Manappuram Finance Ltd.'s share price rose over 3% during the day after the Reserve Bank of India lifted restrictions on its unit Asirvad MFI.

Asirvad MFI had been restricted from sanction and disbursement of loans effective Oct. 22, 2024. After this anticipated move from the RBI, Morgan Stanley remained 'equal weight', while Jefferies increase its target price on the stock.

Jeffries On Manppuram Finance

Jeffries had largely expected the removal of the ban. MGFL's valuation seems attractive, but near term earnings drag, as stress in MFI portfolio can weigh on valuations, according to the brokerage.

It has retained a 'hold' rating. The removal of ban is a major relief for MGFL, but Jefferies sees subdued disbursement in the near term, given stress in MFI sector and tighter guardrails imposed by MFIN.

At 0.9 times book value, Asirvad constitutes around Rs 20 of MGFL's share price. This move of the RBI was expected, following the recent removal of ban on Navi and Arohan, Jefferies said.

This is largely reflected in the rebound in share price to current pre-ban levels at 0.9 times financial year 2026 consolidated.

MGFLs valuation appears attractive, according to Jefferies, but concerns around near term pressure on consolidated earnings due to stress in non-gold portfolio may weigh on valuations.

The brokerage maintains earnings estimates and increased the target price to Rs 190 from Rs 167, based on the 0.9 times consolidation in December 2026 book value.

Morgan Stanley On Manapuram Finance

The brokerage had assumed up to 10% provisions for the MFI loan book owing to the embargo. It removed the valuation assigned to Asirvad MFI in its SOTP valuation.

The brokerage now awaits management guidance on the pace at which it expects disbursements to pick up, revised to lowered loan pricing, and underwriting norms.

"This will drive the brokerage's assumptions of loan growth, margins, credit costs, and structural profitability for the MFI business—and potentially its valuation," they said. MNFL stock has rallied 29% from its low in Oct. 22, 2024, against 3% for the Sensex.

The stock is flat compared to the level prior to the restrictions and the brokerage remains 'equal weight'.

Manappuram Finance Share Price

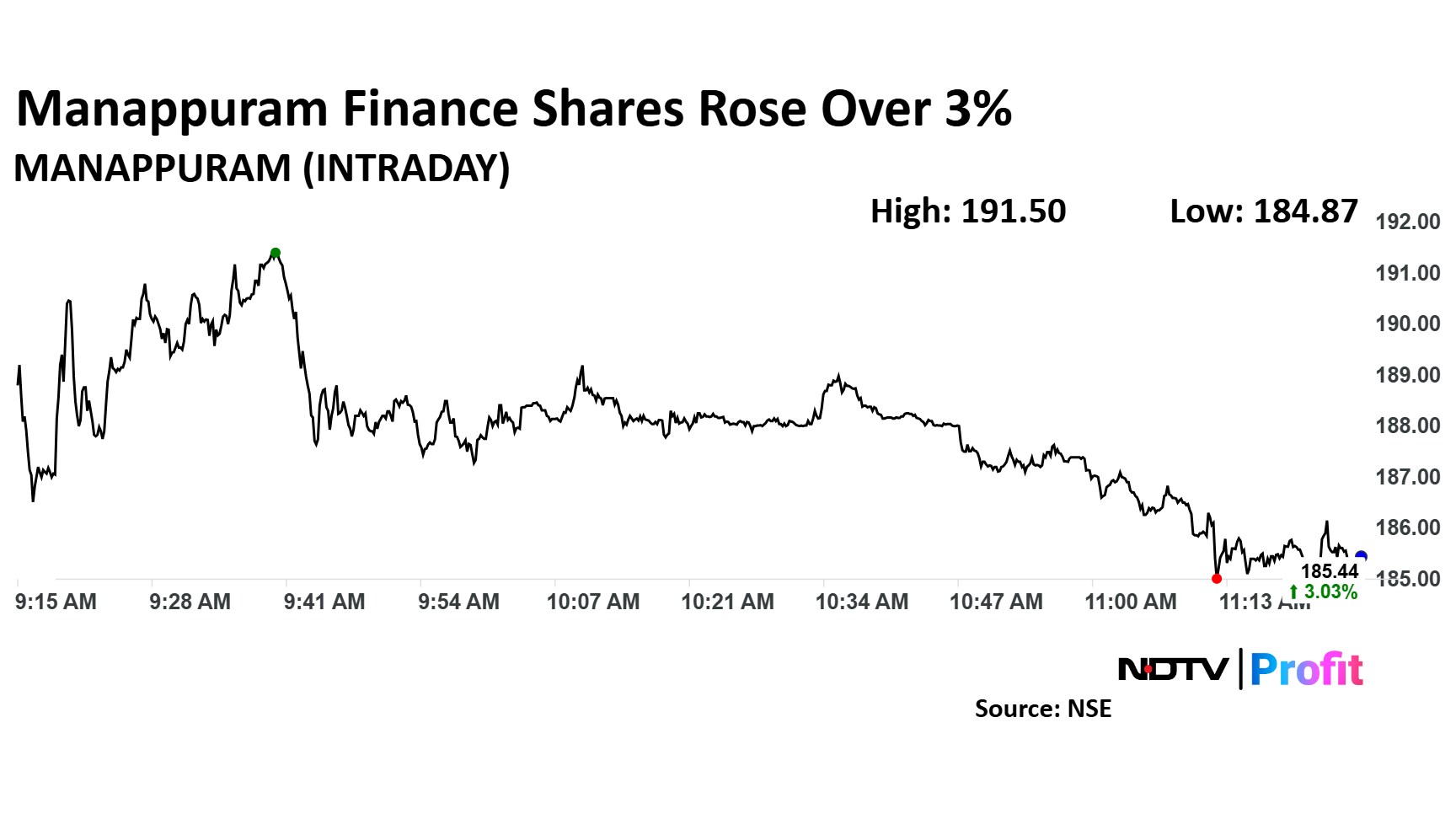

Manappuram Finance stock rose as much as 6.40% during the day to Rs 191.50 apiece on the NSE. It was trading 3.06% higher at Rs 185.49 apiece, compared to a 0.51% decline in the benchmark Nifty 50, as of 11:19 a.m.

It has risen 4.89% in the last 12 months. Total traded volume so far in the day stood at 6.2 times its 30-day average. The relative strength index was at 57.2.

Eight of the 16 analysts tracking the company have a 'buy' rating on the stock, six recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 185.80, implying a downside of 0.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.