- Mahindra & Mahindra’s Q3 standalone net profit rose 33% to Rs 3,931 crore year-on-year

- Revenue grew 26% to Rs 38,517 crore, driven by increased sales after GST rate reductions

- Quarterly auto volumes increased 23% to 3,02,238 units, boosting SUV market share by 90 bps

Mahindra & Mahindra Ltd. reported strong profit and revenue growth in the third quarter of the current financial year, meeting street expectations, as buyers rushed to take benefit from reduced GST on cars.

Standalone net profit surged 33% to Rs 3,931 crore in the October-December quarter, compared to Rs 2,964 crore in the corresponding period last year, according to a stock exchange filing on Wednesday. Analysts' consensus estimates compiled by Bloomberg projected Rs 3,885 crore.

The company had to provision Rs 98 crore as a one-time cost due to the New Labour Codes.

Revenue from operations surged 26%, after growth dipped below 20% in the second quarter, indicating a pickup in sales after GST revisions. Prices of several Mahindra models were revised downwards following a new GST rate structure that kicked in late September.

M&M Q3 Results (Standalone, YoY)

- Revenue rose 26% to Rs 38,517 crore from Rs 30,538 crore (Bloomberg estimate: Rs 38,926 crore)

- Ebitda increased 20.7% to Rs 5,293 crore from Rs 4,384 crore (Bloomberg estimate: Rs 5,721 crore)

- Ebitda margin fell to 13.7% from 14.4% (Bloomberg estimate: 14.7%)

- Profit grew 32.6% to Rs 3,931 crore from Rs 2,964 crore (Bloomberg estimate: Rs 3,885 crore)

Auto and farm has maintained its leadership position on the back of steady customer demand, strong product acceptance and unwavering focus on operational excellence, said CEO & Managing Director Anish Shah.

In the auto segment, quarterly volumes jumped 23% to 3,02,238 units. M&M's SUV revenue market share went up by 90 basis points to 24.1%.Tractor sales surged 23% while market share dipped 20 bps to 44%.

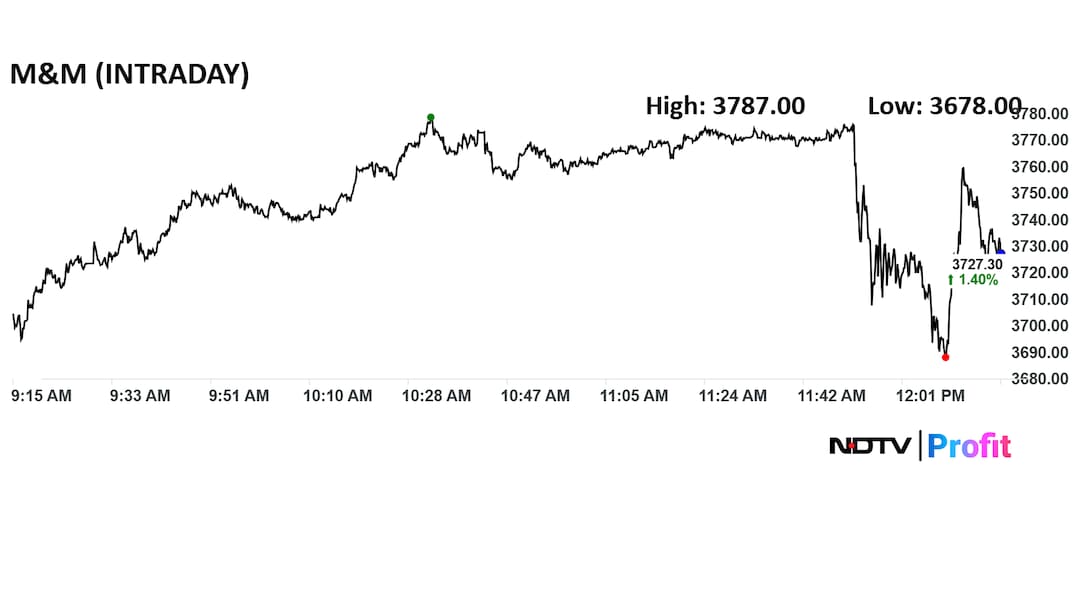

Shares of M&M traded 1.4% higher after the results, compared to a flat Nifty 50. The stock is up 21% in the last 12 months.

Forty-two out of the 41 analysts tracking xx have a 'buy' rating on the stock and one recommends a 'hold', according to Bloomberg data. The average of 12-month analyst price targets is Rs 4,289, which implies a potential upside of 16%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.