Shares of Manappuram Finance Ltd. rose, extending gains for the eighth day on Monday, after Morgan Stanley increased the target price for Manappuram Finance from Rs 180 to Rs 220, following Bain Capital's proposal to become a promoter of the company.

While the strategic shift is expected to bring positive changes, there is not enough information yet to fully assess how this will impact the company's near-term performance, the brokerage said in its note.

Morgan Stanley has updated its scenario-based valuations for Manappuram. The revised base price target takes into account a discount on the open offer price (~14%) for a six-month period, which is typical for such transactions.

With management changes and new strategic plans being introduced, clarity on the company's future earnings will take time. In the meantime, investors are likely to focus on the existing gold loan business and rely on trailing financials.

After Bain Capital's announcement, the stock price increased by about 8%. Despite this, the stock is expected to remain close to the open offer price of Rs 236, until more clarity emerges on future earnings, Morgan Stanley said in its note on Sunday.

In a base case the stock is likely to trade around the open offer price of Rs 236, according to the brokerage. After applying a discount for equity costs, the base case price target is Rs 220.

In a bear case if the gold loan business underperforms, the stock could fall to Rs 130, which is close to the low seen after the RBI embargo on Asirvad MFI in October 2024.

According to the brokerage, in a bull case with a strong performance from the gold loan business, the stock could rise to Rs 275. Including the value of subsidiaries like MFI, HFC, and Insurance Broking, the bull case price target increases to Rs 320.

On Friday, Jefferies had also hiked the target price for the gold loan firm.

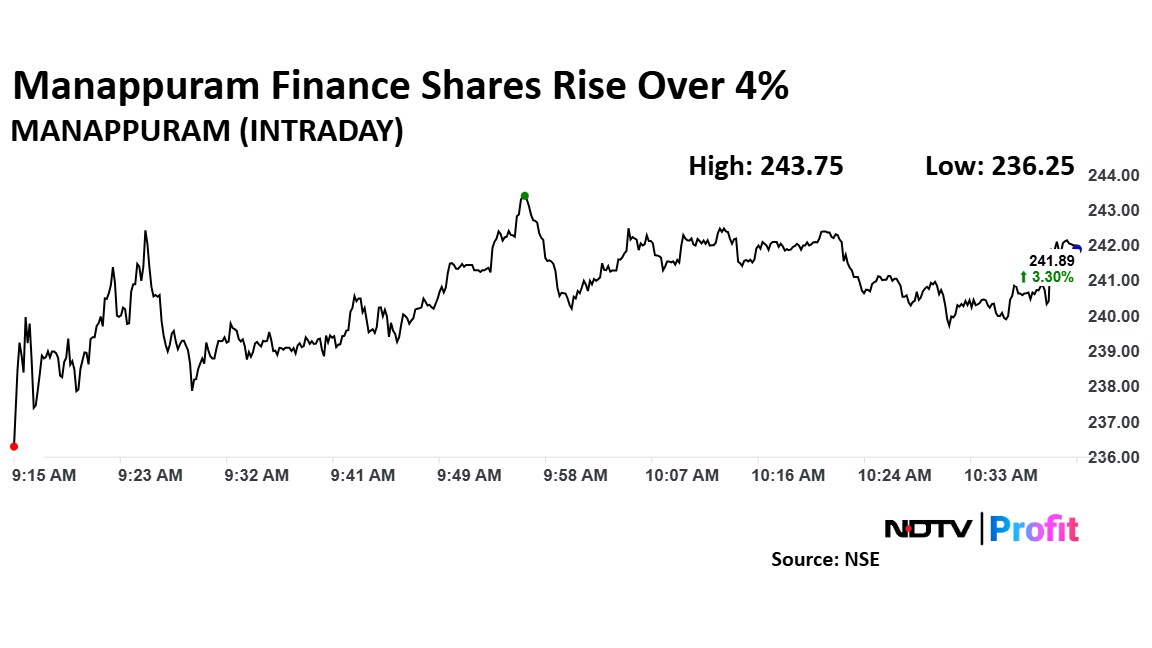

Manappuram Finance Share Price Rise

Shares of Manappuram Finance extended a winning streak for the eighth session, gaining nearly 17%. The shares rose as much as 4.10% to Rs 243.75 apiece on Monday, the highest level since March 21. They pared gains to trade 3.19% higher at Rs 241.64 apiece, as of 10:31 a.m. This compares to a 0.93% advance in the NSE Nifty 50.

The stock has risen 37.88% in the last 12 months and 26.08% year-to-date. The relative strength index was at 76, indicating it was overbought.

Out of 17 analysts tracking the company, nine maintain a 'buy' rating, six recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 7.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.