India's benchmark stock indices were trading higher through midday after hitting fresh record high on Friday supported by gains in index heavyweights ICICI Bank Ltd. and Reliance Industries Ltd.

The Nifty hit fresh high of 22,304 and the Sensex touched lift-time high of 73,574.02 after the country's third-quarter GDP beat economists' estimates.

India GDP grew 8.4% year-on-year in third quarter ended in December 2023, beating analysts' estimate of 6.6% for the period in a Bloomberg's Survey.

As of 12:37 p.m., the NSE Nifty 50 was 310.90 points, or 1.41% higher at 22,293.70, and the S&P BSE Sensex gained 1,042.92 points, or 1.44%, to trade at 73,543.22.

"Expected March series will be strong buying interest due to positive macro and micro data. Strong private sector investment and a pick-up in services spending will be positive for market sentiment," said Vikas Jain, senior research analyst at Reliance Securities Ltd.

Expectations are positive for semiconductor related stocks after the government approved a $15 billion semiconductor plant in India. Cabinet approved $9 billion allocation rooftop solar projects will be positive for solar power stocks. Government approved subsidy of $3 billion fertiliser will be positive for mining stocks and change in critical mining royalty will boost metal and mining stocks, Jain said.

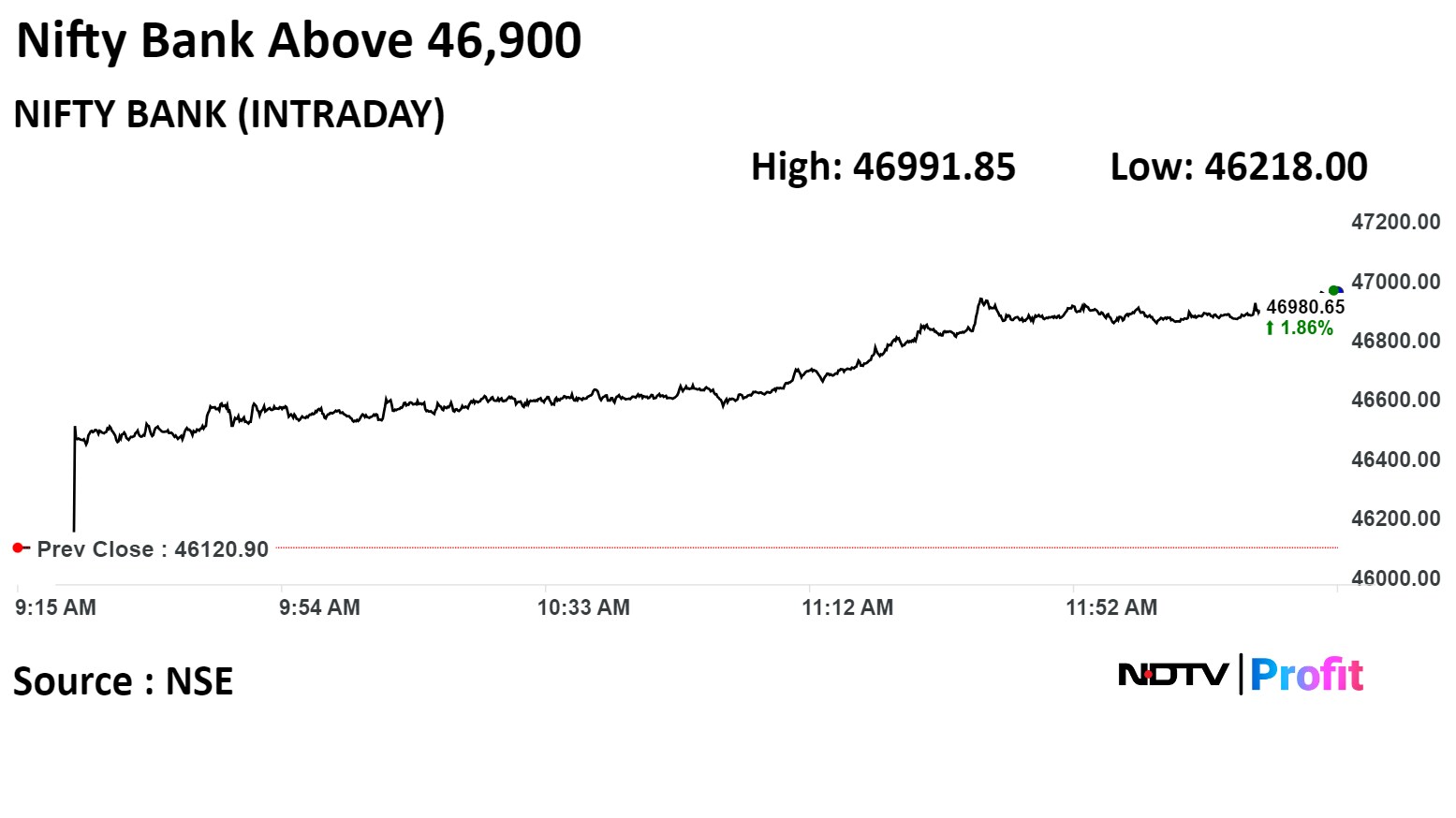

Shares of HDFC Bank Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd., Kotak Mahindra Ltd., and Reliance Industries Ltd. positively contributed to changes in the Nifty.

Britannia Industries Ltd., Cipla Ltd., HCL Technologies Ltd. and Sun Pharmaceutical Industries Ltd. weighed the index.

On NSE, nine sectors of 12 gained, and three decline. The NSE Nifty Metal was the top performer and the NSE Nifty Media was the top loser.

Broader markets underperformed benchmark indices, with the S&P BSE Midcap and S&P BSE Smallcap rising 0.51% and 0.62%, respectively, through midday trade on Friday.

Micap and Smallcap spaces are likely to see some time-bound correction in near future, as companies in the segment need to come up with topline growth to justify the valuation they are setting, said Dharmesh Kant, head of equity research, Cholamandalam Securites Ltd.

"Look at number of Q3, it's all about operating leverage. Top line has not grown to that extent; at best 12-14%—for 500 Mcap companies. Looking beyond 200 Mcap companies, it's such a dismal set of numbers; aggregated PAT has gone up by only 3%. That's where the concern has been in the entire mid-to-small cap segment," Kant said.

On BSE, 17 sectors of 20 advanced, and three declined. The S&P BSE Metal rose over 2% to emerge as the top performing sector. The S&P BSE IT fell 0.60% to become the top loser.

Market breadth was skewed in the favour of buyers. Around 2,475 stocks rose, and 1,203 stocks declined, and 137 stocks remained unchanged on BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.