It's been quite a difficult market of late. First, it took its time to move down from the last projected time and date and chose to go sideways. Then it gave a signal, and the war games started. This created a giant gap down. But that got done in a single day! Then the market tore up in a matter of a few days, chalking up fresh swing highs. And as we ended the week, that is where the market is poised. Chart 1 shows the recent moves. I have added a pitchfork on the chart for perspective.

When the prices fell on the war news, I had fully expected the move to continue lower and test a gap or two down below. So, it was certainly a surprise when the market did a complete about-face on the very next day. The median line and the doji level of that drop now become important support considerations in future declines.

The top of the pitchfork channel is not too far away, please note. I give high importance to such resistances and therefore am not going to be carried away by any big bull talk. On the chart I have marked May 26 as the next upcoming turn date, and the coincidence of the price level channel and the time target is around 25,550. That is where I would be looking for an end to the present advance. It may undershoot but may not overshoot, is what I feel just now.

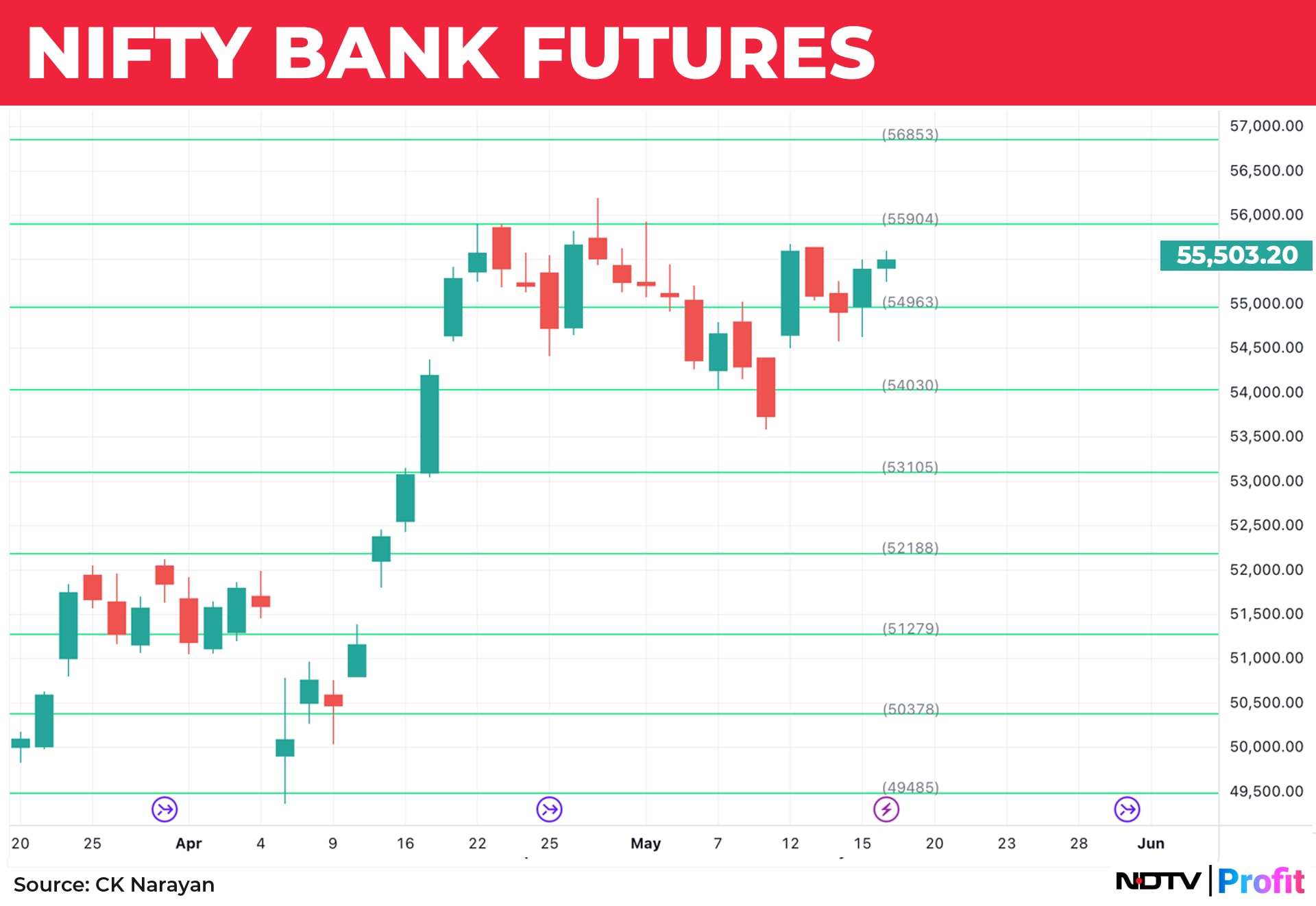

There are some attempts by a few to force-fit an impulse EW count to this upmove. I am not finding that to be the case. There is a small outside case for it , provided the index shoots up from here (for a 3 of 3 move). Even in the case of the Bank Nifty, where the move seems to be clearer as compared to the Nifty, rules are not being met, and one may have to bend them a bit to fit an impulse count. This too would be on once the BNF makes a new high past 56,000. So, that needs to be awaited. If that happens, it can drag the Nifty too higher. Let's see then what kind of wave structures develop. Chart 2 shows the setup in the BNF.

The recent move hit the Gann cycle resistance lines and has seen some pullback since. So, now to move higher, they would need to go above it to make it to the next level, which is at 56,850. Here, there is a ‘look' of a wave 4 in progress, but the deemed w3 is shorter than the required 1.618 count of the w1. So, a bit iffy there. If prices slide beneath 54,850 and lower, then I would drop the chances for a continuation higher for now. But attempts that survive any such retests are buying opportunities during dips.

