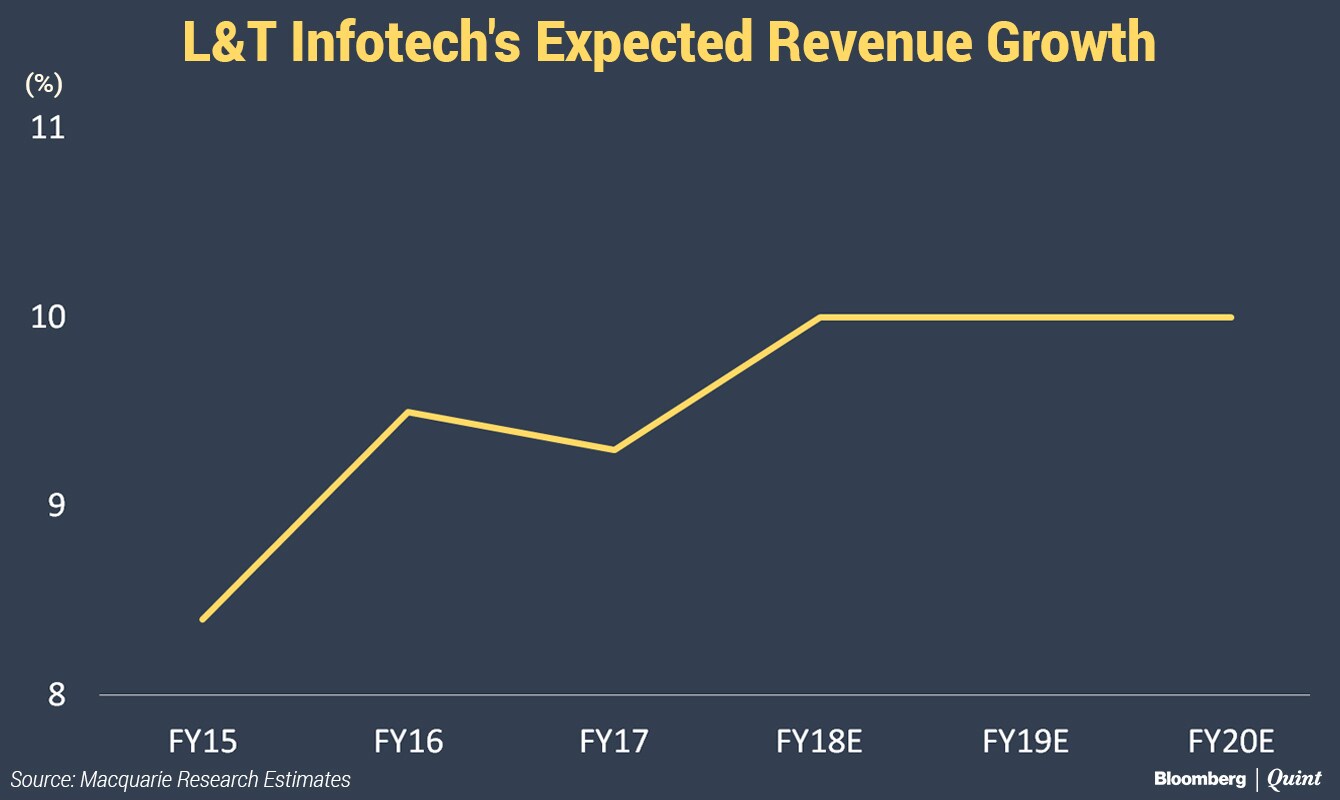

A stable client base and strong presence in the digital and analytics space will hold L&T Infotech Ltd. in good stead, said Macquarie. Larsen and Toubro Ltd.'s I.T. arm will grow at a compounded annual growth rate of 10 percent over the next three financial years, said the international brokerage house which initiated coverage on the company with an 'outperform' rating.

L&T Infotech has significant exposure to the banking, financial services and insurance (BFSI) vertical which grew at a faster pace than the overall revenue growth in the sector, said Macquarie.

