Aaron Industries Ltd., a manufacturer of elevator products, has seen its stock surge over 2,200% since listing. The company's board on Wednesday has approved the issuance of bonus equity shares in a 1:1 ratio.

"The board has considered and recommended the issue of bonus shares in the ratio of 1:1 i.e. one new fully paid-up bonus equity shares of Rs 10 each for every one existing fully paid up equity shares of Rs10 each held by the eligible shareholders on the record date," as per an exchange filing on Wednesday.

The issuance of bonus shares is subject to the approval of shareholders at the ensuing annual general meeting of the company and any other applicable regulatory and statutory approvals.

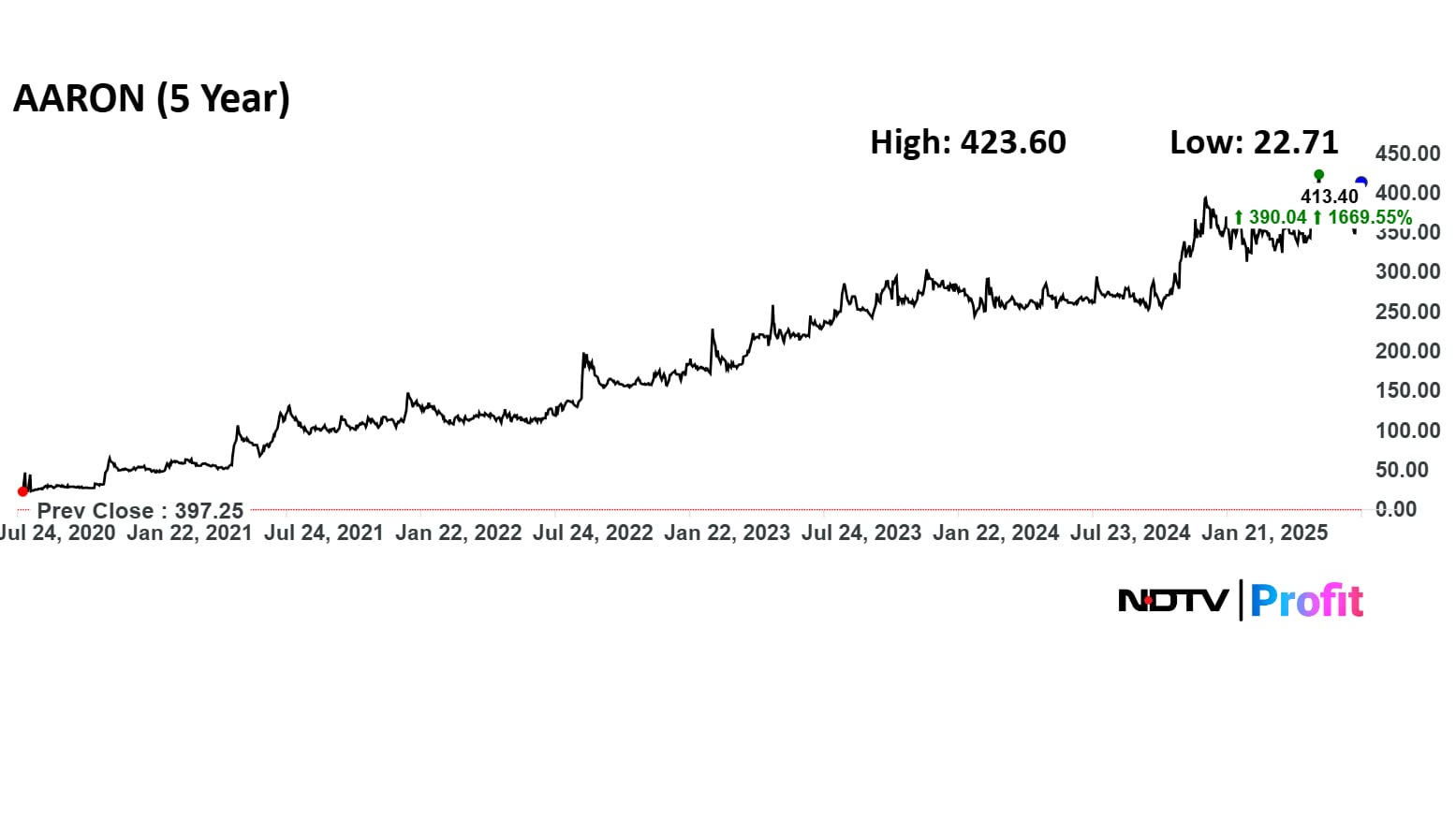

Aaron Industries Share Price Since 2020

The company went public in August 2018, and since then has run up Rs 2,214%. It was first listed on the NSE SME platform, and then went mainboard in November 2020.

In the last five years, the stock's share price had hit a low of Rs 22.71 in July 27, 2020, before it saw a steady climb through the years ahead. The scrip's five year high was Rs 423.60 in May 23, 2025.

Share Price Today

Shares of Aaron Industries rose as much as 6.97% to Rs 424.95 apiece. They pared gains to trade 4.29% higher at Rs 414.30 apiece, as of 12:15 p.m. This compares to a 0.43% advance in the NSE Nifty 50.

The stock has risen 58.60% in the last 12 months and 16.84% year-to-date. Total traded volume so far in the day stood at 0.02 times its 30-day average. The relative strength index was at 63.30.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.