Shares of Max Estates Ltd. rose nearly 10% as its subsidiary Max Estates 128 Pvt., secured pre-sales bookings worth Rs 845 crore within the first week of launching Phase II of Estate 128 in Noida. The second phase includes the launch of the fourth tower.

The pre-sales bookings have exceeded the company's expected target of Rs 800 crore, according to an exchange filing. With this, the total booking value for the Estate 128 community has now reached approximately Rs 2,700 crore.

In the first nine months of the financial year 2025, the company has achieved a booking value of around Rs 5,000 crore. This includes the second phase of Estate 128 as well as Estate 360, a residential project recently launched by Max Estates in Gurugram. Max Estates noted that this performance is in line with its full-year guidance of Rs 4,800-5,200 crore.

"The net price realization in Phase II is at a 40%+ premium to that of Phase I,...... We are very confident in our ability to continue scaling by adding at least 3 million sq. ft. every year to our current portfolio and further diversifying our footprint in Delhi NCR across commercial and residential asset classes,” said Rishi Raj, chief operating officer at Max Estates.

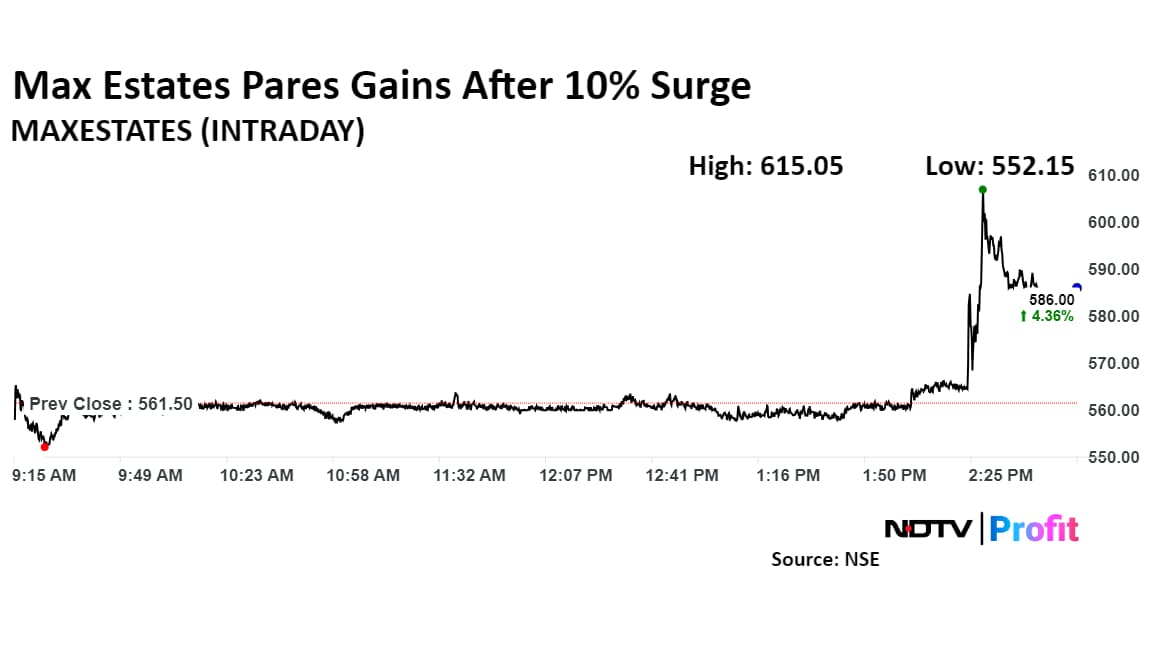

Max Estates Shares Up Nearly 10%

Max Estates shares rose as much as 9.54% to Rs 615.05 apiece, the highest level since Dec. 23. The stock pared gains to trade 4.18% higher at Rs 584.95 apiece, as of 2:55 p.m.

It has risen 83.11% in the last 12 months and 84.38% year-to-date. Total traded volume so far in the day stood at 3.9 times its 30-day average. The relative strength index was at 52.

Both the analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 19.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.