Maruti Suzuki India Ltd. share price erased losses ahead of the company revealing its first electric vehicle at Bharat Mobility Expo 2025. It will tease the eBorn, an electric version of the Vitara model at the show at Expo Centre, Greater Noida.

Maruti Suzuki India has manufactured the e Vitara on HEARTECT–e platform, which is specially designed for battery electric vehicles. The vehicle is equipped with state of the art technology and advanced safety features. The vehicle is expected to offer superior driving experience, Maruti Suzuki India said in the exchange filing.

The e Vitara is a global model manufactured in India to be sold across the world, Suzuki Motor Corp. said in Milan, Italy.

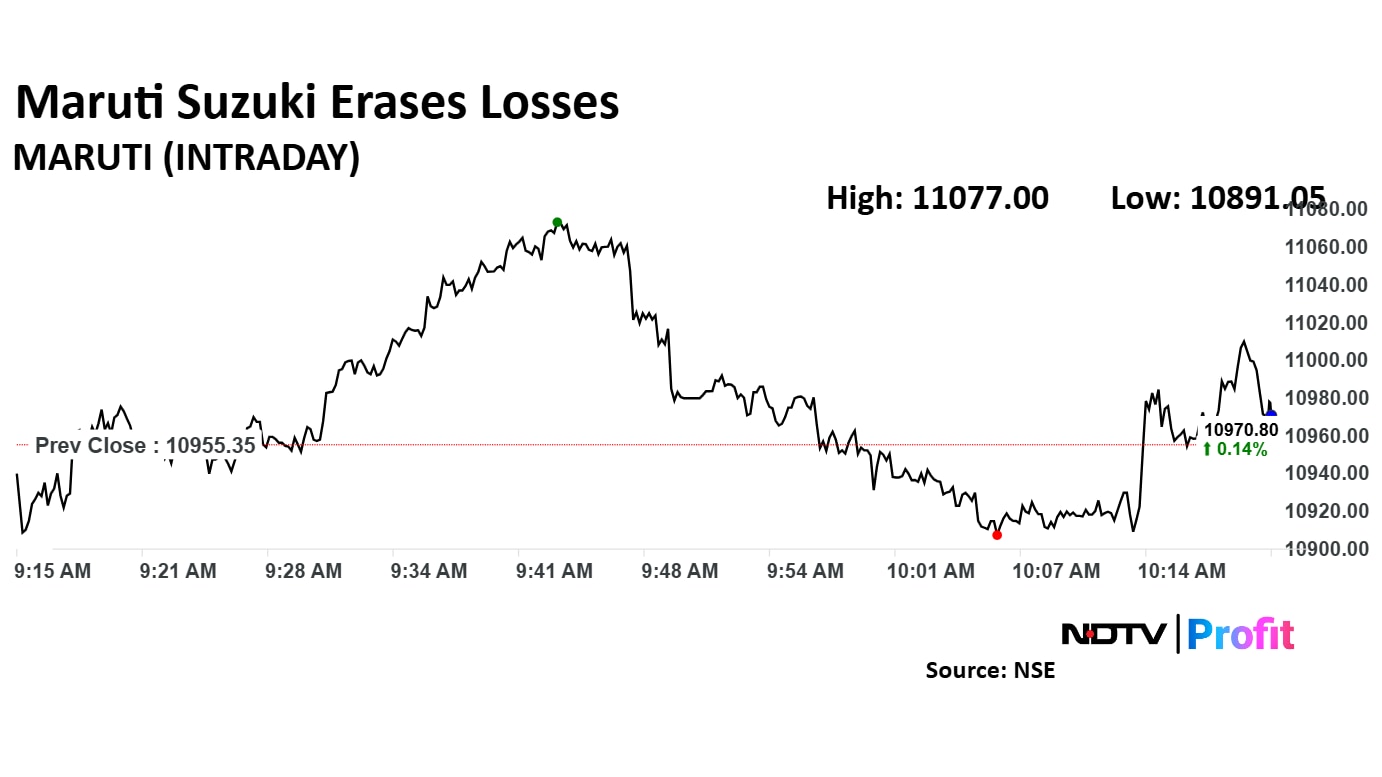

Maruti Suzuki India Share Price

Maruti Suzuki India share price declined 0.59% to Rs 10,891.05 apiece. However, after the announcement, it erased all losses to trade 0.54% higher at Rs 11,014.55 apiece as of 10:37 a.m., as compared to a 0.08% decline in the NSE Nifty 50.

Maruti Suzuki shares opened 0.14% down at Rs 10,940.00 apiece on Friday. It rose 1.11% to the day's high of Rs 11,077.00 apiece.

The stock also snapped a three–day losing streak. It gained 9.26% in 12 months, and 7.04% on year-to-date basis. Total traded volume so far in the day stood at 0.22 times its 30-day average. The relative strength index was at 42.27.

Out of 49 analysts tracking the company, 35 maintain a 'buy' rating, 11 recommend a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 20.0%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.