A month and a half after it downgraded the Indian markets, Morgan Stanley said the outlook for domestic stocks has improved even as volatility persists.

The recent correction was sizeable, especially at the stock level, and has led some of the research firm's leading indicators, which were in the 'sell' zone in early October, to the 'buy' zone, Morgan Stanley said in a Dec. 8 report.

India appears to be in a structural uptrend with a likely new profit cycle, supportive policy, likely rise in fixed income flows, new issuances and falling return correlations with the world, it said.

Morgan Stanley, however, retained India's rating at 'equal-weight', after having downgraded the domestic market from 'overweight' on Oct. 27, citing high valuations and Fed taper fears. Some of these concerns still persist.

The benchmark Sensex is still about 5% below its October peak after the recent pullback. Morgan Stanley cited the U.S. rate cycle, oil prices, elections, a potential third wave of Covid-19, higher domestic rates, rich headline valuations and strong relative trailing performance as some of the challenges.

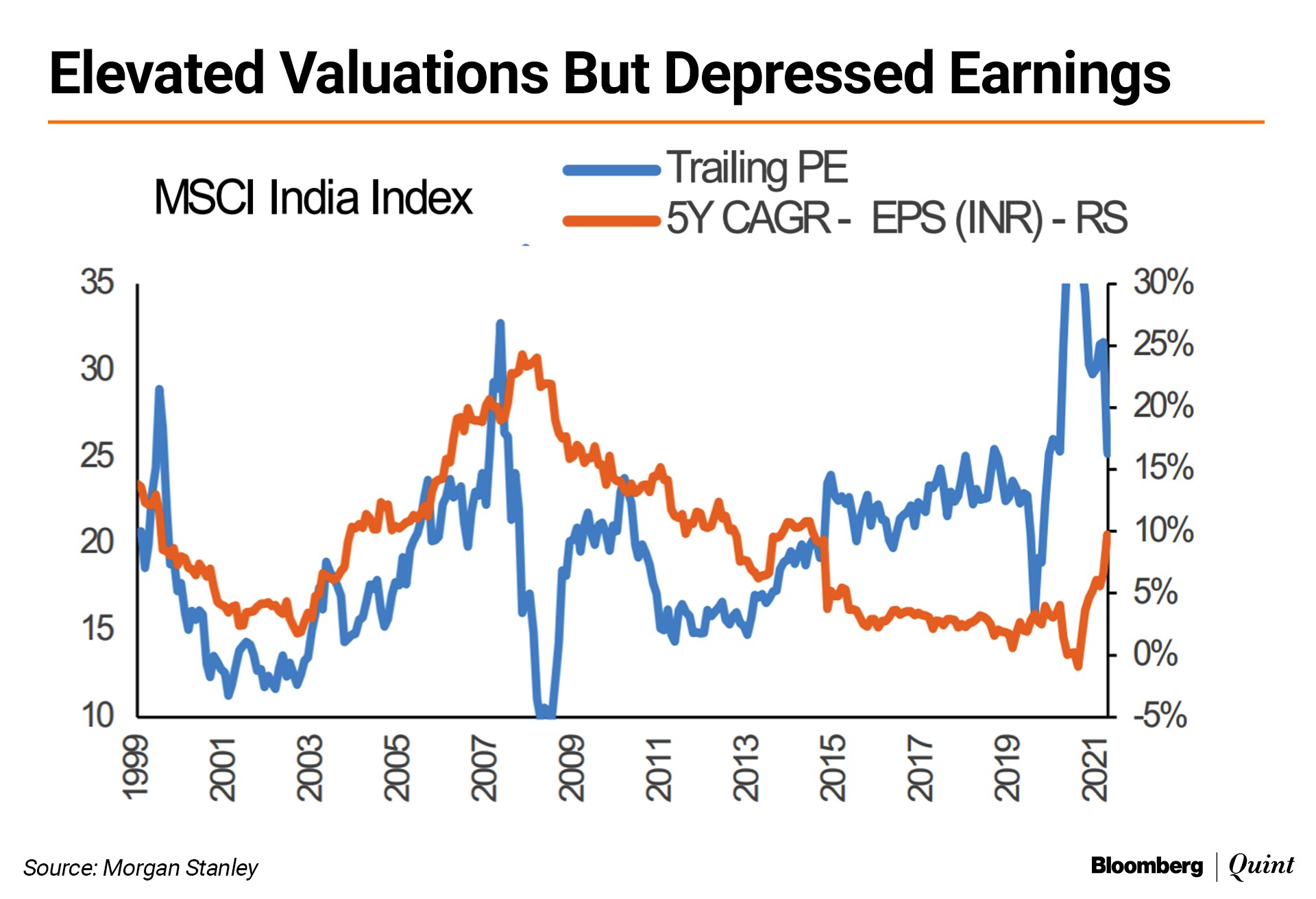

The market is trading at the top end of its relative valuations to emerging market peers, the report said. And volatility is slated to rise, especially in the broad market, amid higher valuations and more event risks on the horizon, it said.

Still, while headline valuations look rich, they must be seen in the context of depressed long-term earnings. "We expect earnings to compound 27% annually over the next couple of years and the Sensex to rise 21% in our base case to 70,000 (December 2022), suggesting that index returns are likely to trail earnings growth in 2022."

Stronger earnings in the second half of the year, fiscals 2023 and 2024 will prove to be a catalyst in achieving targets, it said. India's inclusion in the bond index, a Bharatiya Janata Party win in the upcoming UP elections and rising capex is also likely to spur growth, the report said.

The research firm's key macro themes include a strong pickup in consumption, normalisation of the RBI policy and rising share of manufacturing in GDP. "We are backing financials, cyclical consumption and industrials. We are relatively cautious on export sectors."

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.