The shares of Niva Bupa Health Insurance Co. hit a nearly one-month low on Monday after multiple block deals. The stock fell nearly 12% as 5.17 crore shares changed hands in multiple block deals worth Rs 436 crore on the National Stock Exchange.

According to the term sheet accessed by NDTV Profit, Fettle Tone LLP and Managing Director and Chief Executive Officer Krishnan Ramachandran were to sell 13.2 crore shares or 7.2% of equity.

While True North Entity will be offloading 12.2 crore shares, Ramachandran will be selling one crore shares. The price for the deal, as per the term sheet, was set at Rs 1,082 crore, with an indicative offer price of Rs 82 per share. This was at an 11.1% discount to closing price of Rs 92.29 per share.

ICICI Securities is the book runner for this offer.

Niva Bupa Health Insurance Q4 Performance

Niva Bupa Health Insurance's net profit surged 31% to Rs 206 crore for the fourth quarter as compared to Rs 157 crore for the same period last year.

The insurance provider posted gross written premium of Rs 2,395 crore, up 36% year-on-year for the January-March period of fiscal 2025.

The retail health segment saw an increase in market share, rising to 9.4% from 9.1% in fiscal 2024.

The combined ratio (excluding 1/n) stood at 86.1% for the quarter under review, improving from 96.3% on a quarter-on-quarter basis.

The combined ratio represents a combination of the loss ratio and expense ratio, where a lower percentage indicates better financial performance.

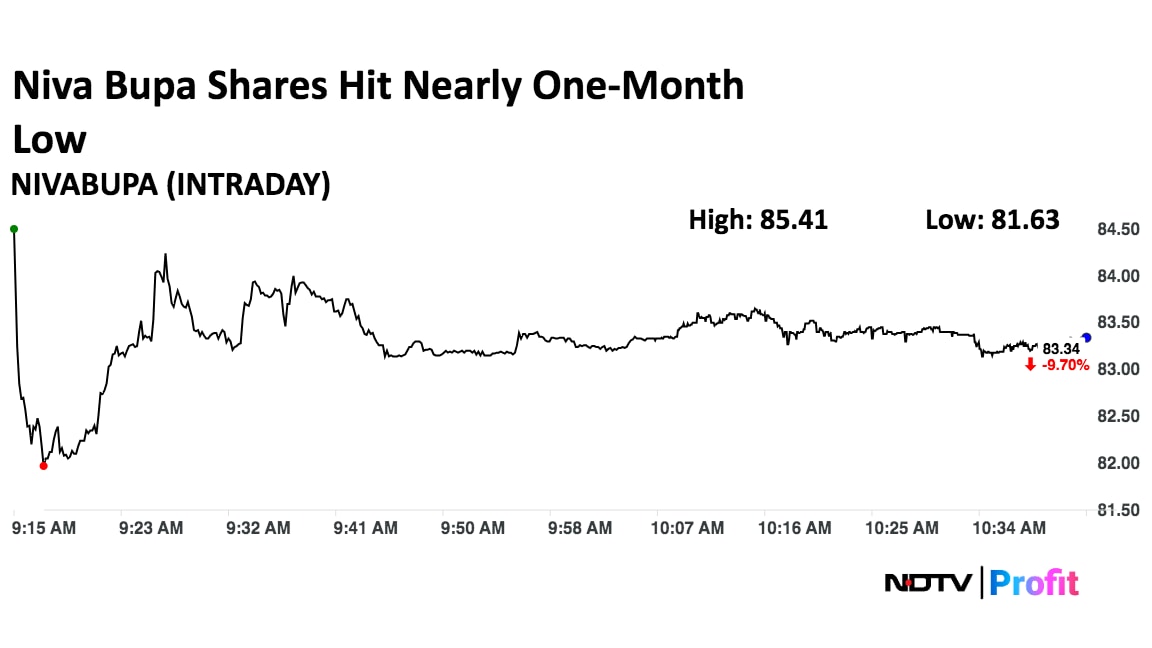

Niva Bupa Share Price Declines

Shares of Niva Bupa Health Insurance fell 11.55% to Rs 81.63 apiece on the NSE on Monday, the lowest level since May 5. They pared losses to trade 9.81% lower at Rs 83.24, compared to a 0.64% decline in the benchmark Nifty 50.

The stock has fallen 1.09% year-to-date. The relative strength index was at 66.38.

Out of the five analysts tracking the company, four have a 'buy' rating on the stock and one suggests 'hold', according to Bloomberg data. The average of the 12-month analysts' price target implies a potential upside of 6.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.