The NSE Nifty Realty index rose to a five-month high after the Reserve Bank of India slashed the repo rate by 50 basis points to 5.5% against expectations of a 25 bps cut. The index has emerged as the top performing sector on the National Stock Exchange.

The market-cap of realty stocks advanced Rs 31,637.7 crore to Rs 7.08 lakh crore as of 11:40 a.m.

Moreover, the central bank also reduced the cash reserve ratio by 100 basis points to 3%.

"This is the third consecutive time this year that the apex bank has cut the repo rates. This effectively lowers the cost of borrowing, making home loan EMIs easier on the pocket and thereby directly improving affordability for buyers," said Anuj Puri, chairman, Anarock Group.

Puri said these policy moves by the central bank can potentially boost demand in the real estate sector, especially in affordable and mid-income segments. Affordable housing faced the sharpest pandemic fallout, with sales and new launches shrinking in the top seven cities.

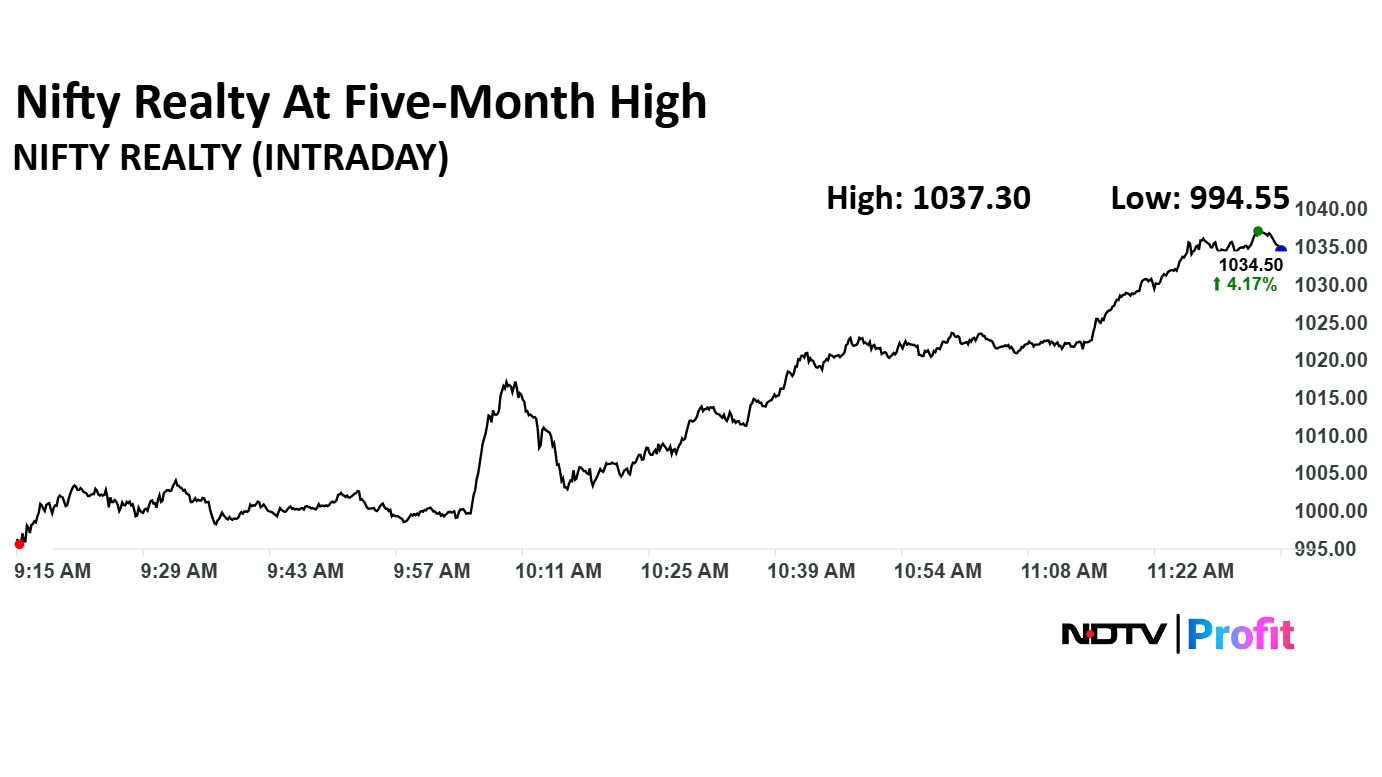

The Nifty Realty index rose 4.47% to 1,037.45, the highest level since Jan. 6. The index was trading 4.36% higher at 1,036.80 as of 11:41 a.m., as compared to a 0.95% advance in the NSE Nifty 50.

