Mankind Pharma Ltd.'s share price declined more than 5% during early trade on Friday after the company's third-quarter results showed the consolidated net profit fell, missing analysts' estimates.

The company posted a net profit of Rs 380.2 crore in the third quarter as compared to Rs 453.8 crore in the year-ago period, a fall of 16%. Analysts tracked by Bloomberg had estimated a net profit of Rs 470 crore.

The decrease in the bottomline was led by a jump in finance cost of the company. The finance cost increased 24 times due to acquisition of BSV.

Revenue from operations rose 24% to Rs 3,230 crore, driven by continued outperformance in Chronic, strong recovery in OTC and consolidation of Bharat serums and vaccines. The Bloomberg estimate was Rs 3,180 crore.

Market share for Mankind Pharma grew from 4.4% in March 2024 to 4.8% in December 2024, driven by the BSV acquisition and strong leadership in the gynecology segment.

The company's consumer healthcare business saw strong revenue growth of 30% YoY, supported by steady growth across all key brands.

Exports saw a revenue growth of 121% YoY, driven by increase in the base business supported by new launches in last 12-24 months and consolidation of BSV.

Company executives are due to address analysts on a post-earnings conference call around noon. Performance review and guidance for the year will be closely tracked.

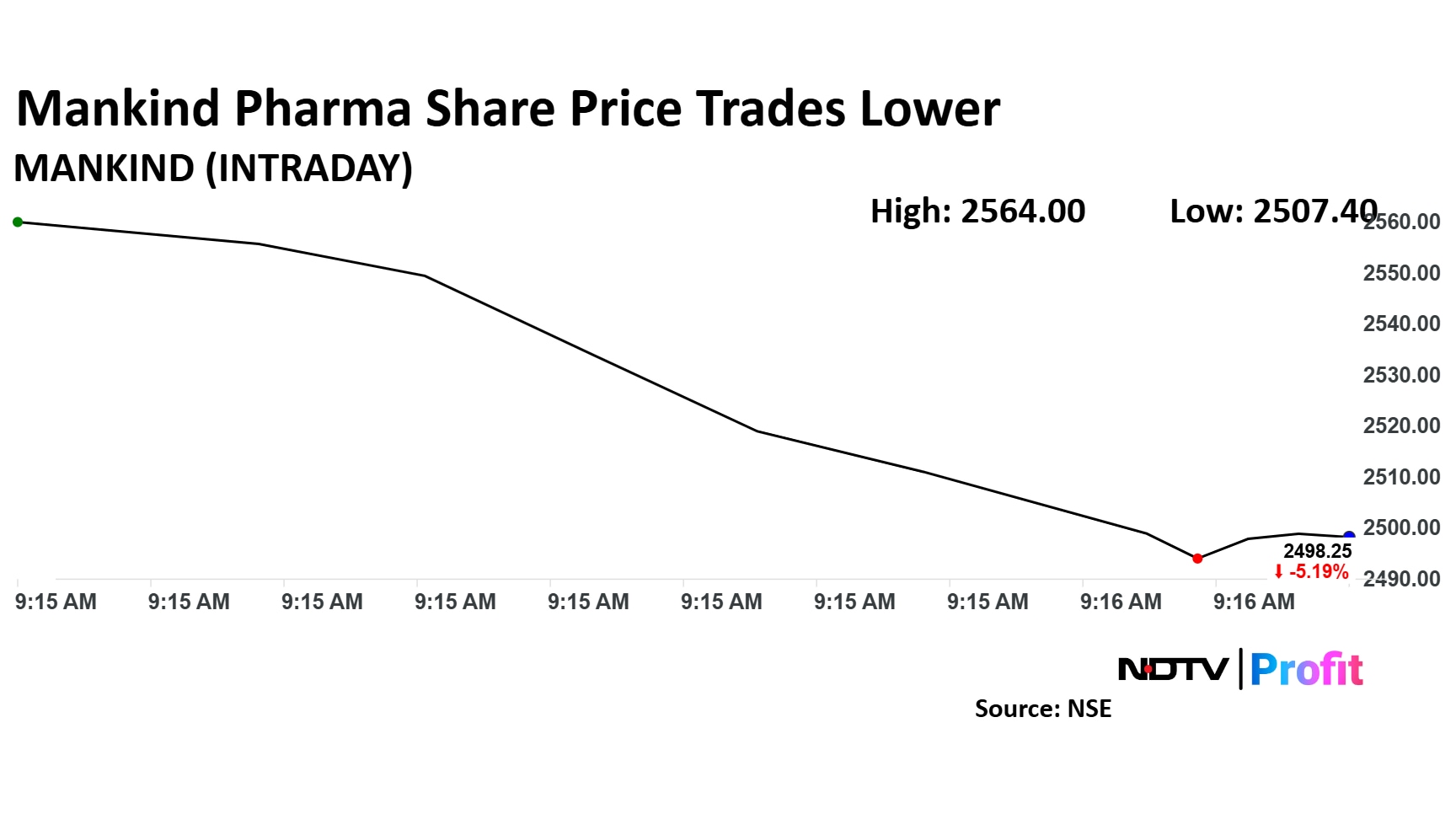

Mankind Pharma Share Price Movement

Mankind Pharma share price declined 5.2% to Rs 2,564 apiece soon after market open. The benchmark NSE Nifty 50 was up 0.25%.

The stock has risen 24% in the last 12 months. The relative strength index was at 50.

Twelve out of 16 analysts tracking Mankind Pharma have a 'buy' rating on the stock, two recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price target of Rs 2,884 implies a potential upside of 9.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.