Indian equities started the week off on a strong note, with the Nifty 50 index advancing 0.7 percent on Monday, to inch closer to the 9,000-mark. There was, however, little change in its March futures open interest.

Similarly, the Nifty Bank index too advanced 0.8 percent in trade but with marginal changes in its futures open interest. Foreign institutional investors (FII) sold index futures worth Rs 327 crore on a net basis.

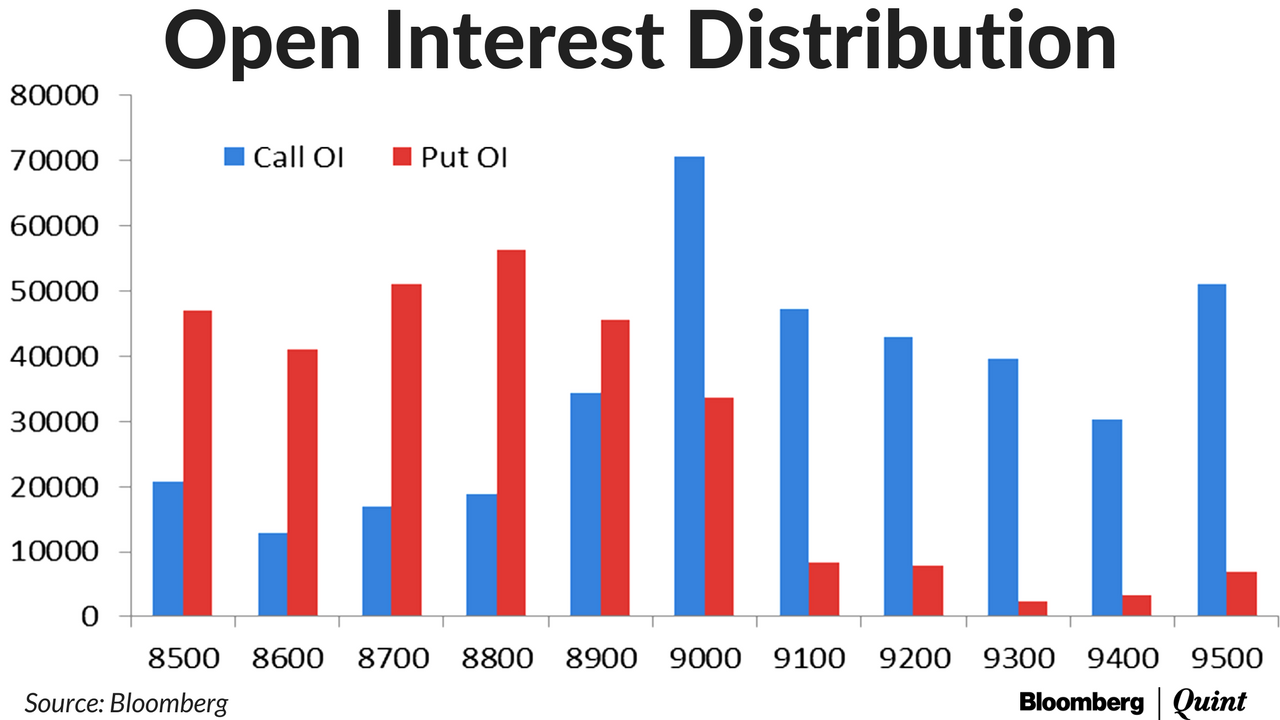

The India Volatility Index (VIX) gained over 2 percent to close at 13.64 to indicate expansion in option contracts. As the Nifty advanced, there was more writing witnessed in the 9,100 and 9,200 call contracts. Maximum open interest remained with the 9,000 call and 8,800 put to indicate a near term range for the Nifty.

FII activity was subdued in options trade as they bought 960 index call contracts and 1,341 index put contracts on a net basis.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.