Share price of automaker Mahindra & Mahindra Ltd. was at a two-month high in early trade on Monday, after the company announced its acquisition of SML Isuzu Ltd. in a deal valued at Rs 555 crore.

Brokerages remain largely bullish on this development, with Citi and Investec maintaining their 'buy' call on the company, while Morgan Stanley issued an 'overweight' rating.

The Scorpio maker will pick up a 43.96% stake held by promoter Sumitomo Corp. and 15% from Isuzu Motors Ltd.—a public shareholder of SML Isuzu, according to an exchange filing on Saturday. Separately, M&M will make an open offer to buy 26% stake at Rs 650 per share.

The acquisition is an attempt to shore up presence in the over 3.5-tonne CV segment where M&M has 3% market share. The deal, M&M said, would double its market share to 6% immediately, with an aim to grow it to 10-12% by 2030-31 and more than 20% by 2035-36.

Mahindra Group sees the acquisition of SML Isuzu as a “significant milestone” in its vision of delivering five times growth in their emerging businesses, Chief Executive Officer Anish Shah said in a statement. “This acquisition is aligned with our capital allocation strategy for investing in high potential growth areas, which have a strong right to win and have demonstrated operational excellence.”

What Brokerages Say

Morgan Stanley holds that this is a small acquisition for M&M's size, and is positive on the business shift toward LCVs, which relatively has lesser emission and competitive headwinds as compared to SUVs.

Citi says that the acquisition provides avenues for some growth in the commercial vehicle market share. The cash consideration is unlikely to dent M&M's balance sheet, according to the brokerage. The deal valuation appears attractive, it added.

Investec also said the valuation was attractive.

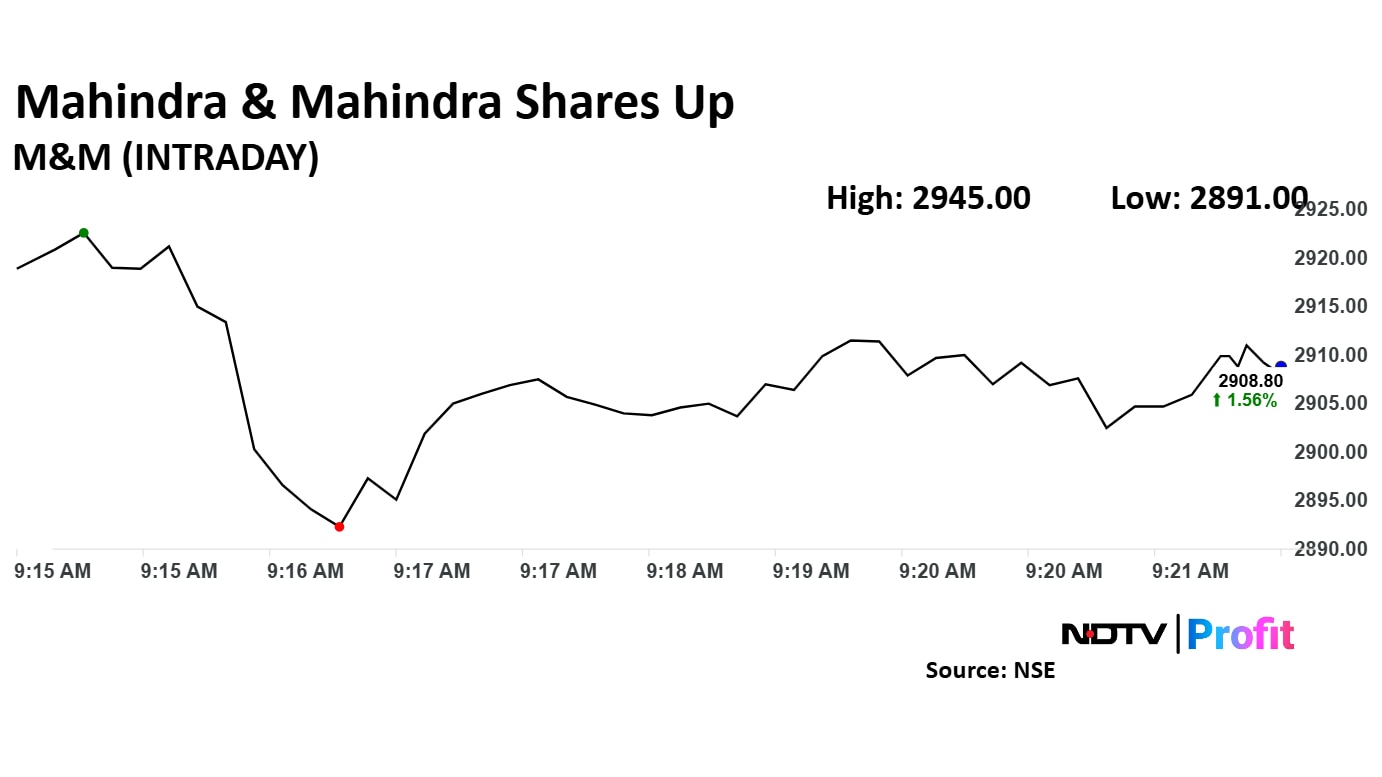

Mahindra & Mahindra Share Price Today

Share price of Mahindra rose as much as 2.82% to Rs 2,945 apiece, the highest level since Feb. 17. It pared gains to trade 1.49% higher at Rs 2,907 apiece, as of 09:25 a.m. This compares to a 0.13% advance in the NSE Nifty 50.

The stock has fallen 9.66% on a year-to-date basis, and risen 40.63% in the last 12 months. The relative strength index was at 64.03.

Out of 41 analysts tracking the company, 39 maintain a 'buy' rating, and two recommend a 'hold', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 17.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.