The NSE Nifty 50 and BSE Sensex declined nearly 2% in the last three sessions to Wednesday as market participants look forward to the policy decisions from the US Federal Open Market Committee. Private bank stocks weighed on the Indian benchmarks the most in the last three sessions.

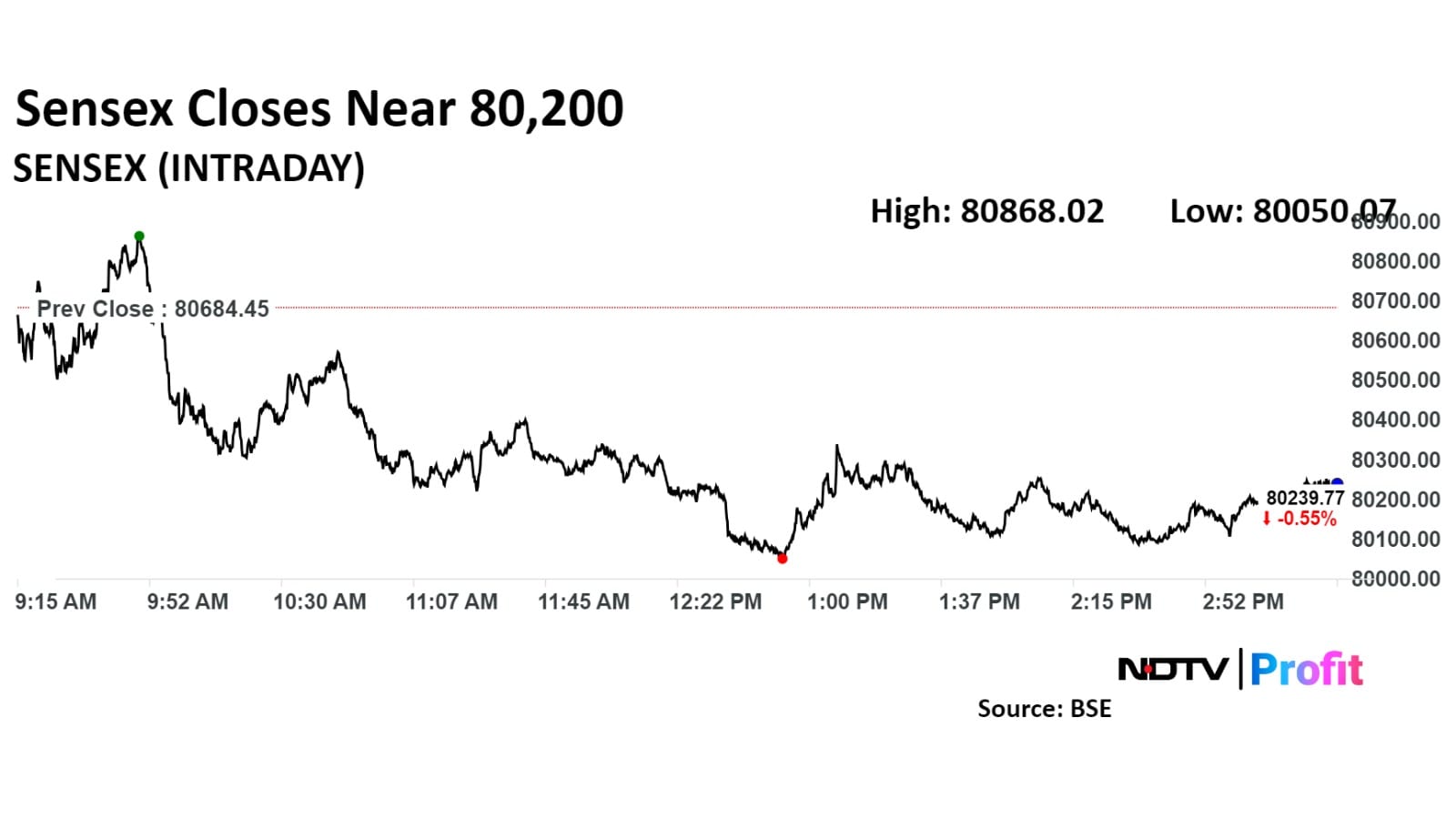

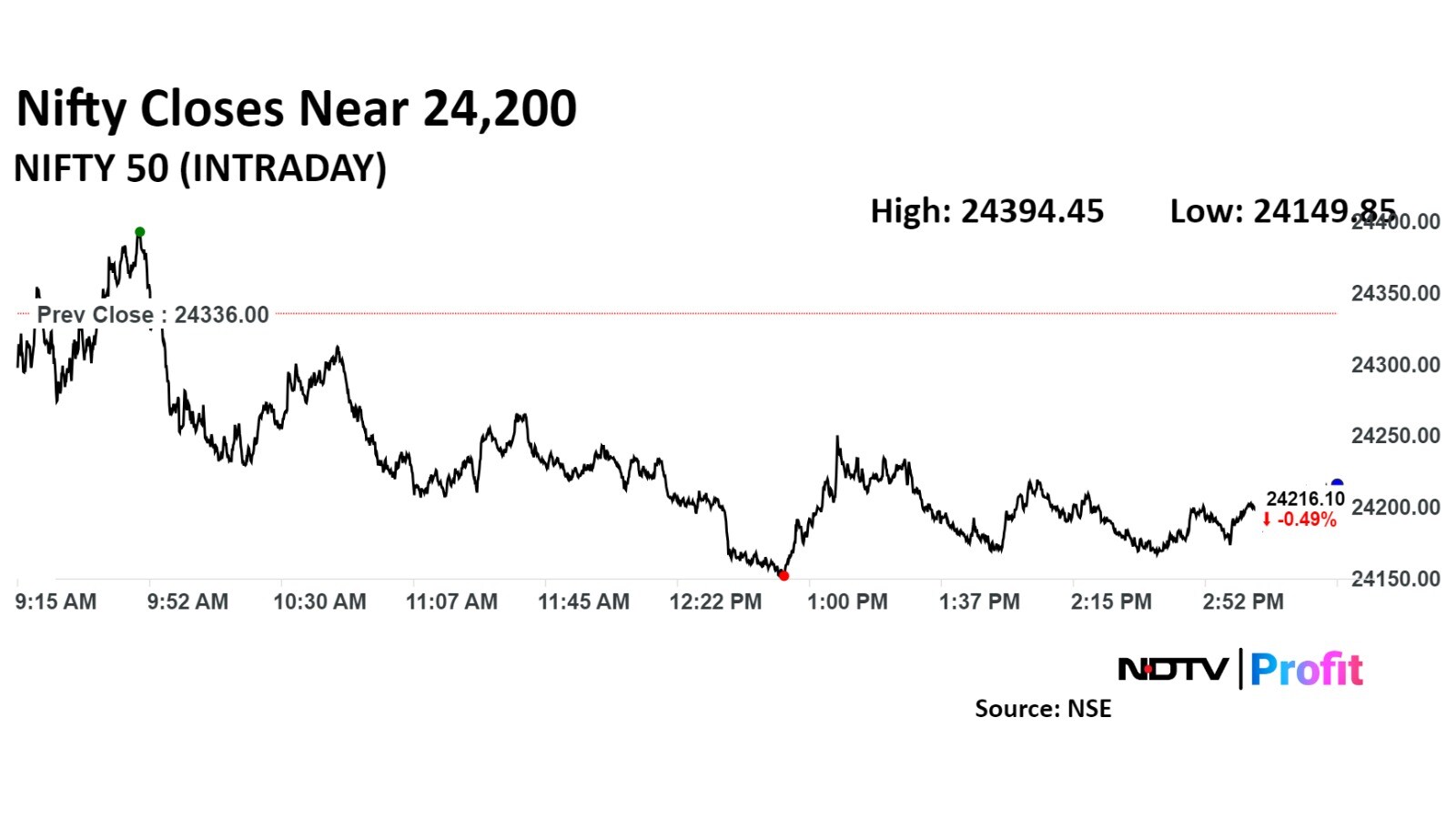

The Nifty 50 ended 137.15 points, or 0.56%, down at 24,198.85, and the Sensex ended 502.25 points, or 0.62%, down at 80,182.20.

During the session, the Nifty 50 fell 0.76% to 24,149.85, and the Sensex declined 0.79% to 80,050.07.