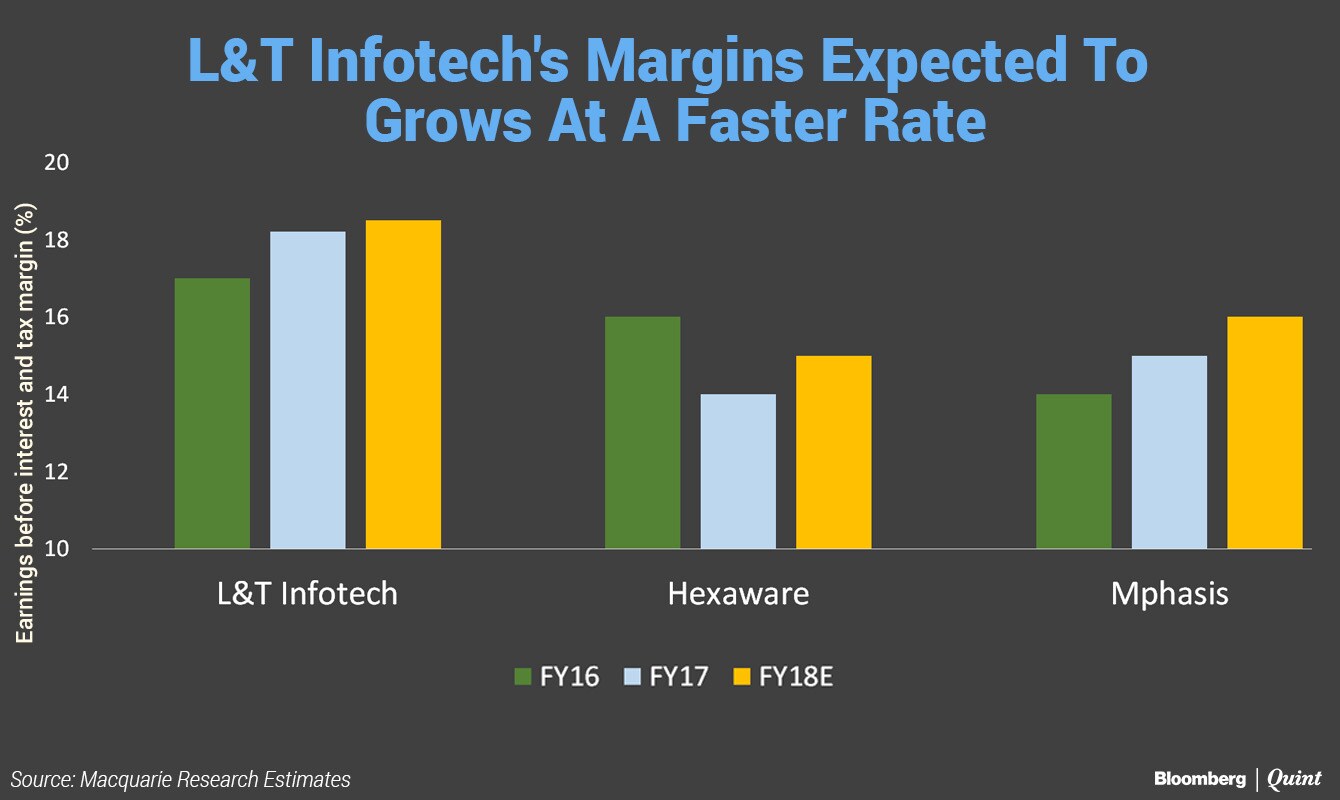

The technology company also has the highest earnings before interest and tax margin among mid-cap IT companies, is expected to maintain the range at 17-19 percent, according to the brokerage house.

