It seems like the market was a in a bit of a hurry. It managed to achieve the targets that we had set for it in the last week. Not that we were too surprised, as we were already anticipating a continuation of the ongoing rise. Only, we were looking for the targets near 17,900/42,300 by April 19 and we got them by April 13. No one is complaining!

The rise has been swift and straight through, without a reaction. And that creates some issues. While it is enjoyable if one was long during such a move (like we were), it starts running into trouble because that kind of pace is difficult to keep up for long. A good chunk of the rise occurred through a gap and the squeeze play in Bank Nifty on weekly expiry day. So, chances are that the market may show you a halt or pullback during the week ahead, even as it tries to maintain its upward trajectory.

Chart 1 shows the recent drive up. We can now see that it is now into the area where there has been considerable number of overlapping moves in the past (the larger rectangle) and therefore the pace of advance, if it were to continue, would meet with resistances. At 17,935, the futures will run into the 50% retracement zone of the decline from the December 2022 high. Continuation can take the prices to 62% pullback zone at 18185.

Now, note that the higher target is still about 300 points higher from current levels. Since we still have the next week to get to the time target, it may be worth waiting, with part position, for the higher targets.

The difficulty here is setting stops on such positions. As can be seen on the chart, the only support area is marked by the smaller triangle, at the gap zone left on March 31. That is way down at 17,300 area. So, maybe a good idea would be to book partially and hold only balance portion with a stop at 17,300. On the options front, the next expiry has large open interest created at the 18300 CE on Thursday. At a price of 2.00, it doesn't seem to me to be short calls. Ergo, they could be long call positions. So, there is a bunch out there, who believes that market may go higher! Maybe worth trying that trade next week. Else one of the trades I may want to make is a 1x2 ratio spread of 18,000-18,200 CE of monthly series that would cost me around 30-33 points. Not too big a deployment for playing for the continuation of the trade.

