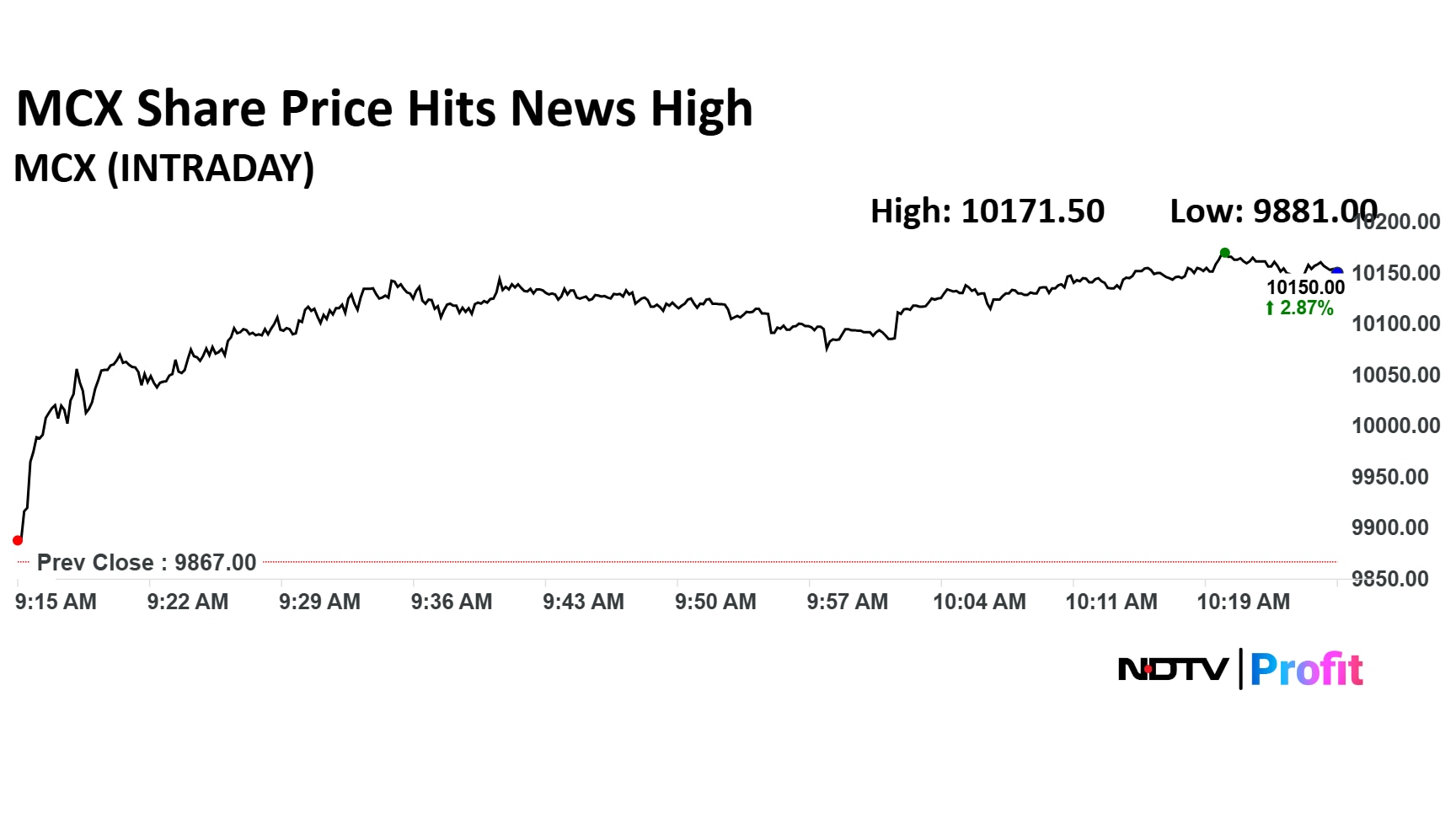

- Multi Commodity Exchange share price hit a new high above Rs 10,000 for the first time

- The stock gained 3.09% to Rs 10,171.50, outperforming the NSE Nifty 50 index

- MCX reported a 0.8% quarterly rise in EBITDA to Rs 244 crore with steady profit margins

Multi Commodity Exchange of India Ltd. share price scaled a fresh high in Wednesday's session. The share price rose for the third day in a row and crossed Rs 10,000 mark for the first time.

India's leading commodity derivatives exchange outperformed most peers in the exchange space in 2025 as yet, despite the hurdles. It has given 123% return from lows compared to the 126% gain BSE Ltd. provided.

The technical glitch overhang is seems to be over for now. The business growth outlook also looks bright, which also supported the stock's recent rally.

Track live updates on stock markets here.

Multi Commodity Exchange share price rose 3.09% to a new high of Rs 10,171.50 apiece. The stock was trading 3.04% higher at Rs 10,159 as of 10:29 a.m. as compared to 0.71% advance in the NSE Nifty 50 index.

The stock advanced 68.69% in 12 months, and 63.14% on a year-to-date basis. Total traded volume on the National Stock Exchange so far in the day stood at 0.60 times its 30-day average. The relative strength index was at 71.47, which implied the stock was overbought.

Out of 11 analysts tracking the company, five maintain a 'buy' rating, four recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 0.6%.

What's Driving The Rally?

Multi Commodity Exchange of India reported strong operational numbers for July–September. The exchange reported that Ebitda rose 0.8% on the quarter to Rs 244 crore versus Rs 242 crore.

Despite a marginal growth in topline, Multi Commodity Exchange of India kept its profit margin steady at 65.1% versus 64.8%.

Currently, Multi Commodity Exchange is handling 1,000 crore orders per day. Bullion and metal segments contributed the most to the commodity exchange's growth. The company also saw that retail participation has grown.

Multi Commodity Exchange of India launched electricity futures which will gain traction in upcoming two-to-three years.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.