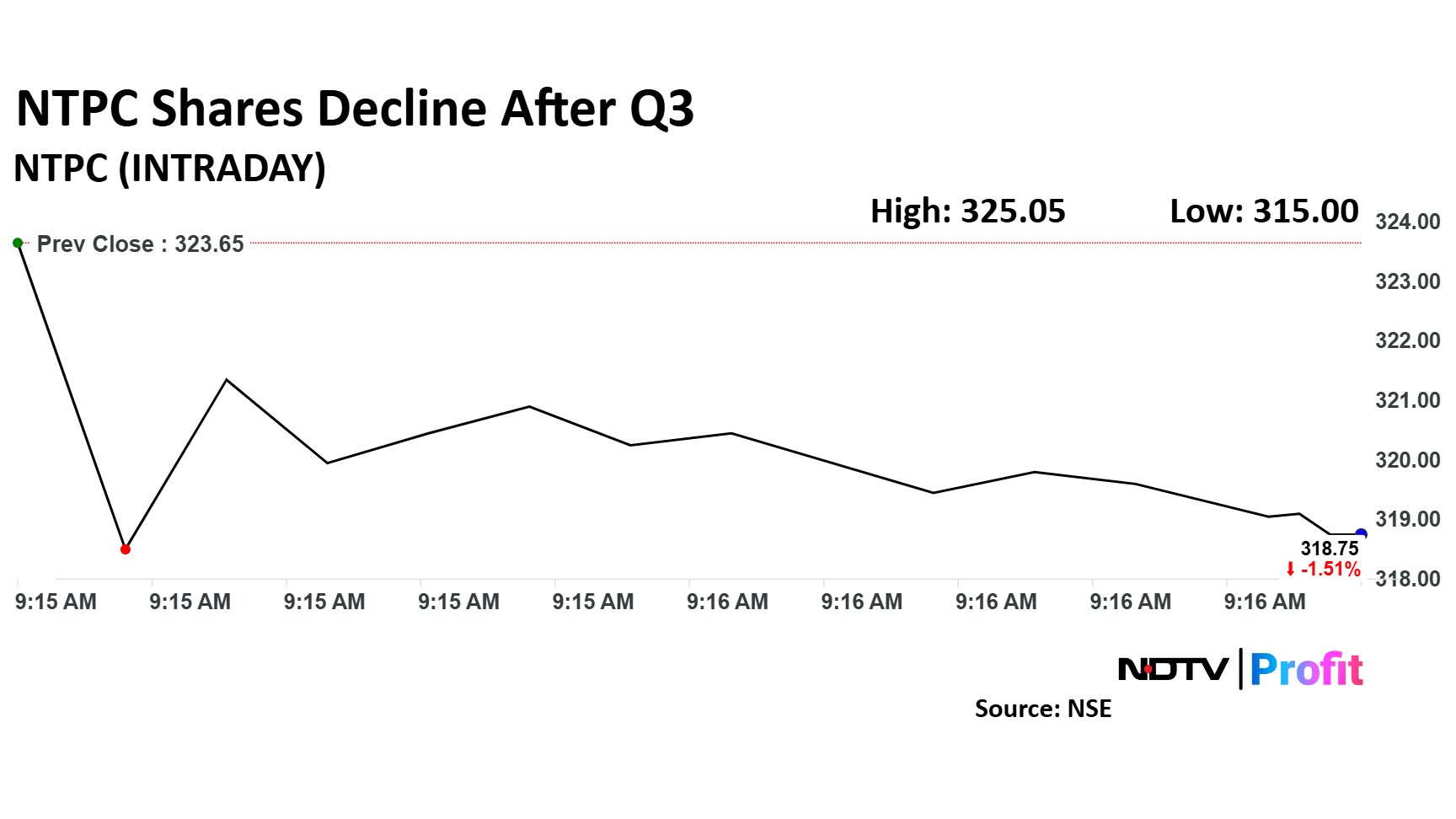

NTPC Share Price Down

NTPC share price dropped 2.8% to Rs 325 apiece soon after the market openef. The benchmark NSE Nifty 50 was down 0.7%.

The stock has risen 1.3% in the last 12 months. The relative strength index was at 44.

Of the 26 analysts tracking NTPC, 22 have a 'buy' rating on the stock, two recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price target of Rs 426.9 implies a potential upside of 32%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.