Shares of Bank of Baroda Ltd. (BoB) gained nearly 4 percent in early trade on Friday, after brokerage house Nomura upgraded the state-owned lender's stock rating to ‘buy' from ‘neutral'. However, it maintained target price at Rs 200, implying a 29 percent potential upside.

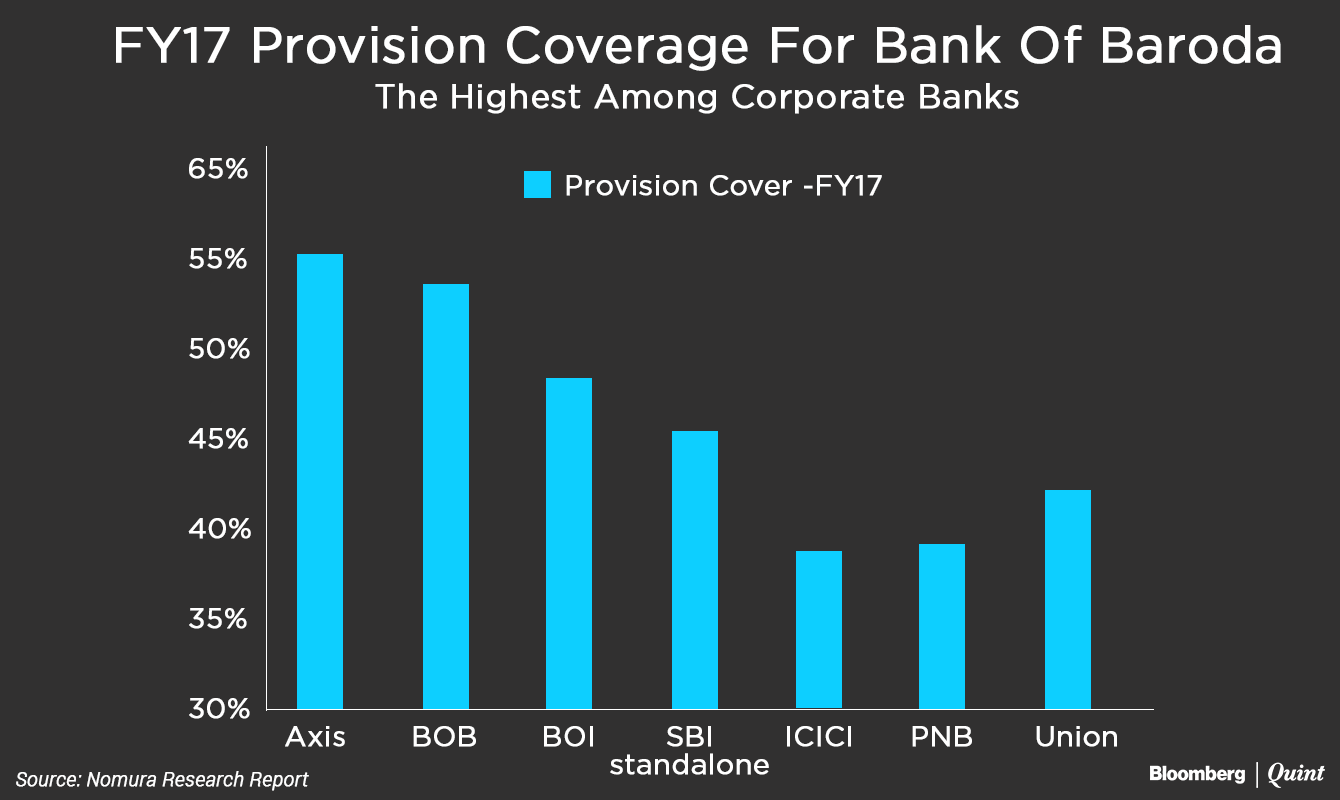

It said early stress recognition and high non-performing assets (NPA) coverage of 58 percent by the bank may result in softer hit on books for the current financial year.

Nomura believes BoB's pre-provision operating profit (PPOP) is heading in the right direction and is better than peers.

PPOP is the amount of income banks keep aside before considering future bad debts. Unlike most corporate bank peers, they expect BOB's net interest margins to improve as the weak credit demand should be offset by lower interest reversals and higher domestic loan mix.

We expect over 10 percent loan growth for BOB overFY17-19 as the bank has already consolidated its loan book in the past twoyears. We thus expect a core PPOP CAGR of nearly 13 percent over FY17-19.Nomura Research Report

With the finance ministry indicating a potential merger of small PSU banks with larger ones, as well as slower resolution process remains a key risk for the company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.