This could be the right time to buy stocks of state-owned banks.

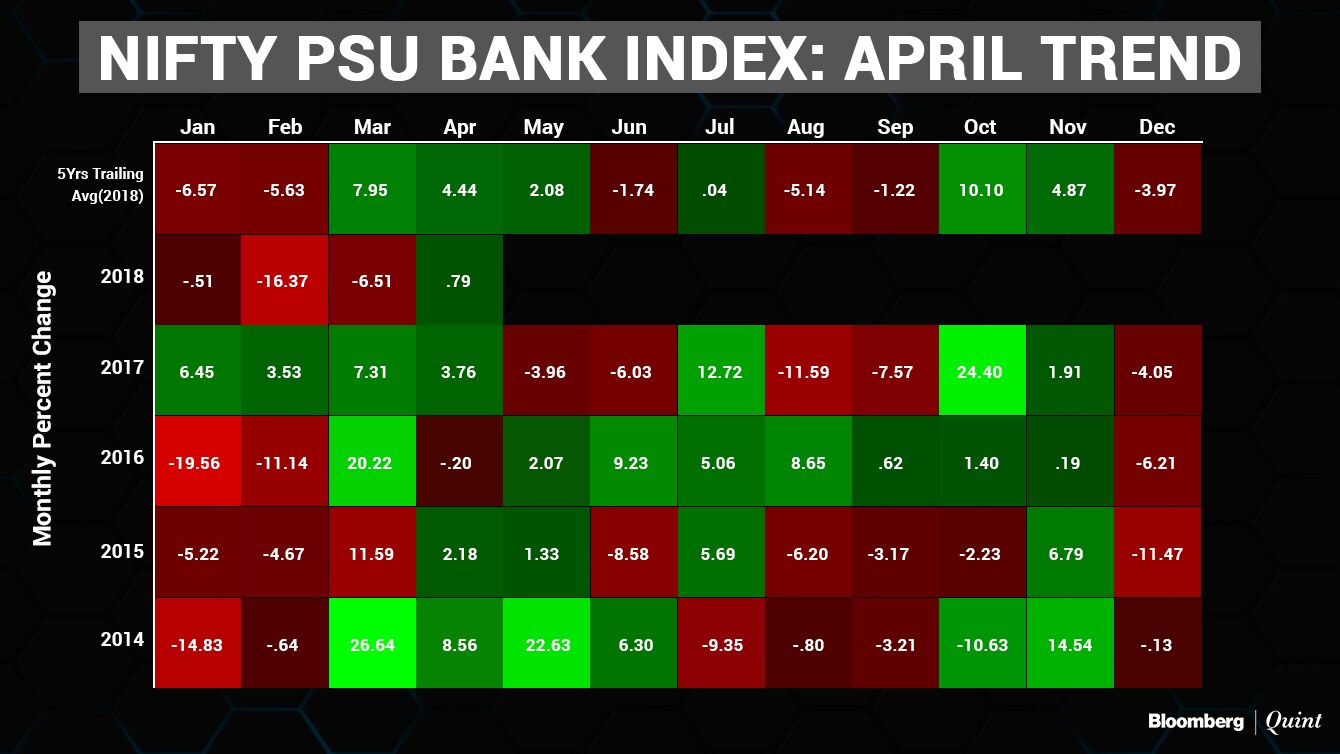

That may appear laughable given that the Nifty PSU Bank Index, driven down by India's largest banking fraud, has fallen 22 percent so far this year compared with a 3 percent decline in the benchmark Nifty 50 Index. Yet, a seasonality factor suggests a possible recovery April onward.

