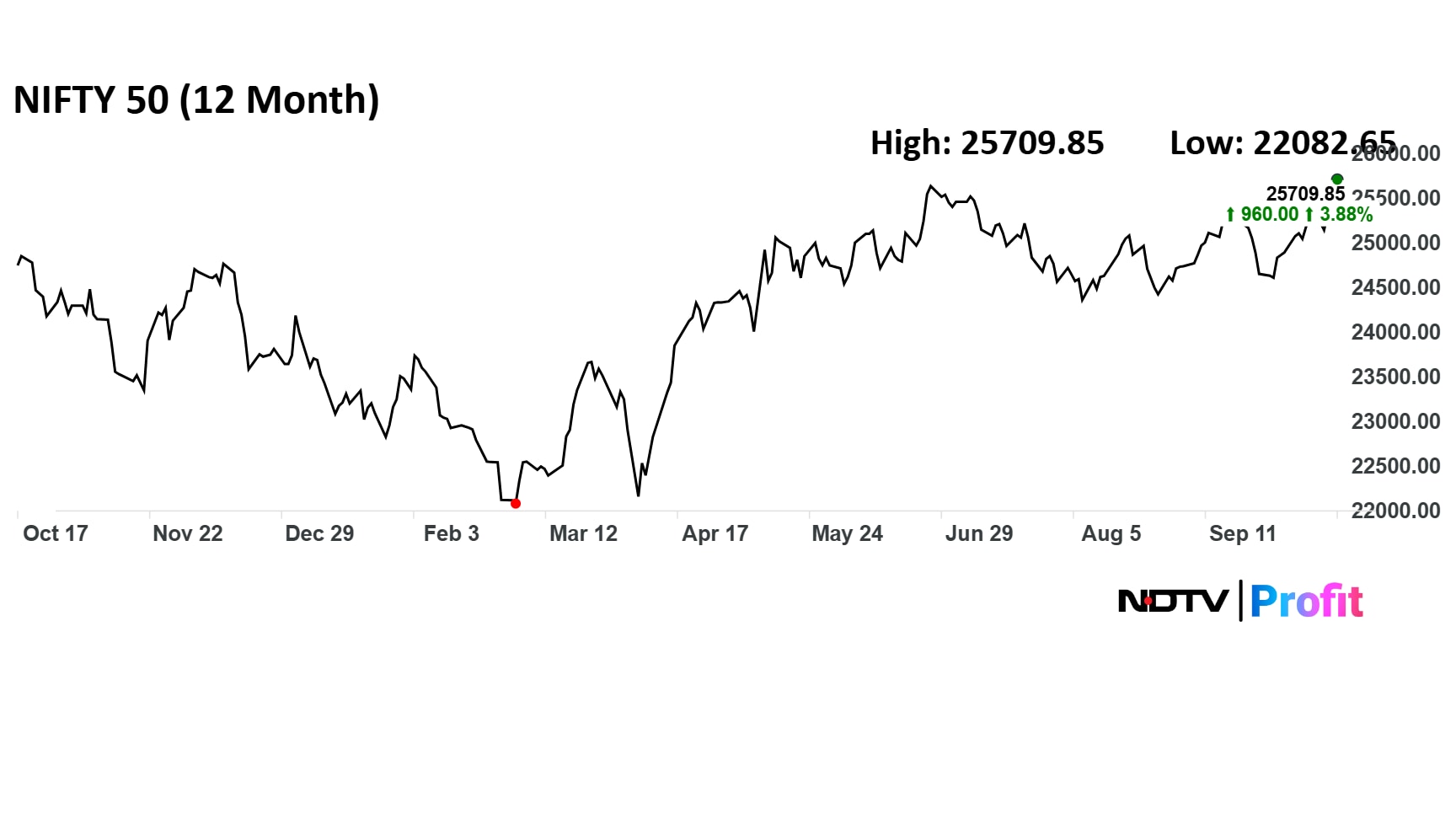

India's 50 largest and most liquid stocks added nearly Rs 86,000 crore in market capitalisation on Friday as the benchmark Nifty 50 scaled a one-year high.

The index closed 0.5% or 125 points higher at 25,709.85, capping a third straight week of gains. The market cap stands at Rs 204 lakh crore.

Intraday, the Nifty hit 25,781, the highest level since mid-October 2024. The 50-stock index is just shy of 500 points from its all-time peak. Telecom, auto and oil and gas sectors contributed the most to gains in the 12 months.

Reliance Industries Ltd. added Rs 25,000 crore in market cap, ahead of its second-quarter financial results. HDFC Bank Ltd. and Bharti Airtel Ltd. gained over Rs 2,000 crore each.

Tata Consultancy Services Ltd. saw its value erode by Rs 4,500 crore amid a broader downturn in IT stocks.

The Nifty Defence and Nifty Finance are the top sectoral gainers. On the other hand, Nifty IT has fallen 18% to be among the top sectoral losers in the last year. The Nifty Media has shed the most by nearly 25%.

Indian equities have managed to stay firm despite persistent foreign fund outflows, global trade frictions including the US-India tariff standoff, and geopolitical uncertainty.

After more than a year of consolidation, the breakout signals that market bulls are back in command and potentially setting the stage for a strong performance in the near term, according to Rajesh Bhosale, equity technical analyst at Mumbai-based broking firm Angel One.

With this breakout, the Nifty now appears poised to retest the calendar year high around 25,700, followed by the 26,000 mark, and eventually the all-time high near 26,300, he said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.