However, both indices have strong weekly candles, and that suggests that we should be looking for the rise to continue. So bet with the bulls for now. Yes, not too long ago we were speaking about a sell-on-rise market, but all that got whipsawed in a flash with the kind of moves we have seen of late.

The FII buying has been a contributory factor, no doubt, in the upmoves. But Jeffries threw some cold water on that front, stating that valuations are back to being expensive (now at 23x) after the recent rise. Will that deter the FII inflow? We need to wait and see.

Good activity is seen in the small- and mid-cap space, though, as people scramble to get on board what seems like a missed rally. FOMO is creeping up. Is that warranted? Well, maybe. Since the market just shrugged off the Trump tariff business earlier (Nov. 7) and then dismissed the war matter also in a single session (May 9), we have to presume that it is simply not interested in going lower.

So, in all probability, we can take the bottom as being the April 7 low in most cases. With that as a background and the fact that a lot of people are still sitting on cash, it does seem like some FOMO is upon us. If the fund-based buying continues (both FII and DII), then this may even become more pronounced ahead. The results flow is now about to abate, and it has not soured the sentiments any, as far as I can see.

Chart 3 is the small-cap index where the moves are not yet very large (like in Bank Nifty), and with some breakouts seen above Gann angle lines, we could probably see some action.

Spoiler alerts usually have been emerging from the US and the White House. The retreat on China and a possible deal with the UK rumoured last week, markets are poised to receive the news well. This will quickly translate more into specific stocks and sectors than get concentrated on the indices. A simple example is how Tata Motors, which was skidding, made a strong rally when the rumours of a UK deal emerged. There shall be many such examples, and so one may have to be on the lookout for news and market reaction to news to grab those opportunities.

The US 10-year yields hold the key to those signals. But the chart (see chart 4) is simply not too clear.