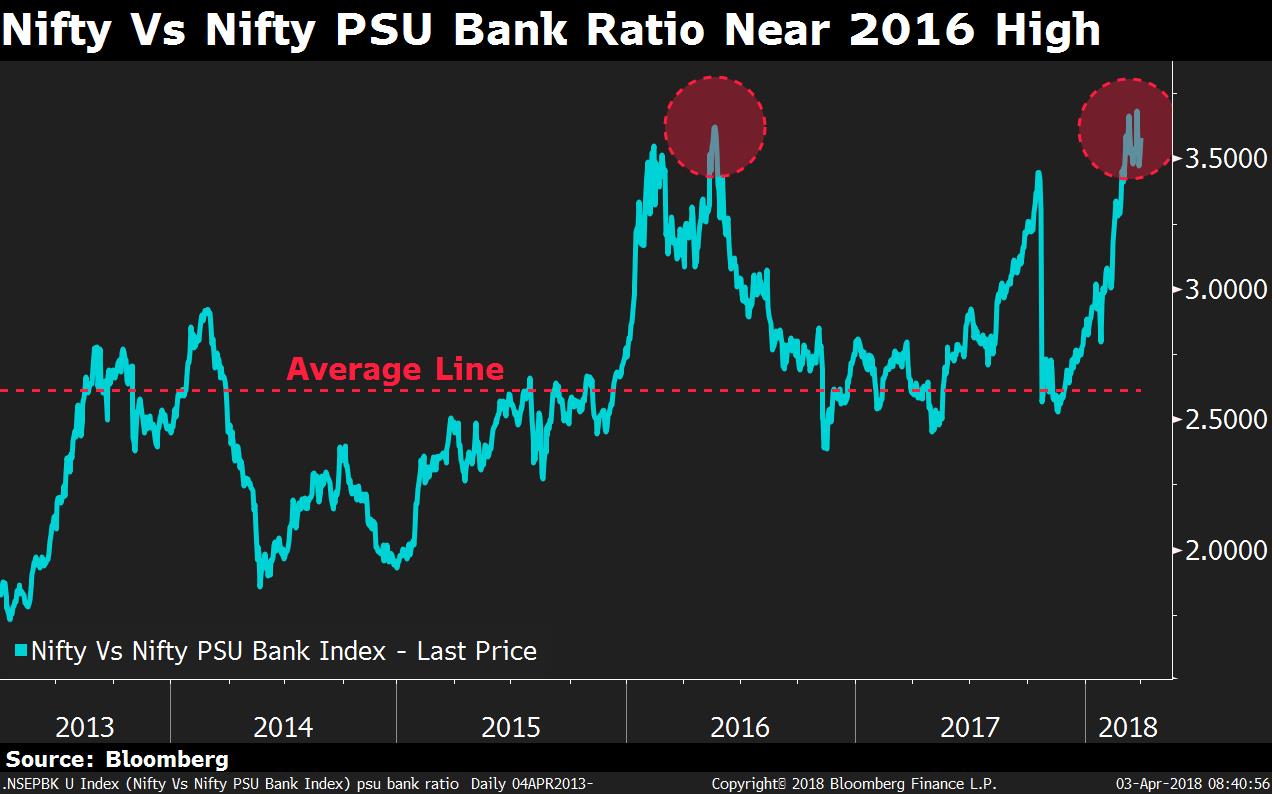

The Nifty 50 is trading at 3.5 times the public-sector bank gauge. The price ratio is near its highest level since 2016 and also above the five-year average. In 2016, the ratio had fallen below the average after reaching the current levels. During the period, Nifty gained nearly 16 percent while the Nifty PSU Bank Index surged 60 percent.

Similarly, the ratio had peaked at 2.9 times and then declined to 1.85 in 2014. Nifty had then surged 19 percent while the PSU bank index almost doubled.

Moreover, in nine out the last 14 years, the PSU bank benchmark ended April with gains.

So far this year, IDBI Bank Ltd. has been the best performing state-owned lender gaining more than 20 percent. In fact, it's the only Nifty PSU Index member to return gains. Punjab National Bank, the second-largest PSU bank that was hit by the Rs 13,000-crore fraud, is the biggest loser with its stock down 44 percent year to date.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.