Shares of L&T Technology Services Ltd. fell on Friday after its fourth quarter net profit declined, despite a revenue rise.

The engineering and R&D services company's net profit slipped by 3.4% quarter-on-quarter to Rs 311 crore for the fourth quarter of the financial year 2025. In comparison, the company's profit in Q3 stood at Rs 322 crore, according to an exchange filing.

Revenue for the quarter under review rose by 12.4% to Rs 2,982 crore. In the previous quarter, the L&T group company had earned Rs 2,653 crore as revenue.

EBIT rose by 6.6% at Rs 394 crore, compared to Rs 422 crore. Its EBIT margin contracted to 13.2% compared to 15.9% in the previous quarter.

The company's board has recommended a final dividend of Rs 38 per share, adding that the dividend payout ratio is 46% of net income for the year.

According to Amit Chadha, chief executive and managing director, the company managed to achieve three milestones. These include, "crossing Rs 10,000 crore in annual revenue, surpassing 1,500 patent filings and being officially recognised as a great place to work in the US for the second year in a row, and in Japan for the first time ever".

The company's full-year revenue rose by 10.6% to Rs 10,670.1 crore, while net profit slipped by 2.8% to Rs 1,266.7 crore.

L&T Technology Share Price

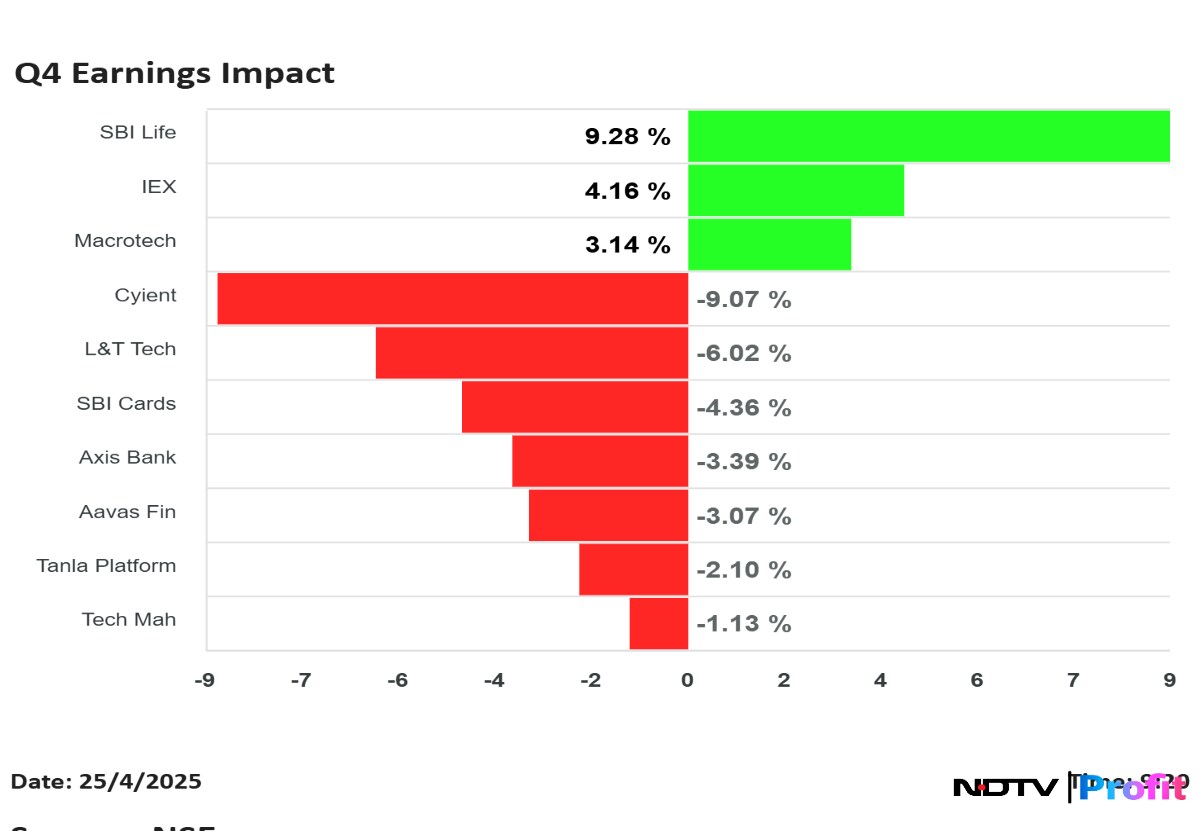

Shares of the company fell as much as 6.99% to Rs 4,164.90 apiece, the lowest level since April 17. It pared losses to trade 5.46% lower at Rs 4,235 apiece, as of 9:18 a.m. This compares to a 0.45% advance in the NSE Nifty 50.

The stock has fallen 18.90% in the last 12 months and 11.25% year-to-date. The relative strength index was at 39.64.

Out of 33 analysts tracking the company, 14 maintain a 'buy' rating, eight recommend a 'hold' and 11 suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.