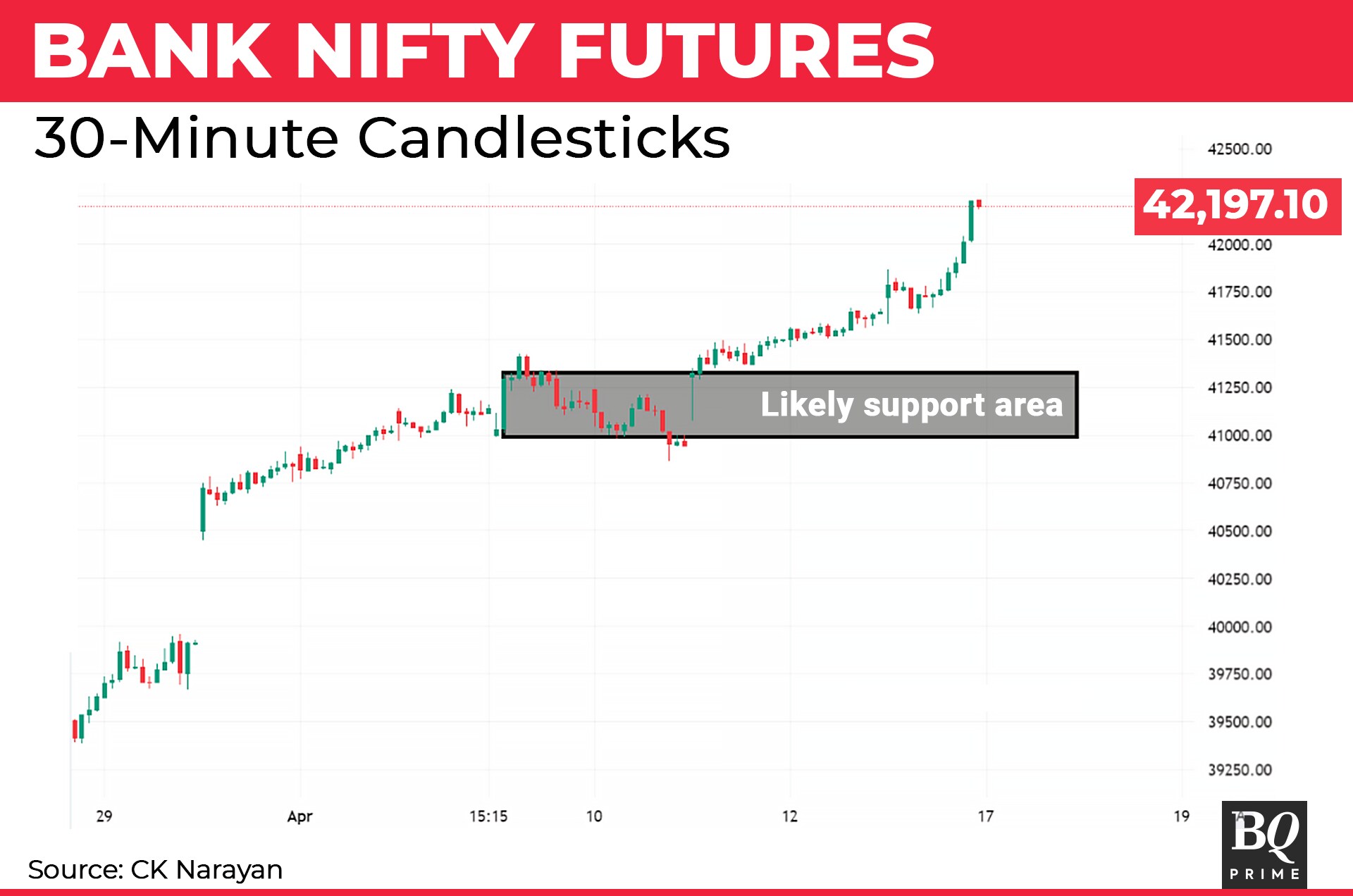

Bank Nifty saw some strong call short squeeze on Thursday and if it continues higher, then it would likely speed up the whole matter. Many people would be looking for reactions, given the straight advance over 10 sessions, that is natural. When you expect a pullback, the first thing you drop is to buy fresh. Second likely action is short lightly. HDFC Bank results fell short of Street expectations. But will that be enough to take banking pack down? Maybe not. But combined with the tech counters doing poorly (both TCS and Infosys), chances are that we may see some pullback in the indices on Monday. The Bank Nifty has a small support zone at 41,000 zone. We need to check whether that holds. Usually, ability to hold the first level of support is a signal of more bullish intent.

Now, the thing is, next week has just one biggie—HCL Technologies (on April 20) for results. So, the market will have not major talking point of major stock results. In that case, the focus on the results of TCS, Infosys and HDFC Bank may be enlarged. Since none of them redeemed themselves, chances are that there may be some pressure on these and to that extent, they may act as a drag on the main indices.

We are already looking for a slowdown in the pace of the market and the above gives us a reason for anticipating the slowing. ICICI Insurance pair is also slated for results. But insurance is not a market moving sector. And, given that Insurance stocks have already seen some moves over recent week or more, the numbers may have to be something of surprise to move the needle further.

So, the conclusion would be that we should not really be expecting the Bank Nifty to charge higher. The option OI for next reveals a large add at the 42,000 PE strike and so, if this strike zone price breaks, then we can expect a pullback to ensue during the week. Absence of any significant activity in the monthly series would imply that traders are willing to take near term bets only. That betrays a tentative sentiment, at best, despite the strong rally.