The Indian currency touched a record low of 84.96 against the US dollar, which also affected the sentiment of the investors.

The US rate-setting panel is expected to cut the rate by 25 basis points. Traders will analyse Chair Jerome Powell's speech for insight about the FOMC's future course of policy action.

"In this volatile environment, traders are advised to remain cautious, use strict stop-loss strategies, and avoid carrying long positions overnight to mitigate risks," said Hardik Matalia, a derivative analyst at Choice Broking.

"After the initial fall in the opening trade, the index remained rangebound for the rest of the day before concluding the session at 24,198.85 with a loss of 137.15 points," said Aditya Gaggar, director, Progressive Shares.

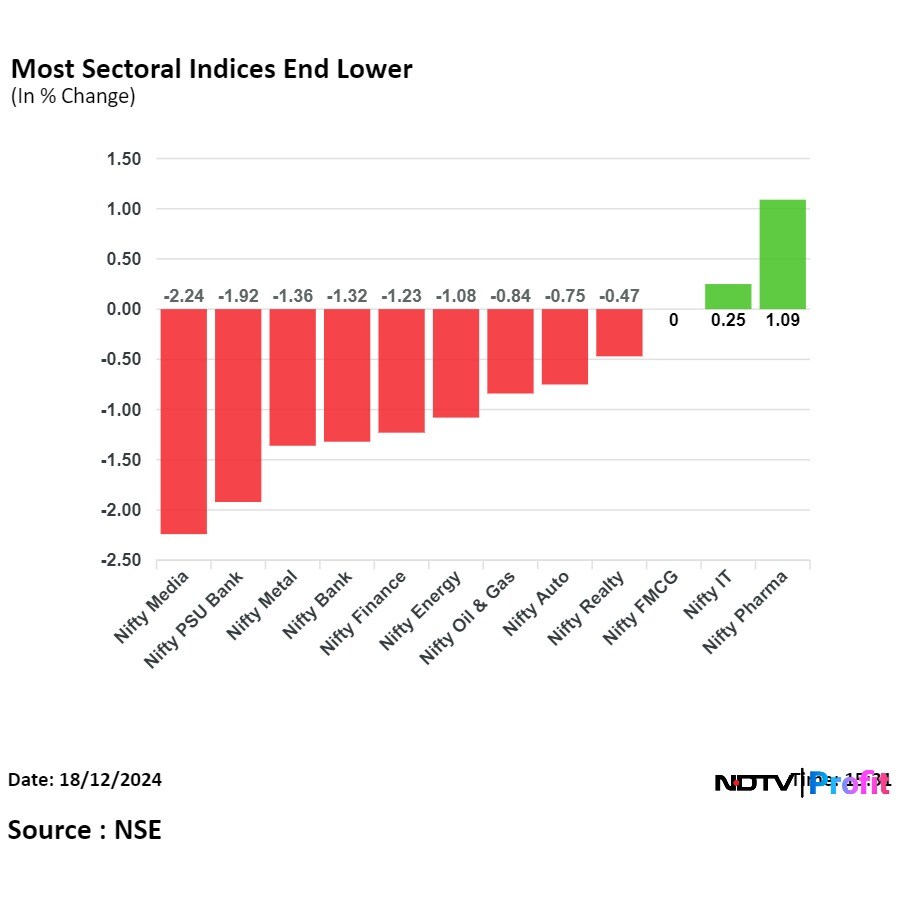

"Barring IT and pharma, all the other sectors ended in red, with media and PSU banking being the major laggards. Selling pressure was also witnessed in the broader markets, as mid and small caps corrected by 0.64% and 0.87%, respectively. Nifty50 has made another bearish candle, but on the hourly chart, the index has entered an oversold condition, and a bounce is warranted. The immediate resistance and support are placed at 24,370 & 24,100, respectively," Gaggar said.