Headwinds

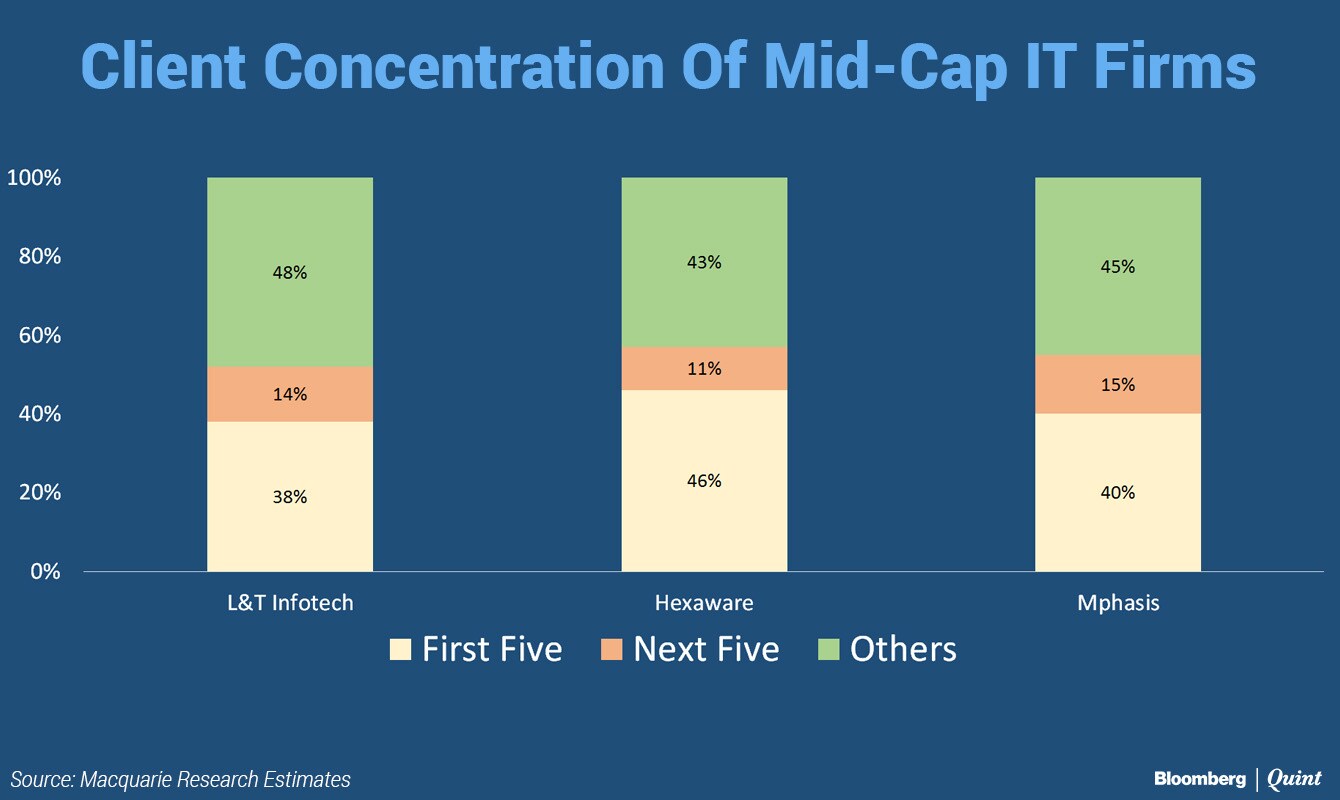

Client concentration and sharp fluctuations in the U.S. dollar are the two key risks for the company. 38 percent of its revenue comes from the top five clients.

Client-specific issues could translate to significant revenue headwind for the company.Macquarie Research

Macquarie expects every Re 1 change in exchange rate to impact earnings estimate by 2.5 percent.

Macquarie also expects L&T Infotech to step up its dividend payout ratio to pre-IPO levels of 60 percent. Going forward the company will focus on smaller acquisitions to augment growth to fill in gaps in capabilities and service lines.

The company also has the option of raising fresh capital as it needs to dilute L&T's holding to 75 percent by the end of financial year 2019-20. Currently, the parent company owns 84 percent stake and at current market price, dilution will boost company's cash balance by more than Rs 670 crore.

Macquarie Research has set a target price of Rs 920, which indicates a potential upside of 17 percent over the next year. The company is expected to give a total return of 70 percent, including dividend payout, over the next three years.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.