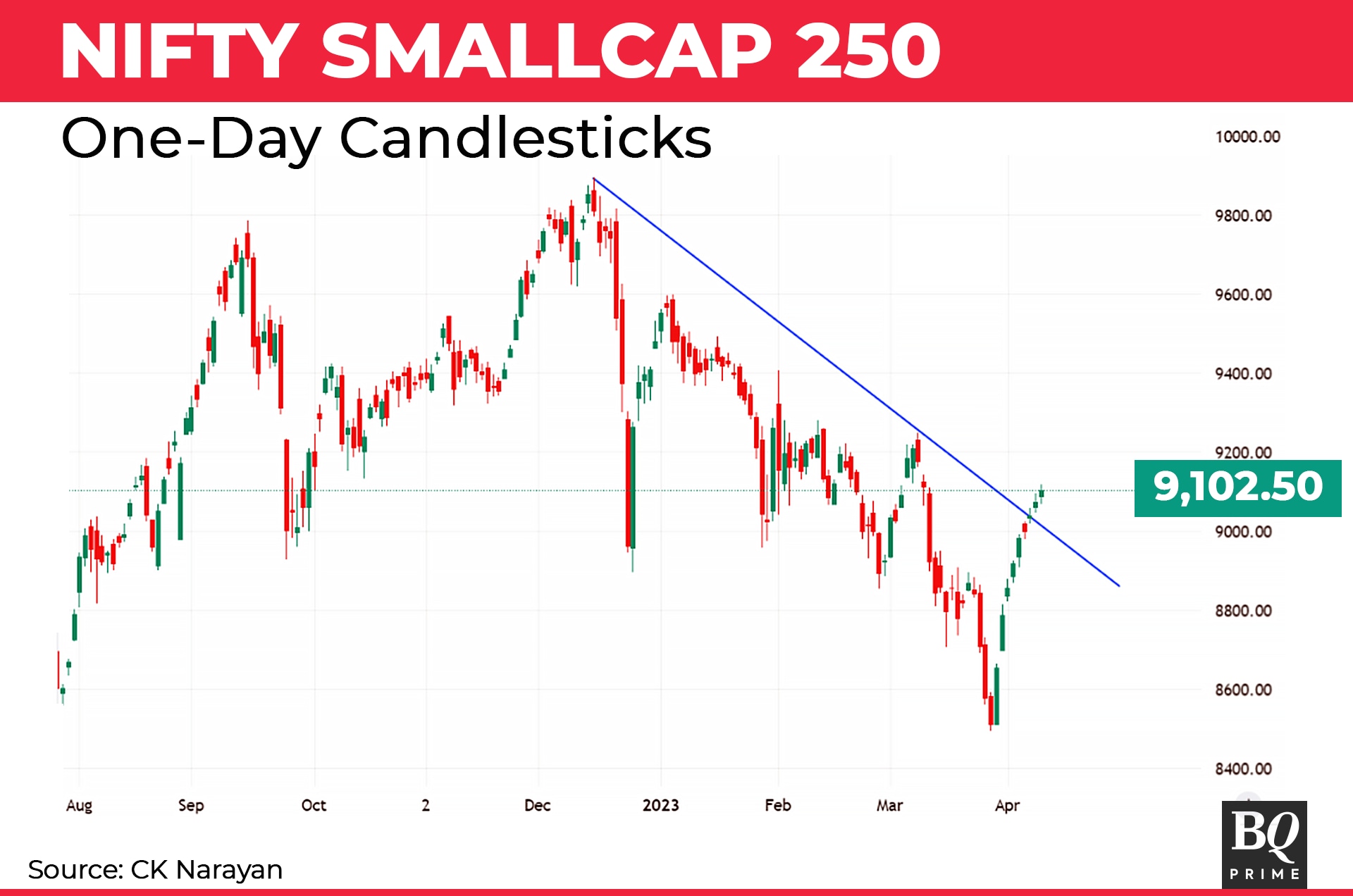

Chart 3 shows the strong rally that has also ensued alongside in the smallcap index. This clearly reveals that the retail public has been active in this rise and probably pitching in money. We read also that the flow into SIPs continue to remain robust. So, sentiment there may be slightly soft but the retail is still quite game to pitch money into the market.

In addition, the FII have been positive for the month so far and that may also be taken as a positive factor, implying that dips during the week could get bought into. Foreign investors have put in Rs 11,500 crore in the Indian equities so far this month, mainly driven by bulk investment from the U.S.-based GQG Partners in the Adani Group companies. This came after a net outflow of Rs 5,294 crore in February and Rs 28,852 crore in January. But in the calendar year 2023, FPIs have sold equities to the tune of Rs 22,651 crore. So, can that be overturned? That will be the question that will need to be answered and that is a difficult one to answer as of now. The return of retail money is certainly good news, in that context. If FPI money continues to trickle in, then we could possibly be over the hump.

The trends in the Dollar Index charts are not too clear about what could happen in the near future. The move of the greenback and alongside the USD-INR pair will also be a big determinant of the quantum of FPI flow. And the way the charts are, it doesn't look we may get any definitive signals till well into May month. So perhaps more churning of the currency pair here. And, trends could be driven more by responses to quarterly numbers. So, I would be watching for the numbers of the stocks where FIIs are interested. Two stocks from such a list with results due out next week are Cyient (April 20) and Tejas Network (April 21). Charts of both hint at continuation of upmoves.

Summing up, we have had a good run and it is time to protect those profits. For the week ahead, some approaches have been suggested but those are more of defensive moves. Still expecting the market trends to find their feet during intra week dip (which may be front-ended). Attention may spread to small- and mid-cap stocks as well and hence one should have an eye in that space as well.

CK Narayan is an expert in technical analysis; founder of Growth Avenues, Chartadvise, and NeoTrader; and chief investment officer of Plus Delta Portfolios.

The views expressed here are those of the author, and do not necessarily represent the views of BloombergQuint or its editorial team.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.