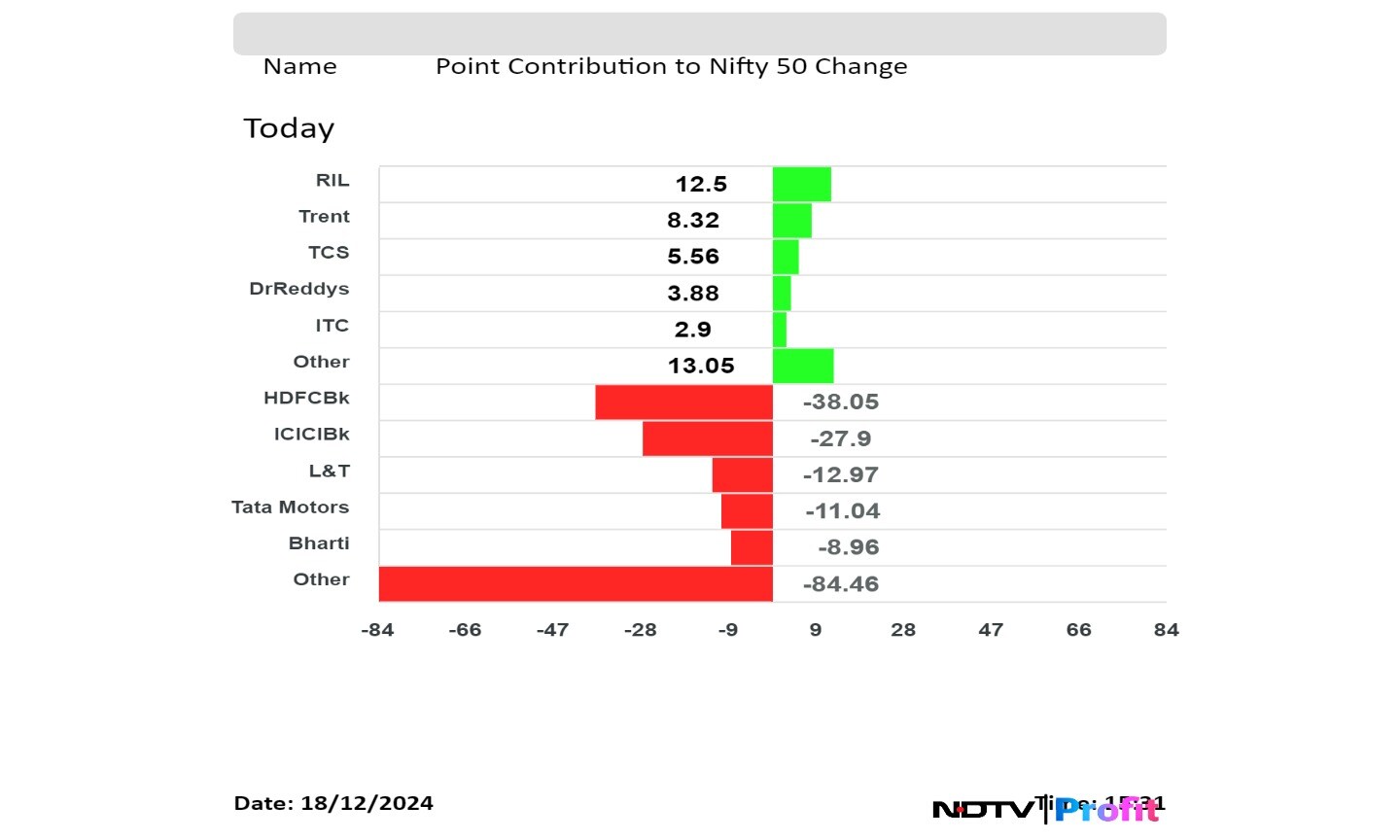

HDFC Bank Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd., Tata Motors Ltd., and Bharti Airtel Ltd. weighed on Nifty 50.

Reliance Industries Ltd., Trent Ltd., Tata Consultancy Services Ltd., Dr. Reddy's Laboratories Ltd., and ITC Ltd. limited losses to the Nifty 50 index.

On NSE, nine sectors declined, two advanced, and one remained flat out of 12. The NSE Nifty Media declined the most. The NSE Nifty Pharma rose the most.

Broader indices also fell. BSE Midcap ended 0.6% down, and BSE Smallcap lost 0.8%.

Only BSE Focused IT, BSE IT, and BSE Healthcare rose of the 21 sectoral indices on the BSE, and the remaining fell.

Market breadth was skewed in the favour of sellers. As many as 2,554 stocks fell, 1,449 rose, and 96 remained unchanged on the BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.