Nifty Next 50 is fast emerging as a high-growth, high-momentum play for investors looking to invest in large-cap stocks. Positioned as India's junior benchmark for big-cap stocks, this index gained over 7% from the 52-week lows after it fell over 29% from its high in the last 12 months.

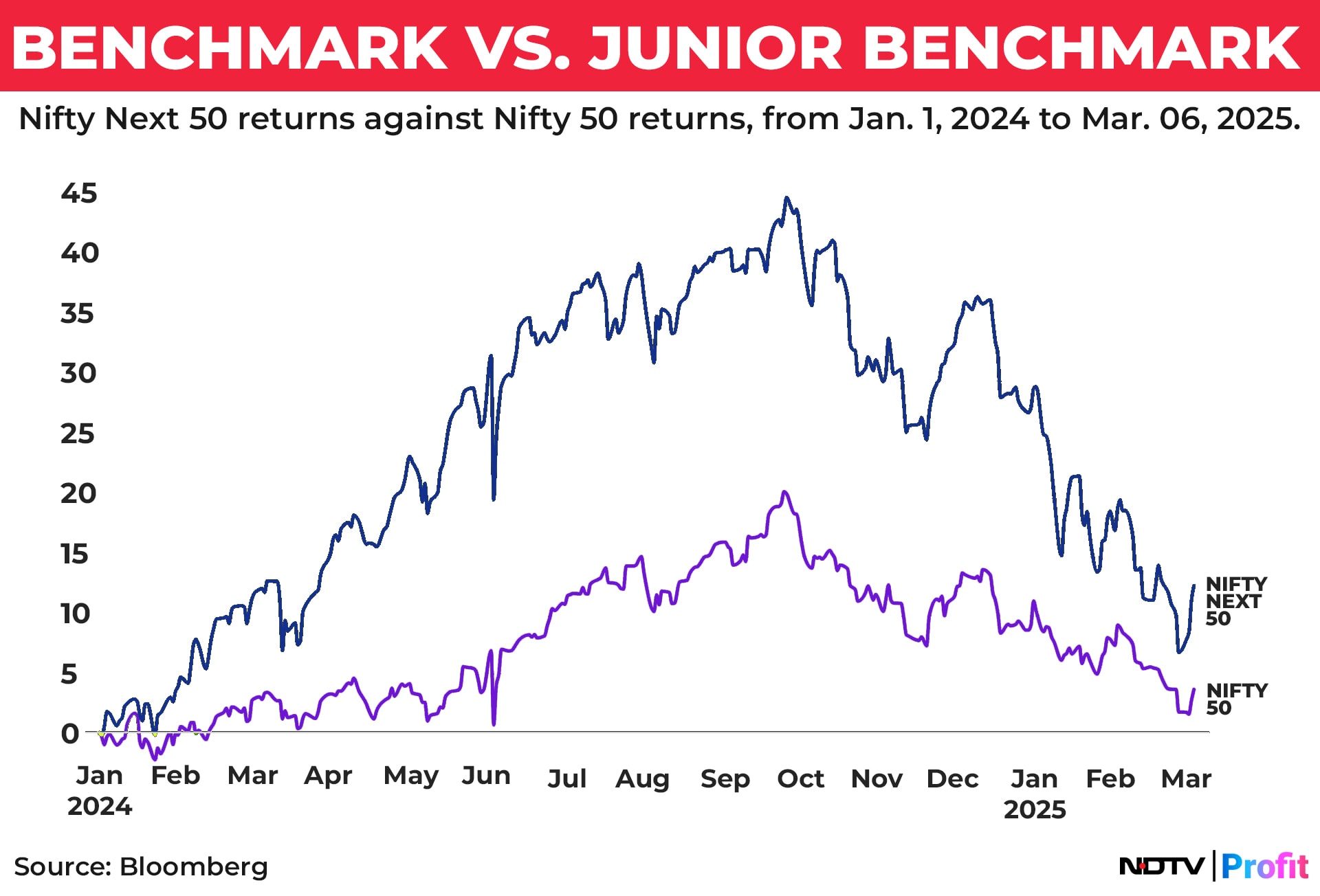

In calendar year 2024, Nifty Next 50 gave a return of 27.30% despite the correction seen in the October-December quarter due to Trump Trades. For the first nine months of the year, the index gave a return of 44.35%. In contrast, the Nifty 50 gave a return of 8.75% in calendar year 2024, and 18.7% in the first nine months of 2024.

The composition of Nifty Next 50 is also turning out to be homogeneous with highly liquid stocks with diversified weights. This is visible from the fact the index has a market cap of Rs 64.71 lakh crore with free float market cap at 32%, factoring the new stock additions and deletions in the index, effective March 28.

InterGlobe Aviation Ltd., the parent of low-cost airline IndiGo, will hold the biggest weight in the index at 4.5%, followed by metal major Vedanta Ltd. with a weight of 3.6%. Divi's Laboratories Ltd. and Indian Hotels Co. will be the other stocks with similar weights.

The index is also turning into a play for public sector undertakings as eleven companies from the space account for a little over 21% weight. This also makes it the proxy for capex play. PSU manufacturing, and bank and finance companies have equal weights in the index with focus on energy, railways, defence, insurance and bank, and power and renewable finance companies.

Bank and finance companies account for nearly a fifth of the index weights at 19.5%, with Bajaj Housing Finance Ltd. and Cholamandalam Investment and Finance Co. the only private sector housing finance and NBFC, respectively, in the Nifty Next 50 Index.

Consumption has the biggest weight with FMCG, retail and consumer services accounting for 22.4% weightage. This is followed by the power sector with 8.6% weight, and capital goods at 6.7%. Auto sector accounted for 6.6%. Clearly, Nifty Next 50 is turning out to be the best benchmark for those betting at consumption and capex to return.

The Index has little exposure to IT stocks with only LTI Mindtree as the lone flagbearer of the sector in the gauge.

Nifty Next 50 has consensus earnings per share of 3,325 and FY26 estimated price-to-earnings ratio of 18 times. This is compared to a 5-year and 10-year average of 23 times. Which means the index is trading at nearly 25% discount on the long-term average.

Before wrapping up, we leave with you the stories we are reading:

In his weekly letter, market veteran CK Narayan advises caution amid 'curious movement' in the Nifty 50.

With tax season in full swing, this author takes a look at how investing in politics can get you income tax cashbacks.

In an exclusive interview with NDTV Profit's Charu Singh, BSE chief Sundararaman Ramamurthy expressed his reservations on a unified expiry day for F&O contracts.

India's Silicon Valley is seeing protests from IT employees' union demanding work-life balance. Ground report by Haripriya Sureban.

Tata Steel has none but one chink in it's otherwise perfect armour: Europe. Mihika Barve does a deep dive.

That's from us this week,

May the markets be ever in your favour.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.