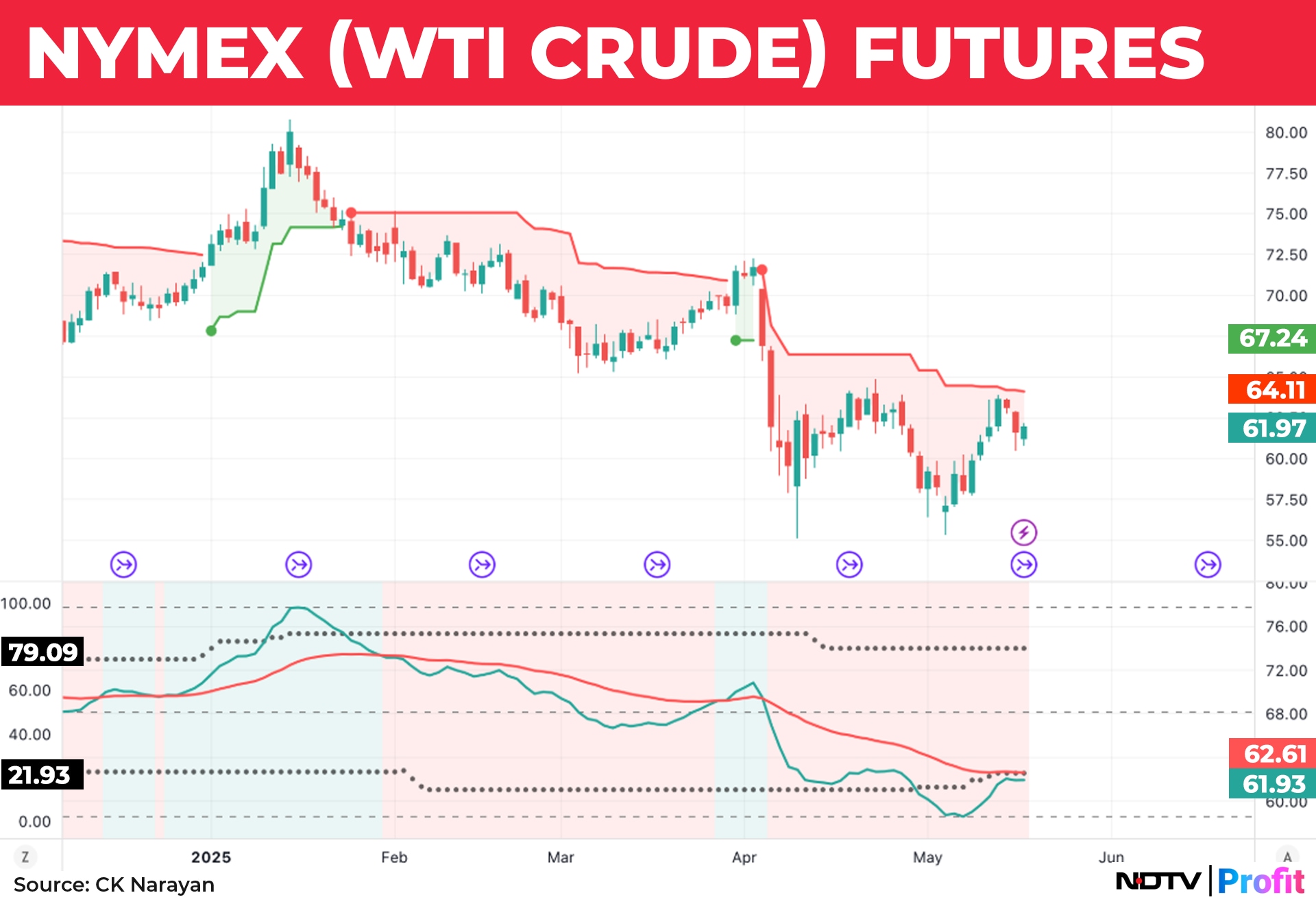

It is caught in a maze of Gann angles, and the momentum too is fizzling out near 4.4%. The odds that it would make it to 4.6% or break below 4.38 appear to be equal. So, it is wait-and-watch time for now. We may therefore focus on our own news for a while, and this could mean stock-specific action for the week ahead. The Dollar Index (DXY) is also struggling to get back on its feet after breaking below the 100 level a while ago. Indicators are oversold, but it may take effort to get the dollar back into a bull mode. So, nothing untoward may emerge from this area for now. Chart 5 is crude oil futures.

It tried to rally up but couldn't work up any fresh momentum and failed at the trailing ATR level. The oscillator too is seen struggling, albeit at oversold. Can be expected to fall afresh, especially if the Iran sanction removal thing gains currency and new supply suddenly emerges into the market. This can be index-moving news. OMC stocks will do well too, and they are already well positioned on the charts too. Take a look at them for some plays.

Summing up, it seems like index plays may be about to reach some resistances higher if they keep up, and I have mentioned the levels above. The immediate time count is on May 26, and following that would be June 2nd. FII inflow continues and can be a factor for more gains provided valuations don't suddenly become an issue once again. Earnings season has repaired sentiments a tad and may now lead to stock and sector-specific action. Inflation numbers, etc., are all coming in ok and may pave the way for another rate cut soon. That can be a fresh positive too.

People sitting on cash are slowly getting into FOMO status, and this may lead to some buying briskness, an example of which was seen in the defence stocks over the last couple of weeks. Would railway stocks be the logical next? Or other PSU? Banks may take a rest, IT may become selective, metals could make a comeback and autos may see some selective buying.

Time to be active in the market in the coming week.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.