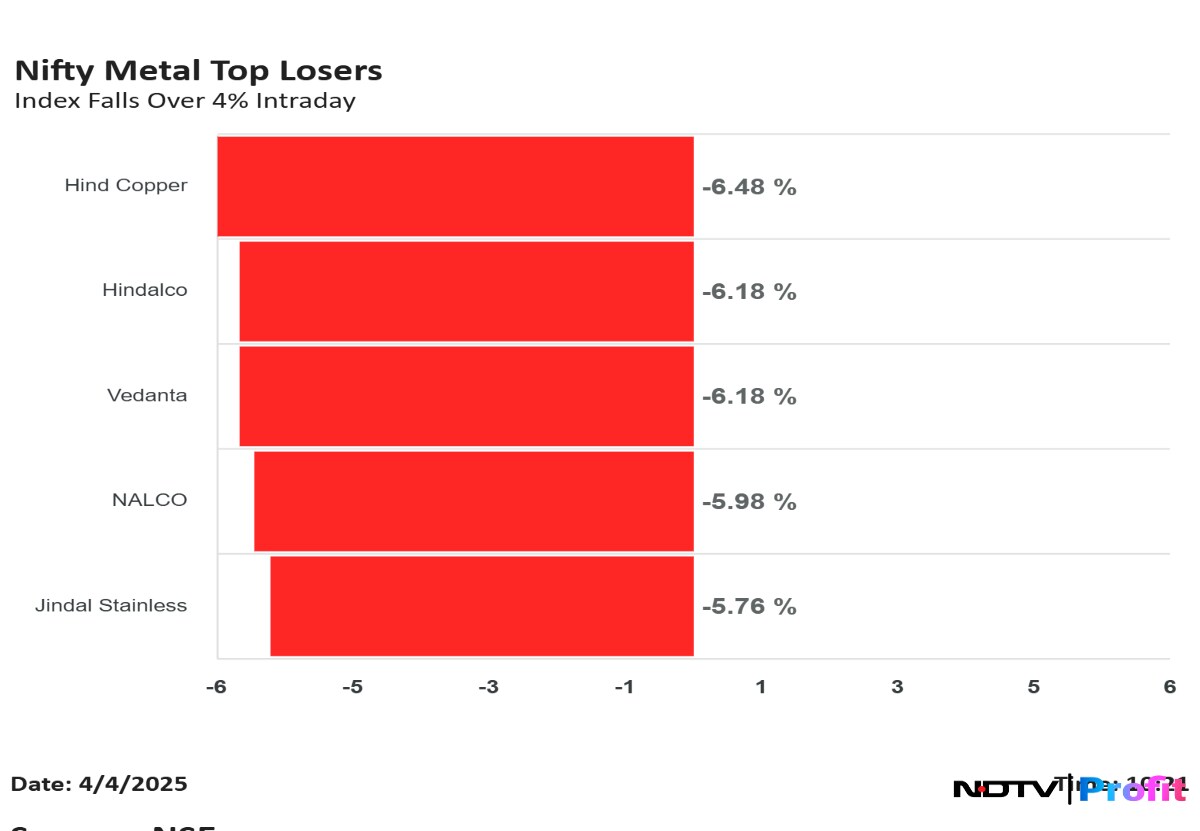

The Nifty Metal was one of the top losing sectors in trade on Friday as the index fell 4.8% intraday.

The main reason for the fall was not the direct impact of Donald Trump's 26% reciprocal tariffs on India but the potential indirect impact on commodity prices.

Metals are a large contributor to FY26 Nifty EPS and the sector now stands vulnerable in a scenario where new capacities are set to come online amid chances of lower metal prices, as per Emkay Research.

Limited Direct Impact

The US' tariffs on Indian steel & aluminium have no material impact on India since we export very less of the two metals to the US.

But There Is An Indirect Impact

While there is no direct tariff impact on the Indian metals sector, the second-order effect could hurt India more, as per Emkay.

Post the broad tariff announcements, the possibility of US entering recession this year has become higher, as per multiple global brokerages. Goldman Sachs has raised the probability of a US recession to 35%, while JP Morgan's probability of a recession now stands at 40%.

This higher chance of severe US recession can cause a significant short-term correction in global commodities prices like metals. Hence, the Nifty Metal is facing its heat today.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.