Nazara Technologies Ltd. on Monday announced that it will raise Rs 495 crore via preferential issue of shares. The shares will be allocated to Axana Estates LLP at an issue price of Rs 990 apiece, which is a 5% discount to the current market price.

The prominent player in the gaming industry will allot 50 lakh shares to Axana Estates, according to the exchange filing. Mithun Sacheti, Siddhartha Sacheti, Yash Sacheti and Arpit Khandelwal are the partners of Axana Estates.

After the issuance of shares Axana Estates will hold 5.4% stake in the gaming company. Arpit Khandelwal is already a shareholder of the company and holds 8.1% stake as of December 2024. Additionally, Khandelwal through Plutus Wealth Management LLP owns 11.82% stake in the company.

This indicates that the preferential issue might trigger an open offer as Arpit Khandelwal in total owns over 25.3% stake.

In addition, the board of directors on Monday increased the limits to provide loans, give guarantee or provide security to Rs 3,500 crore from the earlier Rs 2,931.51 crore.

The board has also approved the acquisition of all intellectual property rights including trademarks, software, gaming works and related assets, pertaining to the mobile game applications titled 'CATS: Crash Arena Turbo Stars' and 'King of Thieves' from Zeptolab UK Ltd. The acquisition will be for Rs 66.59 crore.

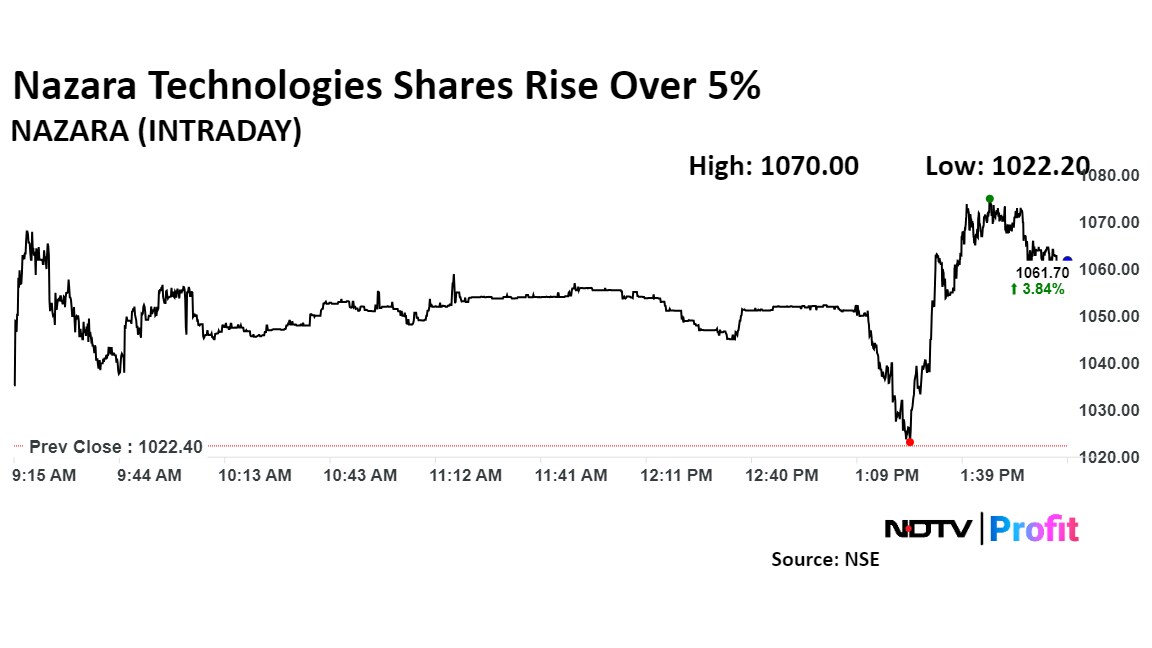

Nazara Technologies Shares Rise Over 5%

The shares of Nazara Technologies rose as much as 5.14% to Rs 1,075 apiece, the highest level since Jan. 10. It pared gains to trade 4.04% higher at Rs 1,063.75 apiece, as of 2:05 p.m. This compares to a 0.62% advance in the NSE Nifty 50 index.

It has risen 15.27% in the last 12 months. Total traded volume so far in the day stood at 5.5 times its 30-day average. The relative strength index was at 62.

Out of 11 analysts tracking the company, six maintain a 'buy' rating, one recommends a 'hold,' and four suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 6.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.