Mahindra & Mahindra Ltd.'s quarterly profit declined but managed to beat analysts expectations even as the automobile slowdown continues.

Net profit declined 24 percent year-on-year to Rs 1,355 crore in the July-September period, the Anand Mahindra-led company said in an exchange filing. That compares with Rs 1,128-crore consensus estimate of analysts tracked by Bloomberg. The financials include numbers of its commercial vehicle unit, Mahindra Vehicle Manufacturers Ltd.

The automaker's revenue fell 15 percent to Rs 10,935 crore—also in line with the Rs 11,330-crore estimate.

That's despite a decline in sales during the quarter. M&M sold 1.10 lakh units of passenger and commercial vehicles between July and September, a fall of 21 percent from the year-ago period, according to the company. Also, sales of tractors declined 6 percent year-on-year to 68,359 units during the period.

India's automakers are grappling with a prolonged slowdown, leading to inventory pile ups at dealerships and forcing companies to offer deep discounts and cut production. Also, consumers delaying purchase ahead of the implementation of the new emission standards from April next year hurt sales.

But last week, Group Chairman Anand Mahindra said the festive season sales were “very good” for the Mahindra Group.

The company's operating profit declined 17 percent over last year to Rs 1,542 crore. Analysts had estimated Ebitda at Rs 1,447 crore. The operating margin contracted 40 basis points to 14.1 percent—against a forecast of 12.8 percent.

The Indian auto industry is undergoing a challenging period with all industry segments declining for two consecutive quarters for the first time in the 15 years, the company said in a statement accompanying the filing.

Despite such a challenging environment leading to a volume drop in both its segments, the company with strong emphasis on cost management, ensured that the Ebitda drop was in line with the revenue decline.M&M's Media Statement

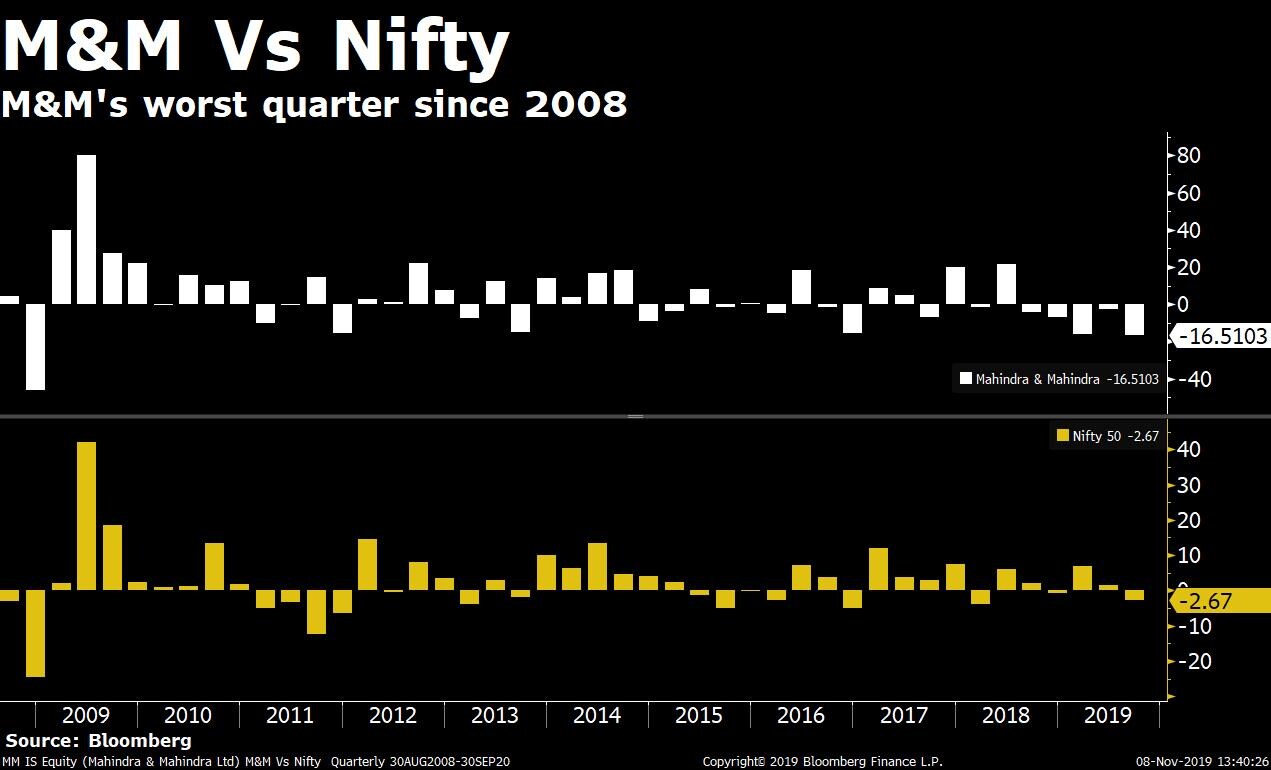

Shares of the Mahindra Group company rose as much as 2.8 percent after the earnings compared with a 0.35 percent fall in the Nifty 50 Index. The shares have declined 16.5 percent in the three-month period—its worst quarter since December 2008.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.