DLF Ltd., Godrej Properties Ltd., Macrotech Developers Ltd., and Prestige Estates Projects Ltd contributed the most to the Nifty Realty.

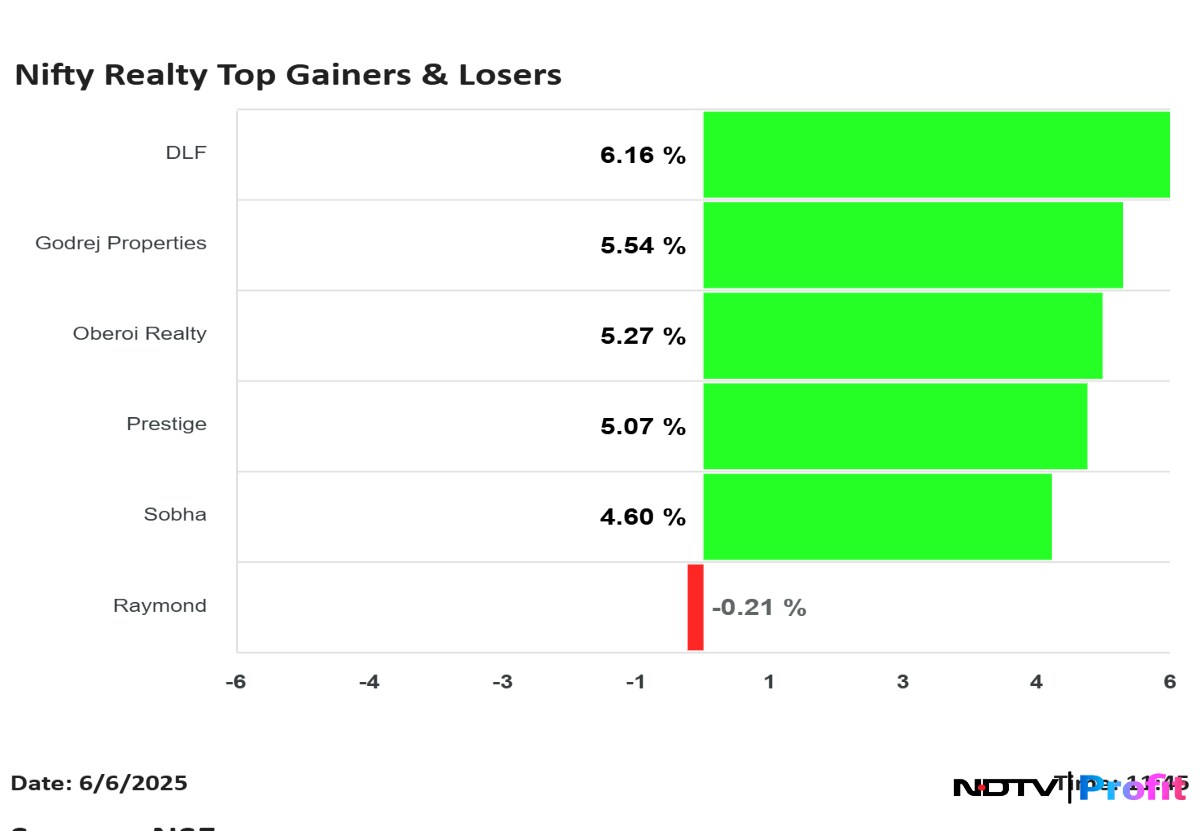

In terms of share price movement, DLF Ltd., Godrej Properties Ltd., Oberoi Realty Ltd., and Prestige Estates Projects Ltd. were the top three gainers in the index.

Raymond Ltd. was the only stock which declined in the Nifty Realty index.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.