- Nazara Tech shares fell 11% intraday on Thursday after a 15% drop on Wednesday

- Nazara Tech's Nitish Mittersain has said that the bill challenges Pokerbaazi's business model

- Pokerbaazi accounts for nearly 35% of Nazara's enterprise value

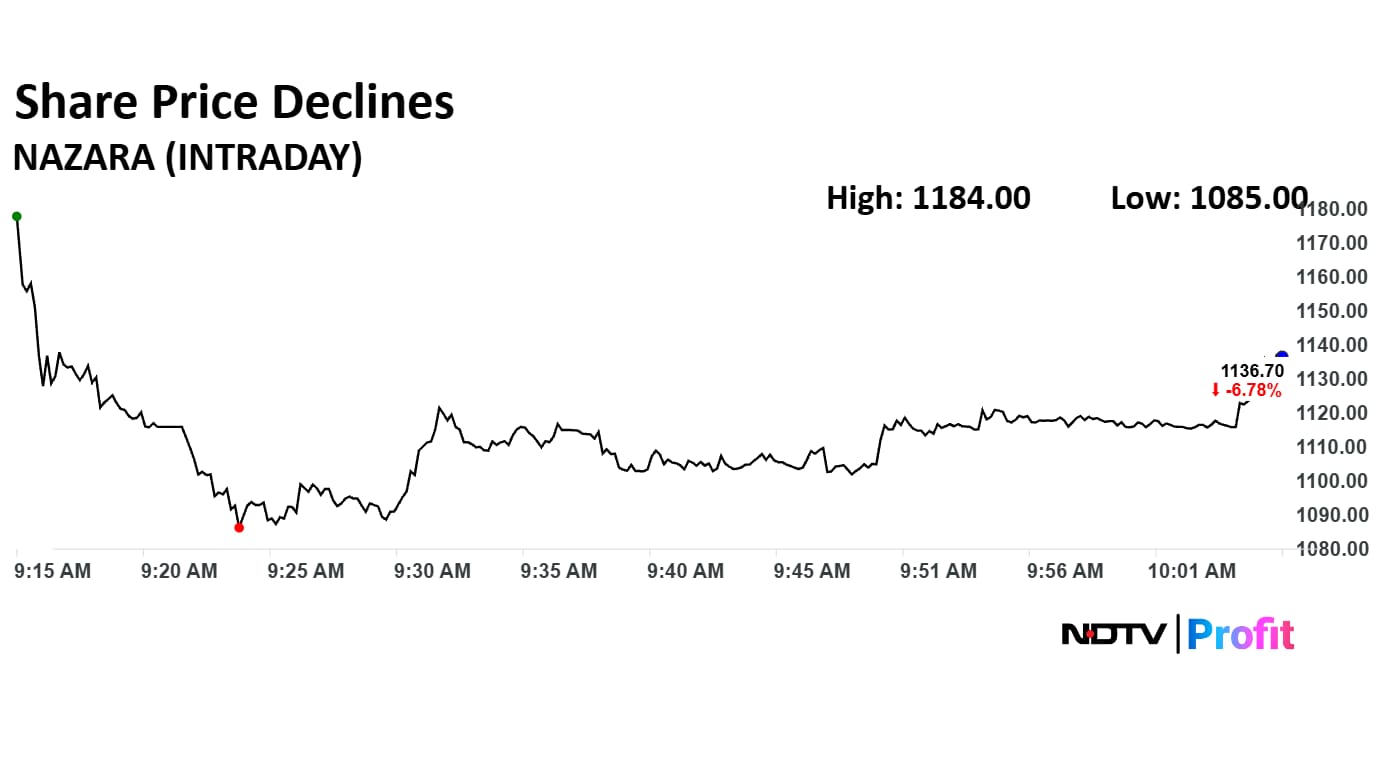

Nazara Tech share price declined 11% at intraday on Thursday after it fell over 15% on Wednesday following central government's proposal for a sweeping ban on all money-based online gaming transactions. Cumulatively, the stock is down 20% as of 09:42 a.m. in the last two trading sessions.

The decline comes after Nazara Tech's Nitish Mittersain said that the proposed online gaming bill could pose some challenges to the current operating model of Pokerbaazi in India, "We will figure out how to adapt the business going forward," he told NDTV Profit.

However, the firm had earlier clarified that it has no direct exposure to real money gaming businesses. Nazara Tech, via an exchange filing on Wednesday, said that the contribution to revenue and Ebitda by real money gaming business is nil. They stated that the company's only indirect exposure to RMG is through its 46.07% stake in Moonshine Tech.

But, late Wednesday afternoon brokerage Prabhudas Lilladher flagged risks to Nazara Technologies' investment in PokerBaazi and said PokerBaazi contributes nearly 35% to Nazara's sum-of-the-parts enterprise value.

The scrip fell as much as 11.02% to Rs 1,085 apiece, It pared losses to trade 8.42% lower at Rs 1,116.70 apiece, as of 10:05 a.m. This compares to a 0.33% advance in the NSE Nifty 50 Index. It has risen 15.46 % in the last 12 months. Total traded volume so far in the day stood at 12 times its 30-day average. The relative strength index was at 21.

Out of nine analysts tracking the company, three maintain a 'buy' rating, two recommend a 'hold,' and four suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 17.5%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.